Upcoming Earnings Release: Cadence Design Systems Set to Report Q4 2024 Results

Cadence Design Systems, Inc. (CDNS) will announce its fourth-quarter 2024 results on February 18.

Keep informed on all earnings reports: Check out Zacks Earnings Calendar.

The Zacks Consensus Estimate for Cadence’s fourth-quarter 2024 earnings remains steady at $1.82 per share, reflecting a 31.9% rise compared to the previous year. Revenue predictions stand at $1.35 billion, which would be a 26.1% increase year-over-year.

Cadence anticipates that its revenues will fall between $1.325 billion and $1.365 billion for the fourth quarter, with Non-GAAP EPS expected to range from $1.78 to $1.84.

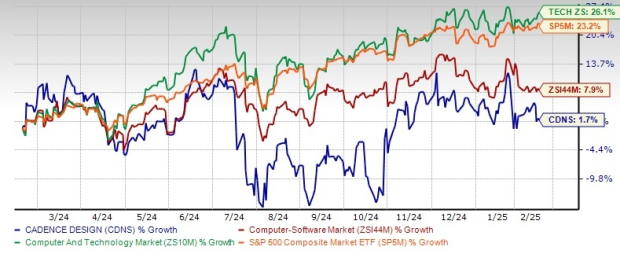

Stock Performance Overview

Image Source: Zacks Investment Research

Historically, Cadence has exceeded earnings expectations, achieving an average surprise of 6.1% over the last four quarters. However, its stock performance has lagged behind its industry, with CDNS shares rising only 1.7% in the past year compared to a 7.9% growth in the Computer Software sector. Meanwhile, the S&P 500 and Zacks Computer and Technology sectors have seen notable gains of 26.1% and 23.2%, respectively.

Key Drivers for Q4 Performance

In recent months, design activity has surged across various sectors, particularly data centers and automotive markets, owing to trends such as artificial intelligence (AI), hyperscale computing, 5G, and autonomous vehicles. Companies are significantly boosting their R&D budgets for AI-driven automation, which likely increased demand for Cadence’s products during the quarter.

Cadence’s solutions have gained traction as system companies look to develop next-generation AI products amidst growing chip complexity. Last quarter, the sales of its Cadence.AI portfolio ballooned, nearly tripling from the previous year. Additionally, Cadence introduced the Cadence OnCloud Marketplace and Cadence Online Support, both utilizing GenAI technology to enhance customer service.

Strong partnerships with industry leaders like NVIDIA, Taiwan Semiconductor Manufacturing Company, and ARM Holdings bode well for future growth.

The firm’s System Design and Analysis segment is expected to see revenues of approximately $192.3 million, reflecting a 49.9% year-over-year increase, driven by the demand for solutions such as Allegro X, Digital Twin platform, Clarity, and Celsius, along with the acquisition of BETA CAE.

Overall, the Core Electronic Design Automation (EDA) business—which includes Custom IC, Digital IC, and Functional Verification—has benefited from new hardware systems and the swift adoption of digital full-flow solutions. These factors are particularly relevant for AI, hyperscale, and automotive clients.

Cadence Design Systems: Price and EPS Trends

Cadence Design Systems, Inc. price-EPS surprise | Cadence Design Systems, Inc. Quote

We estimate revenue from the Functional Verification segment, including the Emulation and Prototyping Hardware sector, will be around $345.6 million—up 34.8% year-over-year.

The Digital IC Design and Signoff segment is expected to generate approximately $343.9 million, marking an 11% increase compared to last year.

Additionally, revenues from the Custom IC segment are anticipated to reach around $274.5 million, reflecting a 16.8% rise year-over-year.

Given current trends in AI applications, high-performance computing, and heterogeneous integration, we expect the IP business to grow remarkably, with revenues projected to rise 36.3% year-over-year to approximately $189.3 million in Q4.

Despite these expectations, ongoing global economic uncertainties and rising operating costs pose challenges. Moreover, Cadence faces intense competition in the EDA landscape, which has impacted pricing power and margin stability.

Earnings Outlook for CDNS

According to our earnings model, Cadence is not likely to beat estimates this quarter. Typically, a combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) creates higher chances for an earnings beat; however, CDNS currently holds a Zacks Rank of #4 (Sell) and an Earnings ESP of +3.05%.

Other Stocks to Watch

Investors may want to consider these stocks, which exhibit characteristics likely to lead to earnings beats this season:

Freshpet, Inc. (FRPT) has an Earnings ESP of +14.67% and a Zacks Rank of #2. It will release its quarterly earnings on February 20, with estimates set at 44 cents per share and $263.5 million in revenue. Over the past year, FRPT shares have increased by 44.6%.

Savers Value Village, Inc. (SVV) currently features an Earnings ESP of +2.85% and a Zacks Rank of #2. SVV’s earnings report is also due on February 20, with estimates of 12 cents per share and $402 million in revenue. The stock has seen a decline of 42.9% in the past year.

Sprouts Farmers Market, Inc. (SFM) shows an Earnings ESP of +9.58% and a Zacks Rank of #2. Scheduled for a February 20 release, SFM’s earnings and revenue estimates stand at 72 cents per share and $1.95 billion, respectively, with stock gains of 235.2% over the last year.

Latest Release: Zacks’ Top 10 Stocks for 2025

Don’t miss your chance to be among the first to access our top picks for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio boasts impressive success. From inception in 2012 through November 2024, the Zacks Top 10 Stocks have realized a gain of +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Discover these newly selected stocks with high potential.

See New Top 10 Stocks >>

Want the latest insights from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days for free.

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Savers Value Village, Inc. (SVV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.