Positive Outlook from Wells Fargo

Fintel reports a noteworthy development in the financial world: on September 20, 2024, Wells Fargo has upgraded their forecast for Annaly Capital Management, Inc. – Preferred Stock (NYSE:NLY.PRI) from Equal-Weight to Overweight. This shift in perspective from a leading financial institution is a vote of confidence that can sway investor sentiment and potentially impact the market.

Understanding Fund Sentiment

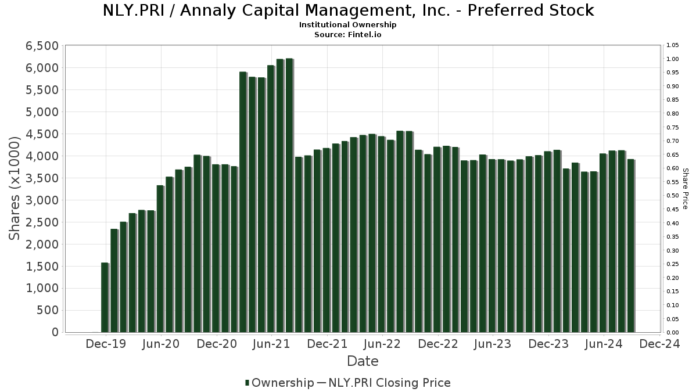

There are 18 funds or institutions currently reporting positions in Annaly Capital Management, Inc. – Preferred Stock. This number reflects a decrease of 1 owner or 5.26% in the last quarter. The average portfolio weight of all funds invested in NLY.PRI stands at 0.64%, showcasing an increase of 2.63%. Over the past three months, the total shares owned by institutions have decreased by 3.26%, amounting to 3,931K shares. These figures provide valuable insights into the shifting landscape of fund sentiment towards this particular stock.

Examining the actions of other key shareholders sheds light on the current state of affairs. PFF – iShares Preferred and Income Securities ETF, for instance, has reduced its holdings of NLY.PRI by 0.90%, owning 1,647K shares in comparison to its previous 1,662K shares. Conversely, PFXF – VanEck Vectors Preferred Securities ex Financials ETF has increased its NLY.PRI portfolio allocation by 6.79% over the last quarter, holding 719K shares, up from 636K shares. Meanwhile, FFSAX – Touchstone Flexible Income Fund has enlarged its stake with an increase of 4.47%, totaling 420K shares, and BRMSX – Bramshill Income Performance Fund Institutional Class maintained their 396K shares with no change over the quarter. FRIFX – Fidelity Real Estate Income Fund also preserved their 193K shares without adjustments in recent months. These movements reflect the diverse strategies employed by various shareholders in response to market conditions and opportunities.

Fintel’s Role in Financial Research

Fintel stands as a beacon for investors, traders, financial advisors, and small hedge funds, offering a comprehensive investing research platform. Through detailed data that covers a global scale, including fundamentals, analyst reports, ownership data, and fund sentiment, Fintel equips individuals with the tools necessary to make informed decisions in the ever-evolving financial landscape. Their commitment to providing exclusive stock picks generated by advanced quantitative models further enhances the potential for profitable outcomes in the market.

For more information and insights, visit Fintel to harness the power of data-driven investment strategies.

This article was originally published on Fintel.

The opinions expressed in this article belong solely to the author and do not necessarily represent those of Nasdaq, Inc.