Wells Fargo & Company saw a 4% decline in its stock value post the announcement of a formal agreement with the Office of the Comptroller of the Currency (OCC) regarding its anti-money laundering (AML) and sanctions risk management practices.

The agreement identifies weaknesses in various facets of Wells Fargo’s AML internal controls, such as suspicious activity reporting, customer due diligence, and customer identification initiatives.

This development follows the bank’s disclosure in its second-quarter SEC filing that it is in discussions with the U.S. SEC regarding an investigation tied to cash sweep options for new investment advisory clients.

Wells Fargo is actively fortifying its AML and sanctions risk management capabilities through the official agreement with the OCC, aligning with the bank’s ongoing efforts to bolster its risk management structure and comply with regulatory standards.

Assuring stakeholders, WFC’s management affirmed their commitment to fulfilling the requirements of the formal agreement promptly, echoing the urgency shown in other regulatory obligations.

Insights into WFC’s Agreement With OCC

The agreement necessitates the establishment of a Compliance Committee to supervise Wells Fargo’s compliance with its stipulations, targeting areas like front-line risk management, independent testing, and customer identification and suspicious activity detection.

Furthermore, the agreement mandates improvements in AML and sanctions risk management protocols, including gaining OCC approval for assessing such risks in new offerings and notifying the OCC before expanding these services.

WFC’s Regulatory Hurdles

Since September 2016, WFC has grappled with a series of penalties and sanctions, including an asset cap imposed by the Federal Reserve.

In a lawsuit from July 2024, former employees alleged mismanagement of Wells Fargo’s employee health insurance plan, resulting in overpayments for prescription drugs due to inflated drug prices negotiated by pharmacy benefit managers.

Additionally, a proposed class action lawsuit from June 2024 accused the bank of involvement in a $300-million Ponzi scheme that victimized over 1,000 investors, especially seniors, leading to substantial losses.

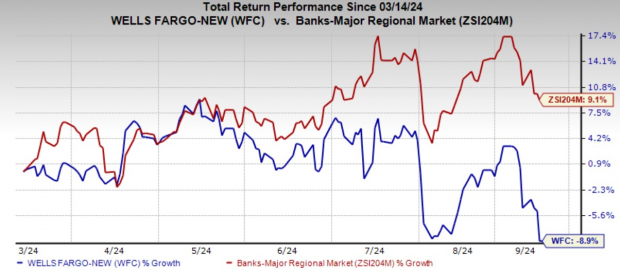

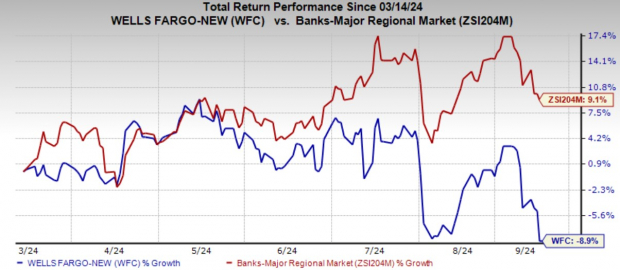

Over the last six months, WFC’s stock has declined by 8.9% while the industry witnessed a growth of 9.1%.

Image Source: Zacks Investment Research

Wells Fargo currently holds a Zacks Rank #3 (Hold).

Other Financial Firms Facing Legal Scrutiny

In a settlement with the CFPB on Sept. 11, 2024, The Toronto-Dominion Bank (TD) consented to pay a $28 million penalty for mishandling customer credit information, leading to credit reporting issues.

Robinhood Markets, Inc.’s HOOD cryptocurrency platform is set to pay $3.9 million as part of a settlement with the California Department of Justice over allegations of preventing customers from withdrawing their cryptocurrency holdings.

California’s Attorney General emphasized that HOOD violated state laws by hindering customers from accessing their cryptocurrency assets, compelling them to sell off investments to exit the platform.

To view the original article on Zacks.com, please click here.

© 2024 Benzinga.com. Benzinga does not offer investment advice. All rights reserved.