Home Depot (NYSE: HD) investors might be pinching themselves right about now. Their stock has kept up with the rally in the S&P 500 over the past 12 months, allowing the home improvement giant to stand out from many of its struggling peers. It’s not just the wider retailing industry that’s under pressure, either. There’s less demand for home improvement projects in the wake of the pandemic, and rising interest rates have pinched home sales as well.

Home Depot isn’t immune to these challenges. The retailer recently announced another quarter of declining comparable-store sales, in fact.

Yet there were some bright spots in the mid-May report that have investors feeling optimistic that the business will recover its positive momentum. Let’s take a closer look.

Improving sales results

Home Depot couldn’t break out of the negative operating trend that’s characterized the last full year. Sales still declined in the Q1 period that ran through late March, and customer traffic was negative once again. “The quarter was impacted by a delayed start to spring and continued softness in certain larger discretionary projects,” CEO Ted Decker said in a press release.

Look closer and you’ll see signs of stabilizing demand, though. Despite the spring weather delay, sales declines improved to a 3.2% drop from 4% in the previous quarter. There was even better news around customer traffic. Home Depot’s traffic declines slowed for a second straight quarter, landing at 1% in Q1 compared to 2% in Q4 and 3% for the full 2023 fiscal year.

It’s a bit early to call an end to the pandemic growth hangover, in other words, but it seems to be approaching. Executives say Home Depot gained market share, too, which is a great sign for the eventual growth rebound to come when the industry begins expanding again.

Financial trends

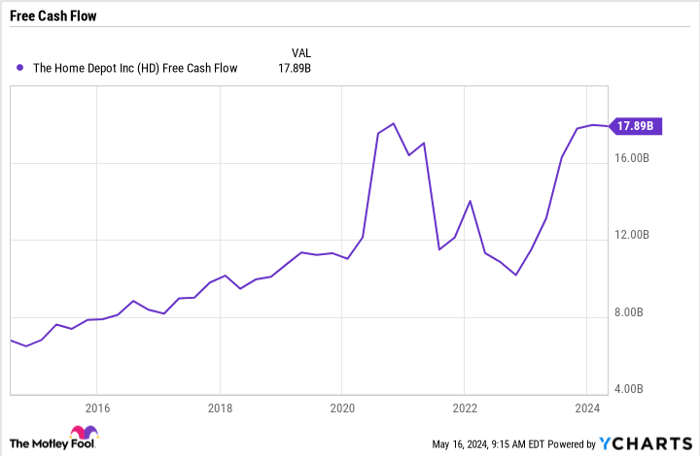

Home Depot’s earnings growth has slowed along with its sales trends over the last several quarters. Yet its sparkling finances still reflect its premium industry position. The retailer’s operating profit margin is holding above 14% of sales right now, down just slightly from the 14.5% rate that investors saw during the pandemic growth boom. Cash flow is healthy, allowing management to direct resources toward growth initiatives and paying down debt.

HD Free Cash Flow data by YCharts

Home Depot is spending cash on direct shareholder returns as well, which is helping boost investor returns during this sluggish industry period. The chain still improved its cash holdings following spending on all these categories in early 2024.

Buy now or later?

Shares are priced at about the middle of the valuation range that investors have seen over the last few years. You can own Home Depot stock for 2.3 times sales today, down from the pandemic-era high of 3 times sales but up from the low of about 1.8 times sales back when investors were more worried about a sharp recession striking the U.S. market.

That’s always a possibility, and Home Depot’s business will still be highly sensitive to any changes in economic growth rates over the next year. However, current trends point to sales falling slightly in 2024 as the retailer takes a big step toward returning to revenue growth. Those excellent profitability and cash flow trends will provide further support for investors’ returns in 2024.

So while there’s no guarantee Home Depot stock will rise in the next year, there’s a good chance that shares will beat the market if the business progresses toward sales growth in the context of stable or expanding profit margins.

Should you invest $1,000 in Home Depot right now?

Before you buy stock in Home Depot, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Home Depot wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Demitri Kalogeropoulos has positions in Home Depot. The Motley Fool has positions in and recommends Home Depot. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.