Why Eli Lilly Remains a Strong Investment Despite High Valuations

Understanding stock valuations is crucial for investors. The price at which a stock trades can significantly affect overall returns. Metrics like the price-to-earnings (P/E) ratio help investors determine whether a stock is relatively expensive or cheap.

Sometimes it may be worthwhile to invest in a company with a high P/E ratio, especially if it shows strong growth potential. Waiting for a top growth stock to sell at a P/E below 20 might mean missing out entirely on future gains.

Where to invest $1,000 today? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Eli Lilly: Continued Acceleration in Growth

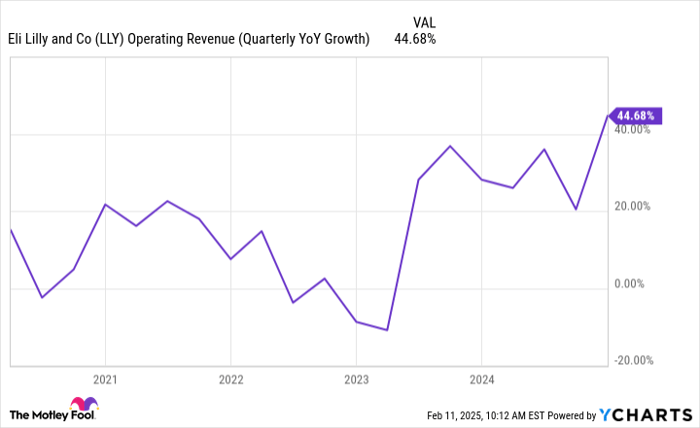

Eli Lilly, a leader in the pharmaceutical industry, has consistently shown solid growth. Recently, however, this growth has picked up speed, evidenced by a remarkable 45% revenue increase during the last quarter of 2024:

LLY Operating Revenue (Quarterly YoY Growth) data by YCharts.

This surge can largely be attributed to Eli Lilly’s highly successful GLP-1 drugs, including Mounjaro for diabetes and Zepbound for weight loss, which together generated $5.4 billion in sales, accounting for 40% of the company’s total revenue last quarter.

Such immense demand has caused shortages of these drugs, prompting Eli Lilly to invest billions to boost production capacity at its Lebanon, Indiana site. Increased output there, possibly starting next year, could further drive sales growth.

Potential for New Drug Growth

Eli Lilly’s growth in GLP-1 treatments is still in its early stages. These medications are significant for patients, aiding in weight loss and improving overall health. Currently, the treatments are injectables.

However, by next year, Lilly is anticipated to offer an attractive new option: orforglipron, an oral weight loss drug. By April, the company expects to release late-stage trial data that has indicated the potential for an average weight loss of around 15%. Positive trial results could lead to approval next year.

Approval of orforglipron would not only boost investor enthusiasm for the stock but also potentially add another blockbuster drug to Eli Lilly’s portfolio, reaching a broader range of patients.

The Path to a $1 Trillion Market Value

Although Eli Lilly’s shares have faced challenges recently, the company is well-positioned for future recovery. Currently valued at approximately $780 billion, the stock could achieve a $1 trillion market cap with less than a 30% increase from current levels.

While the P/E ratio may seem high now, it’s important to focus on the company’s growth potential. As Eli Lilly expands its operations and increases profits, this ratio will likely decrease. Thus, waiting for a lower P/E could lead to missing out on substantial gains.

Current shareholders might benefit from selling now, but unless they need the funds, holding on to the stock for its long-term growth potential seems more reasonable.

Seize This Second Chance for Investment Success

Have you ever thought you missed the chance to invest in top-performing stocks? Here’s your opportunity.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies poised for strong performance. If you’re worried you’ve missed your investment chance, now is the perfect time to act before it’s too late. The historical returns of our previous recommendations are impressive:

- Nvidia: if you invested $1,000 when we doubled down in 2009, it would be worth $350,809!*

- Apple: if you invested $1,000 when we doubled down in 2008, it would be worth $45,792!*

- Netflix: if you invested $1,000 when we doubled down in 2004, it would be worth $562,853!*

We are currently issuing “Double Down” alerts for three outstanding companies, and this opportunity may not come around again soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.