Westport Fuel Systems Reports Smaller Loss in Q3 2024

Westport Fuel Systems Inc. (WPRT) reported a loss of 22 cents per share for the third quarter of 2024. This was an improvement compared to the Zacks Consensus Estimate, which expected a loss of 41 cents. In the same period last year, the company faced a more significant loss of 68 cents per share.

Consolidated revenues totaled $66.2 million, falling short of the Zacks Consensus Estimate of $67 million. This figure also represented a decline from $77.4 million in the third quarter of 2023. Adjusted EBITDA showed a loss of $0.8 million, but it was an improvement from a loss of $3 million recorded in the prior year’s quarter.

Stay up-to-date with the quarterly releases: See Zacks Earnings Calendar.

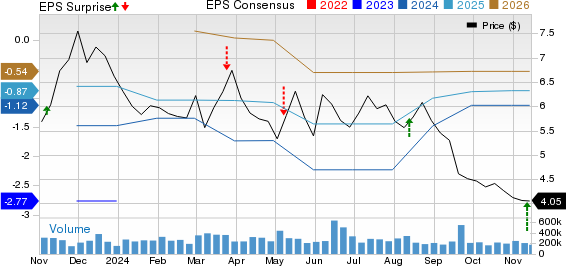

Westport Fuel Systems Inc. Price, Consensus, and EPS Surprise

Westport Fuel Systems Inc. price-consensus-eps-surprise-chart | Westport Fuel Systems Inc. Quote

Quarterly Segment Highlights

In Q3 2024, Westport transitioned to reporting its results under five segments: Cespira, Light-Duty, High-Pressure Controls and Systems, Heavy-Duty OEM, and Corporate. Cespira is the company’s joint venture in high-pressure direct injection with Volvo Group.

Cespira: This segment reported net sales of $16.2 million but incurred an operating loss of $5.3 million for the quarter.

Light-Duty: The segment experienced an increase in net sales to $61.5 million, up from $60.2 million the previous year, exceeding the estimate of $53.2 million. The growth was mainly driven by higher sales in the light-duty original equipment manufacturer (OEM) and independent after-market (IAM) businesses. An operating income of $2.4 million was reported, compared to an operating loss of $3 million in the same quarter last year. Gross profit rose to $13.9 million, representing 23% of revenues, improved from $12 million, which was 20% of revenues last year. This change is attributed to increased sales volumes and a favorable shift in the sales mix towards European customers.

High-Pressure Controls and Systems: This segment reported net sales of $1.6 million, down from $3.7 million in the previous year and below our estimate of $3 million. The decline was due to slower progress in hydrogen infrastructure development, which has affected the adoption of hydrogen-powered solutions in automotive and industrial sectors. An operating loss of $1.2 million was recorded, wider than the loss of $0.4 million reported a year ago, though it was narrower than the estimated loss of $1.3 million. The gross profit fell to $0.4 million (25% of revenues), down from $1 million (27% of revenues) in Q3 2023.

Heavy-Duty OEM: Including revenues from the HPDI business through June 3, 2024, this segment reported net sales of $3.1 million, down from $13.5 million a year earlier and missing our estimate of $11.4 million. This decline stemmed from the transition of heavy-duty operations to Cespira. The segment still managed to attain an operating income of $0.9 million, a significant increase from a loss of $3.7 million in the same quarter last year, surpassing our projected loss of $4.2 million. Gross profit was $0.2 million (6% of revenues), consistent with the previous year.

Corporate: The Corporate segment reported an operating loss of $1 million, reduced from a loss of $5 million last year. This was better than our estimated loss of $3.2 million.

Financial Overview

As of September 30, 2024, Westport had cash and cash equivalents (including restricted cash) totaling $33.26 million, down from $54.85 million at the end of December 2023. Long-term debt also decreased to $23.5 million as of September 30, 2024, from $30.96 million as recorded at the end of 2023.

Zacks Rank & Other Noteworthy Stocks

Currently, WPRT holds a Zacks Rank of #2 (Buy).

Among other top-ranked stocks in the automotive sector are Dorman Products, Inc. (DORM), Tesla, Inc. (TSLA), and BYD Company Limited (BYDDY), each holding a Zacks Rank of #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for DORM’s 2024 sales and earnings indicates anticipated year-over-year growth of 3.66% and 51.98%, respectively, with EPS estimates improving by 75 cents for 2024 and by 88 cents for 2025 over the past month.

For TSLA, the 2024 sales forecast suggests year-over-year growth of 2.85%, with EPS estimates rising by 22 cents for 2024 and 18 cents for 2025 over the last 30 days.

The Zacks Consensus Estimate for BYDDY’s sales and earnings in 2024 predicts growth of 25.07% and 31.51%, respectively, with EPS estimates increasing by 35 cents for 2024 and 39 cents for 2025 during the same period.

Emerging Opportunities in Solar Energy

The solar industry is expected to see significant growth as technology companies and the economy shift from fossil fuels to renewable energy to support the expanding demand for AI. Trillions of dollars are projected to be invested in clean energy over the upcoming years, and solar power could account for 80% of this growth. This creates ample opportunities for early investors in the right stocks.

Learn more about Zacks’ top solar stock recommendations. Interested in the latest insights from Zacks Investment Research? Download his report on 5 Stocks Set to Double.

Tesla, Inc. (TSLA): Free Stock Analysis Report

Westport Fuel Systems Inc. (WPRT): Free Stock Analysis Report

Dorman Products, Inc. (DORM): Free Stock Analysis Report

Byd Co., Ltd. (BYDDY): Free Stock Analysis Report

For more information, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.