Buffett’s Big Move: Why Selling Ulta Beauty and Floor & Decor Might Be a Mistake

Warren Buffett bought Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) about 60 years ago. At that time, the business was struggling, and many saw the purchase as a poor choice. Today, however, Berkshire Hathaway is valued at more than $1 trillion, a testament to Buffett’s long-term strategy of reinvesting the company’s cash wisely.

With such an impressive history, I constantly analyze Buffett’s investing mentality to enhance my own skills. My office is filled with highlighted copies of his annual letters to shareholders and well-worn books about him. Clearly, I am both a student and a fan.

Recent Moves: Disappointing Sales of Ulta Beauty and Floor & Decor

On Nov. 14, Berkshire Hathaway disclosed its latest quarterly stock holdings. While I’m generally interested in these decisions, this time it was more concerning: the company sold shares of Ulta Beauty (NASDAQ: ULTA) and Floor & Decor (NYSE: FND). I believe these sales were missteps.

Having great respect for Warren Buffett and the decisions of Berkshire Hathaway, I do not take this stance lightly. I believe that both Ulta Beauty and Floor & Decor are well-positioned to outperform the S&P 500 over the next five years. Thus, I respectfully disagree with the decision to sell them.

Analyzing Ulta Beauty

Ulta Beauty operates over 1,400 retail locations, establishing itself as a significant player in the cosmetics sector. However, this growth may be reaching its limit, a sentiment echoed in their management’s 2024 guidance that forecasts a slight decline in net sales due to modest drops in same-store sales. Such outlooks have left investors concerned.

While growth is crucial, there are other ways for stocks to perform well, and Ulta Beauty has those capabilities. The company remains highly profitable, projecting an operating margin close to 13% for this year and aiming to maintain above 12% for the long term.

Thanks to its strong profits, Ulta Beauty has initiated a $3 billion share buyback plan. By reducing the number of shares available, this strategy can enhance earnings per share (EPS) growth significantly quicker than revenue growth. In fact, management anticipates double-digit EPS growth moving forward.

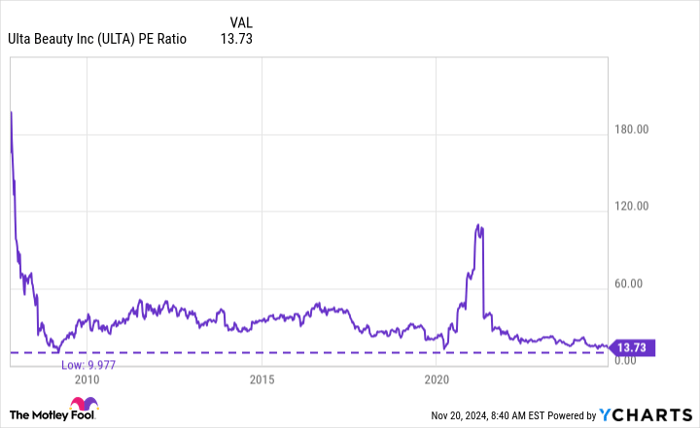

Such double-digit EPS growth may allow Ulta Beauty’s stock to rise faster than the S&P 500. Cosmetic spending typically remains stable, and the stock is currently trading at one of its lowest price-to-earnings (P/E) ratios, reducing the risk of a downturn as profits continue to grow.

ULTA PE Ratio data by YCharts

Diving Into Floor & Decor

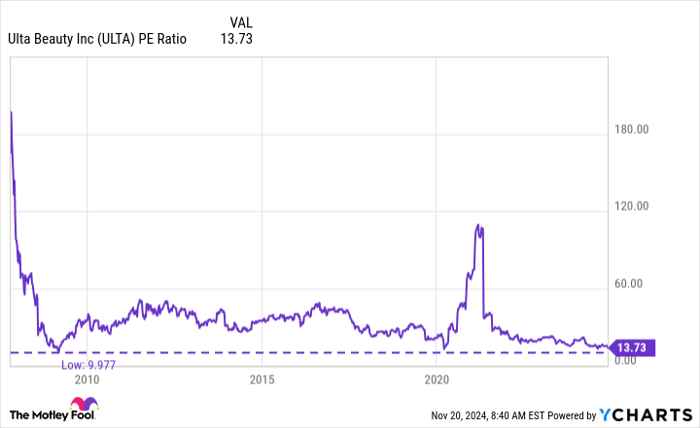

Floor & Decor’s stock has seen a 30% drop from its peak. Currently, the home-improvement market is shrinking, adversely affecting the company’s sales. They project a year-over-year same-store sales decline of about 8% for 2024. Despite these challenges, I believe concerns may be overblown. Encouragingly, their sales growth trends closely mirror existing U.S. home sales.

US Existing Home Sales data by YCharts

It’s essential to remain pragmatic. If home sales start to improve, yet Floor & Decor’s revenues continue to struggle, that would raise valid concerns. Nevertheless, I think current fears are premature. The housing market operates in cycles, and a recovery is likely, which would boost Floor & Decor when it occurs.

At the end of the third quarter of 2024, Floor & Decor had 241 locations and substantial opportunities to grow. The management team aims to expand to 500 locations in the long run. They plan to open 30 new stores in 2024, with 20 already launched before the end of Q3. In 2025, the pace will slow slightly with just 25 additional stores due to the current market’s softness.

During these tougher times, Floor & Decor’s leadership is working hard to maintain profitability by trimming expenses. Although the profit margin for the first three quarters of 2024 sits at only 4.7%—a decrease from a high of 9% in previous years—the company remains financially solid, positioning itself well for a market rebound.

While it is uncertain when the housing market will rebound, historical patterns suggest it will happen within the next five years. When it does recover, I expect sales and profit margins to revert closer to historical levels, likely enhancing stock performance.

Warren Buffett’s Berkshire Hathaway made the choice to divest from Ulta Beauty and Floor & Decor—companies known for wise investment decisions. However, for investors seeking to outpace the S&P 500 over the next five years, I believe both Ulta Beauty and Floor & Decor offer relatively low-risk opportunities to achieve that goal. Therefore, I respectfully disagree with the choice to sell and recommend considering buying both stocks today.

Don’t Miss Out on a Potential Opportunity

Have you ever felt like you missed your chance to invest in top-performing stocks? If so, there’s good news for you.

Our expert analysts occasionally issue a special “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’re worried you’ve already missed your moment, now is the ideal time to invest before it’s too late. Here are the impressive past returns:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $368,053!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $43,533!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $484,170!*

Currently, we have “Double Down” alerts for three outstanding companies, and this opportunity may not come again for quite some time.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 18, 2024

Jon Quast has positions in Floor & Decor. The Motley Fool has positions in and recommends Berkshire Hathaway and Ulta Beauty. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.