The Plateau Shift: Big Tech to the Rescue

Entering a week fraught with market volatility, where uncertainty looms like a heavy cloud, all eyes turn to the elite ‘Magnificent 7’ for a glimmer of hope. The recent market retreat seems more tied to the Fed’s impending actions amidst evolving inflation rather than any significant erosion in corporate profitability. Despite the gloomy clouds, a silver lining emerges as companies within the ‘Mag 7’ gear up to unveil their quarterly results.

A Tale of Titans: Earnings Evolution

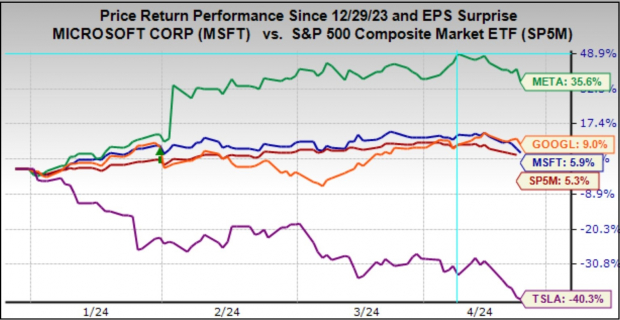

The standout stars, Meta Platforms, stand tall, while Microsoft and Alphabet move in tandem, as a synchronized dance of financial might. This hierarchy of performance has remained steadfast since late October 2023, echoing a tale of divergent paths shaped by their respective earnings outlooks.

The Numbers Speak: Glimmer of Hope Amidst the Gloom

While Meta revels in a rosy outlook, buoyed by a flourishing digital ad arena and astute cost management, Tesla grapples with a myriad of challenges, from leadership distractions to supply-demand imbalances. Microsoft and Alphabet, squarely setting the bar in the AI realm, show minimal shifts in Q1 estimates, serving as the flag bearers of innovation.

Charting the Future: Outlook for the ‘Mag 7’ Titans

As expectations soar, the consensus paints a promising picture for the ‘Mag 7’, with a projected surge of +33% in earnings compared to the same period last year, coupled with a significant +12.7% uptick in revenues. This envisaged growth trajectory mirrors a return to normalized growth patterns, following the peaks of 2021.

Grounding Expectations: Sector-wide Reflections

Beyond the titans, the broader Technology sector anticipates a robust +19.4% surge in Q1 earnings year-on-year, riding on an +8.3% revenue escalation. Mirroring the ‘Mag 7’, the sector sheds its pull-forward revenue streak from 2021, poised to maintain a steadfast growth trajectory.

The Pulse: This Week’s Earnings Extravaganza

As the Q1 earnings season hits its crescendo, with over 500 firms unveiling their results, and 155 S&P 500 members set to disclose their financial standing, the market wades through a sea of revelations. The unveiled figures thus far paint a favorable image, with 77.5% beating EPS forecasts and 63.4% surpassing revenue estimates.

Beyond the Horizon: A Glimpse into Future Earnings

Gearing up for 2024, the S&P 500 anticipates an upswing of +8.8% in total earnings on a +1.7% revenue surge, paving the way for sustained growth. This landscape of anticipated profitability signals a trajectory marked by resilience and measured ascendancy, amidst the backdrop of market uncertainties.