Adobe’s Record Revenue Overshadowed by Disappointing Outlook

Investors react negatively to Adobe’s future projections despite strong fiscal year-end performance.

Adobe’s recent earnings report revealed record revenue for the fiscal year ending November 29. However, shares have been declining as investors were not satisfied with the company’s future guidance. Known for its innovative products like Photoshop and Acrobat, Adobe has been a leader in generative artificial intelligence (AI), yet its strategies to monetize these advancements seem to lag behind expectations.

As of now, Adobe’s stock is down approximately 18% year-to-date. A closer analysis of the results may help determine if this situation represents a potential buying opportunity as we head into 2025.

Strong Fiscal Results but Cautious Projections

Adobe reported impressive growth, achieving a revenue increase of 11% for the fiscal year, totaling $5.61 billion. This performance surpassed prior projections, which estimated revenue between $5.5 billion and $5.55 billion. Additionally, its adjusted earnings per share (EPS) jumped nearly 13% to $4.81, exceeding the forecasted range of $4.63 to $4.68.

The Digital Media segment, which encompasses both Creative and Document Cloud, experienced a 12% revenue increase to $4.15 billion. Within this segment, Document Cloud led with a 17% spike to $843 million, while the larger Creative part showed a 10% growth to $3.30 billion.

Adobe also secured $578 million in new Digital Media annualized recurring revenue (ARR), bringing its total to $17.33 billion. This marks only a 2% growth compared to $569 million from the previous year.

The company highlighted the success of its AI tools, announcing that AI-generated images from the Firefly AI model surpassed 16 billion in total. Additionally, the beta version of the Firefly video model, which generated significant interest, is set for a broader release in early 2025.

Image source: Getty Images.

Adobe’s Digital Experience segment saw a revenue bump of 10%, reaching $1.4 billion. Subscription revenue for digital experience services climbed by 13% to $1.27 billion, reflecting robust demand for Adobe GenStudio for Performance Marketing.

Despite these strong results, Adobe’s forecasts disappointed analysts. For fiscal year 2025, the company anticipates revenue between $23.30 billion and $23.55 billion, indicating growth between 8% and 9%. This estimate falls short of the analyst consensus of $23.78 billion, as compiled by LSEG. Adjusted EPS is projected to be between $20.20 and $20.50.

For the upcoming fiscal first quarter, Adobe expects revenue to range from $5.63 billion to $5.68 billion, a rise from $5.18 billion last year, representing a 9% to 10% increase—still below the $5.73 billion analyst consensus. The projected adjusted EPS falls between $4.95 and $5.00.

| Metric | Fiscal Q1 Forecast | Fiscal Year 2025 Forecast |

|---|---|---|

| Revenue | $5.63 billion to $5.68 billion | $23.30 billion to $23.55 billion |

| Digital Media segment revenue | $4.17 billion to $4.20 billion | $17.25 billion to $17.4 billion |

| Digital Experience segment revenue | $1.38 billion to $1.40 billion | $5.8 billion to $5.9 billion |

| Adjusted earnings per share | $4.95 to $5.00 | $20.20 to $20.50 |

Data source: Adobe earnings releases.

Evaluating Stock Potential for Recovery

Over the past year, Adobe’s stock performance has not met expectations. Even with the company’s exciting talk about AI innovations, this has not translated to faster revenue growth. The Creative Cloud business saw a modest 2% increase in new ARR during the quarter, and projections for 2025 suggest a slowdown in revenue growth.

Currently, Adobe is balancing attracting new AI users while trying to improve its ability to monetize these technologies. While growth is occurring, it has not increased the overall revenue rate that investors desire to see. Although Adobe’s guidance may be somewhat conservative and beatable, it lacks indications of accelerated revenue growth for the coming year.

The company is currently using a credit model for offering generative AI services, but executives see potential in shifting away from this strategy. During an earnings call, they discussed opportunities to implement tiered pricing for Creative products, which could lead to more effective monetization of AI capabilities.

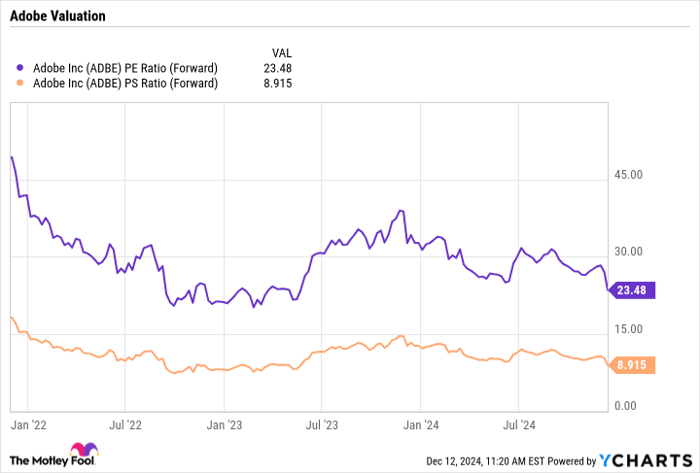

From a valuation perspective, Adobe trades at a forward price-to-earnings (P/E) ratio of 23.5 based on fiscal year 2025 estimates and a forward price-to-sales (P/S) ratio of under 9, which could be appealing to some investors.

ADBE PE Ratio (Forward) data by YCharts.

While there are uncertainties ahead, Adobe’s commitment to product innovation, such as the Firefly video offerings, showcases its potential. I believe the company can explore better monetization strategies through tiered plans. Thus, it may be worthwhile for investors to consider capitalizing on the stock’s recent decline.

Is Now the Right Time to Invest $1,000 in Adobe?

Before making an investment decision regarding Adobe, consider this information:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investment currently, and Adobe is not included in this list. The vetted companies demonstrate significant potential for high returns in the future.

When Nvidia was recommended on April 15, 2005, a $1,000 investment would be worth $822,755 now!

Stock Advisor supports investors with a clear strategy that includes portfolio-building advice, consistent analyst updates, and two new stock picks each month. The Stock Advisor service has notably outperformed the S&P 500 by over four times since 2002.

Discover the 10 stocks »

*Stock Advisor returns as of December 9, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.