Westinghouse Air Brake Technologies: A Potential Turnaround Ahead

Shares of Westinghouse Air Brake Technologies Corporation WAB experienced a steep decline yesterday due to disappointing earnings. However, signs suggest a possible recovery is on the horizon.

Current Market Position and Support Levels

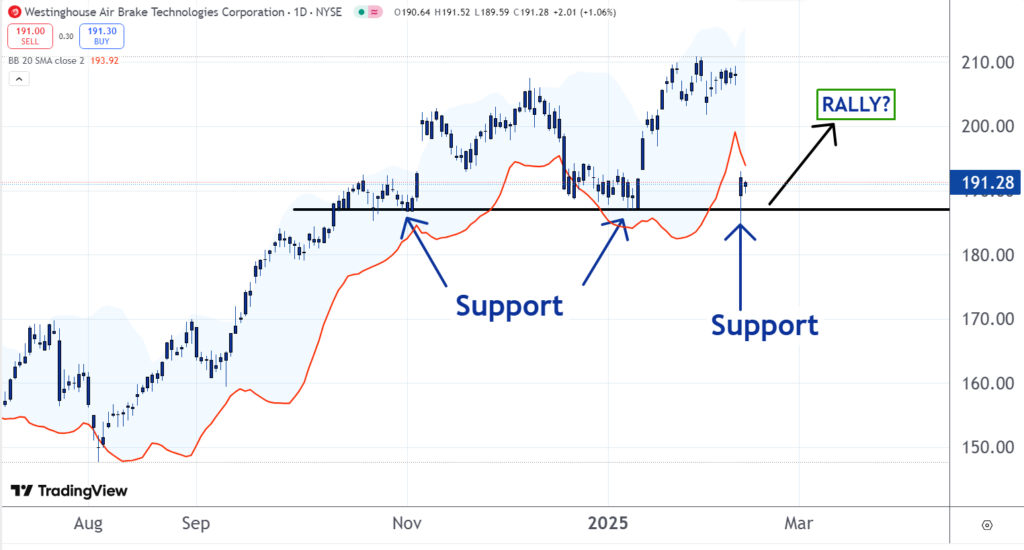

The stock is currently deemed oversold and aligns with strong support at the $187 mark, which has held firm since October. This support indicates that a significant number of investors are ready to buy at this price point, typically halting sell-off trends as demand matches or exceeds available supply.

Historical Context and Buyer Behavior

A rebound often follows when stocks reach established support levels. For instance, Westinghouse saw a recovery in December and January after hitting similar support levels, raising expectations for another potential rally.

Market Dynamics and Trading Algorithms

Investor behavior plays a crucial role in these scenarios. As buyers grow anxious over missing potential trades, they increase their bids, which can initiate a bidding war. This snowball effect often leads to rising stock prices.

Furthermore, Westinghouse is currently very oversold. The stock sits two standard deviations below its 20-day moving average, a situation that typically grabs the attention of trading algorithms. These algorithms operate on statistical patterns, and the recent drop below the trend line indicates a probable rebound, prompting more buyers to enter the market.

Looking Ahead: Possible Recovery

With Westinghouse shares at support and oversold conditions, the current market dynamics may position the stock for a promising upward movement.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs