Nvidia: The Stock of the Decade?

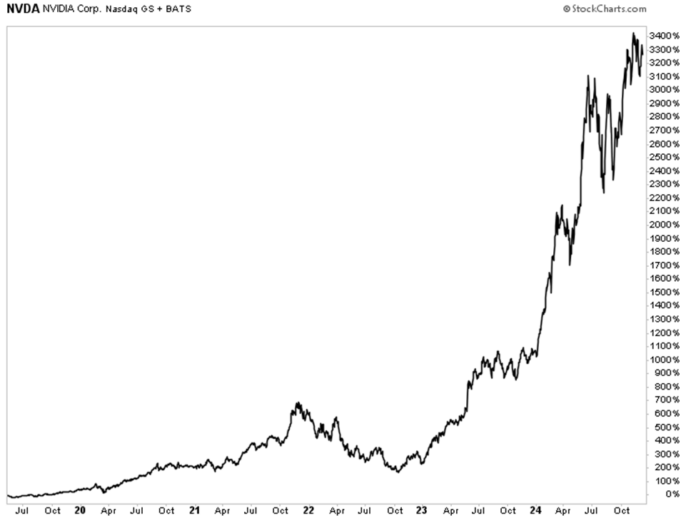

Editor’s Note: Louis Navellier has been ahead of the game in the AI Revolution, recommending Nvidia long before the buzz around ChatGPT and advanced data centers. This foresight has proven rewarding for his Growth Investor members, who have enjoyed about 3,300% in gains. In this letter, Louis explains why it’s still a wise decision to add NVDA to your investment portfolio, dubbing it the “stock of the decade.”

Despite the impressive returns from AI companies, those gains may be nearing their peak. While AI itself won’t dominate the world, businesses leveraging AI certainly will. Louis will also highlight upcoming winning AI stocks, focusing on companies that are constructing new ventures on the AI superhighway.

Recently, I collaborated with Louis and our colleague Luke Lango to curate a collection of top stocks in this sector. We even took to the airwaves to share our insights. You can find Louis’s analysis of Nvidia below and click here to catch our discussion.

As the year draws to a close, it’s a period typical for reflection on successes and setbacks.

We are also approaching the midpoint of the decade. This prompts me to ponder my over forty years in the financial world.

Throughout my career, I’ve had more than my share of successful investments, primarily because of a tool called Stock Grader (subscription required).

One of my top picks was Tyson Foods Inc. (TSN), known for supplying McDonald’s Corp. (MCD) with Chicken McNuggets. Following a surge in demand for McNuggets, Tyson found itself with excess “chicken parts.” They responded by creating “Chicken Chunks,” effectively establishing a monopoly in this new product category.

This shift led to increased operating margins and significant earnings, resulting in my members earning over 900% from the stock.

Another significant winner was Conair Corp., known for its hair products. During the early 1980s, Conair introduced a handheld hair dryer just as the “big hair” trend sparked demand. As a result, the power of hair dryers rose from 800 to 1,200 watts, and eventually to 1,800, propelling Conair’s earnings. Once the competition entered the market, I advised selling Conair shares, leading to over 1,000% profits for my subscribers!

It’s rare for most investors to experience even one 1,000% gain in their lifetime. For a skilled analyst, it may only happen once a decade.

So what’s my secret to spotting these lucrative investments before they skyrocket? It’s straightforward. The most successful stocks I’ve identified share a common trait—they exhibit monopolistic characteristics. Their dominance in the market significantly reduced competition, which in turn led to extraordinary returns.

With this trend in mind, I am convinced that the “Stock of the Decade” for the 2020s will be Nvidia Corp. (NVDA).

This letter will delve into why I believe that.

I will also explore Nvidia’s business trajectory and how I recognized its potential prior to the onset of the AI Revolution.

Finally, I will share my outlook on the continued momentum of the AI Revolution beyond Nvidia and outline how you can capitalize on this growth.

Nvidia and the Beginning of the AI Revolution

Nvidia is a prominent player in the computer graphics chip industry, well-known for its graphics processing units (GPUs).

Initially, these graphics chips were sought after mainly by gamers. However, Nvidia’s GPUs have proven useful in many areas, including financial modeling, oil and gas exploration, virtual reality, and autonomous vehicles.

