Westlake Corporation Invests in Sustainable Graphene Innovator

Westlake Corporation’s WLK subsidiary, Westlake Innovations, has made a significant investment in Universal Matter, Inc., a company based in Ontario that aims to become a leading provider of high-quality, sustainable graphene and advanced materials to aid global decarbonization efforts. This investment aligns with WLK’s commitment to foster a sustainable future through improvements in its manufacturing processes and investments in innovative technologies and startups.

Innovative Technology Driving Graphene Production

Universal Matter utilizes patented Flash Joule Heating technology, initially developed at Rice University, to produce tunable graphene in 1D, 2D, and 3D forms. This technology enables the cost-effective, industrial-scale conversion of carbon waste into high-quality graphene. Additionally, Universal Matter can disperse graphene in various liquid or solid mediums, simplifying its incorporation into downstream industrial applications and enhancing performance.

Potential Benefits for Westlake’s Product Lines

Graphene presents numerous potential performance and sustainability advantages across several of Westlake’s business sectors, including Performance & Essential Materials and Housing & Infrastructure Products. Hence, WLK identified a valuable opportunity to collaborate with Universal Matter and its experienced management team.

Macroeconomic Recovery Insights

During its third-quarter call, WLK acknowledged a disparity in the recovery rates following the recent downturn in global manufacturing and industrial sectors. However, it suggested that macroeconomic recovery may gain momentum thanks to recent fiscal and monetary support measures. WLK plans to focus on developing and launching innovative new products to meet customer demand, enhance plant profitability, and create long-term shareholder value.

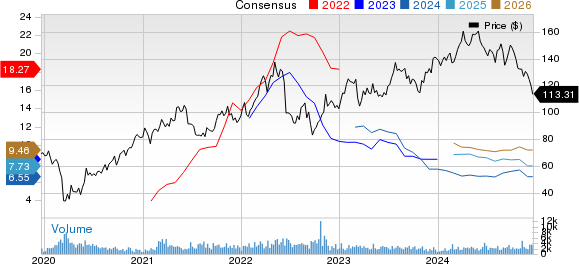

Westlake Corp. Price and Consensus

Westlake Corp. price-consensus-chart | Westlake Corp. Quote

WLK’s Current Zacks Rank and Notable Stocks

Currently, WLK holds a Zacks Rank of #3 (Hold). In the Basic Materials sector, other notable stocks include CF Industries Holdings, Inc. (CF), Coeur Mining, Inc. (CDE), and Ingevity Corporation (NGVT). CF and CDE both have a Zacks Rank of #1 (Strong Buy), while NGVT is ranked #2 (Buy).

CF Industries Earnings Overview

The Zacks Consensus Estimate for CF’s current-year earnings is $6.35 per share. The company has beaten this estimate in two out of the last four quarters, with an average surprise of 10.3%, and its shares have increased by 7.8% over the past year.

Coeur Mining’s Performance

For CDE, the Zacks Consensus Estimate for current-year earnings is set at 15 cents per share, reflecting a substantial 165.2% increase from the previous year. The company has outperformed the consensus estimate in three of the last four quarters, with an average surprise of 46.1%. CDE shares have surged 63.2% over the last year.

Ingevity Corporation’s Earnings Prospects

NGVT’s earnings consensus estimate for the current year stands at $2.55 per share. It has surpassed the consensus estimate three times in the last four quarters, generating an average surprise of 95.4%.

Highlighted Stock Recommendations

Zacks recently named a top semiconductor stock that is significantly smaller than NVIDIA, which has risen over 800% since being recommended. This emerging company is well-placed to capitalize on the growing demand in sectors such as Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to rise from $452 billion in 2021 to $803 billion by 2028.

Explore more stock recommendations with Zacks Investment Research, including those poised for significant growth. For detail, see:

Westlake Corp. (WLK) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Coeur Mining, Inc. (CDE) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

To access the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.