How Amazon’s Diversified Growth Places it Among Top AI Investments

It might come as a surprise that in the last 12 months, Amazon (NASDAQ: AMZN) generated a remarkable 60% of its total operating income from Amazon Web Services (AWS). While many still view Amazon as a leading online retailer, it’s increasingly clear that AWS is its most profitable segment, particularly with the increasing importance of artificial intelligence (AI).

To illustrate why Amazon stands out as one of the best AI investment options today, let’s take a look at three key charts:

Where to invest $1,000 right now? Our analyst team recently identified the 10 best stocks to buy today. See the 10 stocks »

1. Data Centers: The Backbone of AI Growth

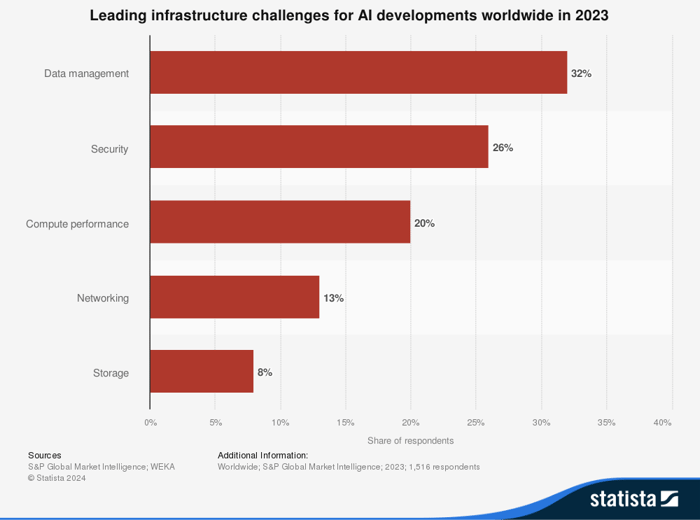

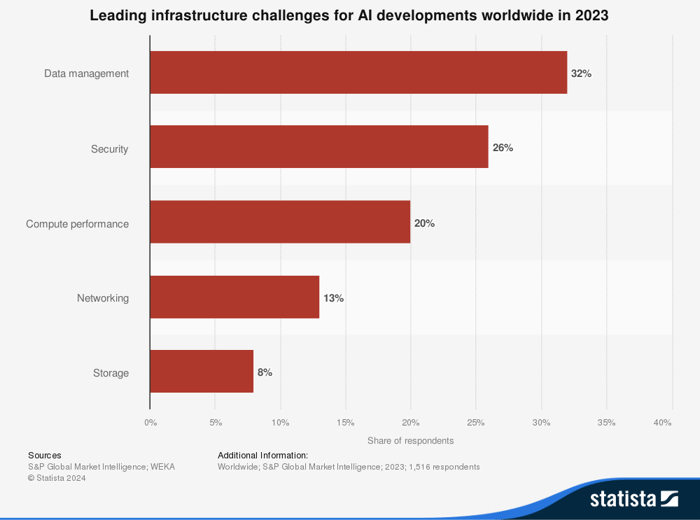

AI technologies promise to enhance efficiency and productivity. However, they also come with unique challenges, especially concerning data management and processing. The graph below highlights these challenges:

Amazon is determined to remain the world’s top provider of cloud data services. The company plans to invest around $100 billion in over 200 data centers globally over the next ten years. This strategic move will help ensure that AWS can handle the ever-increasing demand for data.

AWS operates similarly to a utility, where customers are billed based on the amount of data consumed. This model is particularly effective in an era where data consumption is constantly on the rise. In Q3 2024, AWS experienced robust growth, increasing 19% to $27.5 billion. Over the last year, this segment recorded sales exceeding $100 billion and operating income of $36 billion, suggesting that AWS will continue to be a significant profit driver.

2. Outstanding Cash Flow Generation

Amazon capitalized on government stimulus measures in 2020 and 2021, which led to increased consumer spending and low interest rates. Consequently, the company’s operating cash flow reached unprecedented highs during this period. Operating cash flow measures the amount of cash generated by a company’s core operations, making it a useful success indicator.

For Amazon, this cash flow stems from product sales, advertising revenue, third-party seller services, and AWS. After a significant boost during the stimulus years, its recent operating cash flow has surged even higher:

AMZN Cash from Operations (TTM) data by YCharts

Over the past year, Amazon generated $113 billion in operating cash flow, setting a new record that surpasses the peaks of 2020 and 2021. This surge is largely attributed to increased sales in AWS. With AI demand on the rise, Amazon’s cash flow is expected to continue to climb, enabling the company to invest in growth and maintain its cloud computing leadership.

3. Favorable Valuation Metrics

The S&P 500 index reached new all-time highs more than 50 times in 2024, pushing many company valuations upward. Nevertheless, Amazon’s stock price remains relatively reasonable. Its current valuation, based on cash flow and earnings, is below its historical five-year averages:

AMZN Price to CFO Per Share (TTM) data by YCharts

Amazon’s price-to-earnings ratio stands at only 37 based on next year’s earnings estimates. Although this figure might appear high at first glance, it is relatively low when considering the company’s historical performance. Even amid a rapidly rising market, Amazon offers favorable value for long-term investors.

Is Amazon a Smart Investment for $1,000?

Before making a decision to invest in Amazon, it’s essential to consider this:

The Motley Fool Stock Advisor analyst team has recently pinpointed the 10 best stocks currently available for purchase—and surprisingly, Amazon is not on that list. The selected stocks hold the potential for substantial returns in the years to come.

Just consider the example of Nvidia, which made this list on April 15, 2005. If you had invested $1,000 at that time, it would be worth $874,051 today!*

Stock Advisor provides investors with a straightforward plan for success, offering portfolio-building guidance, regular analyst updates, and two new stock picks every month. Since 2002, the Stock Advisor service has more than quadrupled the return of the S&P 500.*

Learn more »

*Stock Advisor returns as of January 21, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, sits on The Motley Fool’s board of directors. Bradley Guichard holds shares in Amazon. The Motley Fool has positions in and recommends Amazon. A disclosure policy is provided by The Motley Fool.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.