By the late 2010s, Nvidia noticed a surge of unusual orders. Cryptocurrency miners were seeking high-performance GPUs, while machine-learning researchers turned to these powerful chips for training their models.

GPUs excel in “parallelization,” which breaks down complex tasks into smaller, manageable segments that can be processed simultaneously. This capability makes GPUs significantly more efficient than top-tier central processing units (CPUs) in certain computations.

According to data storage provider Pure Storage, GPUs operate roughly three times faster than equivalent CPUs for machine-learning algorithms, presenting a massive edge in a field where training large AI models can take months and cost millions.

This unique advantage has helped Nvidia accelerate its growth. With a robust portfolio of patents and strong research capabilities, Nvidia was positioned ahead at the start of the AI Revolution.

No other competitor came near its level of innovation.

Why I Endorsed Nvidia

My interest in Nvidia was piqued by its role in developing autonomous vehicles. My son, an engineering student at Stanford University, witnessed the debut of an autonomous race car named “Shelley” that utilized Nvidia chips.

However, in 2019, when I discovered Nvidia’s ambitious plans for AI, I promptly added it to my Growth Investor Buy List. Since then, NVDA stock has surged, leaving Growth Investor members with an impressive 3,300% gain!

The Power Behind Nvidia’s Success: AI Chips

Nvidia has experienced remarkable growth, largely due to its advanced AI chips.

The Hopper Chip and the Rise of AI

In March 2022, Nvidia launched the Hopper chip, which marked a significant leap in GPU technology aimed at supporting AI computing demands. Consequently, Hopper accounted for approximately $19.4 billion of Nvidia’s $26 billion in revenue for the latest quarter.

The AI boom escalated further with the launch of ChatGPT in November 2022, setting the stage for an impressive growth trajectory for Nvidia.

Introducing Blackwell: The Future of AI Chips

To maintain its lead, Nvidia unveiled the Blackwell GPU in March 2024, positioned to replace Hopper. Blackwell boasts performance that is 2.5 times faster and 25 times more energy-efficient than its predecessor.

Designed for generative AI, Blackwell distinguishes itself by focusing on machine learning capabilities. In contrast, competitors like Intel Corp. (INTC) and Advanced Micro Devices Inc. (AMD) are mainly developing chips for optimizing data rather than resolving complex problems.

Nvidia, therefore, holds a dominant position in the market, with its advanced GPU technologies ensuring minimal competitive threats.

High Demand and Future Prospects

The demand for Blackwell GPUs has been overwhelming, with tech giants such as Microsoft Corp. (MSFT) and Meta Platforms Inc. (META) eager to secure these chips. Reports indicate that Blackwell is sold out for the next year, which could further enhance Nvidia’s growth as production ramps up.

Why NVDA Stands Out as a Long-Term Investment

Nvidia is expected to keep pushing the boundaries of transistor technology, approaching atomic levels by the decade’s end. In light of these advancements, the company is looking toward quantum computing, a next-generation technology that can reshape computational methods.

Historically, quantum computers have been limited to government and academic use due to costs. However, Nvidia is poised to spearhead developments that could expand access to this technology, thereby supporting the advancement of generative AI.

This unique position solidifies Nvidia’s standing, making it a compelling investment moving forward. While market dynamics can shift, it is unlikely that Nvidia’s edge will diminish anytime soon. Its ability to innovate with generative AI GPUs puts it in a league of its own.

Looking Ahead: The Next Wave of AI Innovation

Investors should remember that relying on a single stock is not a sound strategy, even with Nvidia’s promising outlook. The AI Revolution is still in its infancy, and new advancements are expected to emerge in the coming years.

As new AI models capable of reasoning are set to debut, similar to the monumental impact of the internet in the late 1990s, they will bring about vast changes in the economy. While these changes will enhance efficiency, they may also exacerbate income inequality, making it critical for investors to position themselves for success.

To assist interested investors, my colleagues Luke Lango and Eric Fry joined me in developing a detailed presentation outlining the top stocks to watch in this ongoing AI Revolution. With time being of the essence, staying informed could prove beneficial.

Click here to watch the presentation now.

Sincerely,

Louis Navellier