Nvidia’s Growth Sparks Predictions of Stock Surge

Nvidia (NASDAQ: NVDA) stands out as a primary manufacturer of networking hardware and chips used in gaming, computing, robotics, and particularly in data centers, where much of the artificial intelligence (AI) development is accomplished.

The company’s journey began in 1999 with a market capitalization of about $500 million. Over the years, this figure has skyrocketed to approximately $3.5 trillion, with more than $3 trillion generated in just the last two years. This remarkable growth is primarily driven by rising demand for its AI data center chips.

Start Your Mornings Off Informed! Subscribe to Breakfast News for market updates every day. Sign Up For Free »

Nvidia stock is currently priced at $144.47, and two driving factors suggest it could rise to $200 (or more) by 2025. Should this prediction come true, it would push the company’s valuation close to $4.9 trillion, offering investors a 38% return.

Image source: Nvidia.

Strong Sales Expected from New Blackwell GPUs

Graphics processing units (GPUs) are outpacing traditional central processing units (CPUs) for AI tasks due to their design for parallel processing. This design allows GPUs to efficiently handle multiple tasks simultaneously, which is essential given the data-heavy nature of AI development.

Nvidia’s H100 GPU, built on the Hopper architecture, secured a dominating 98% share of the AI data center chip market in 2023. Its successor, the H200 GPU, began shipping in mid-2024 and nearly doubles performance. However, Nvidia introduced a groundbreaking architecture called Blackwell in 2024 that promises even greater advancements.

The Blackwell-based GB200 NVL72 GPU system can perform AI inference up to 30 times faster than the H100 system. This leap is partly due to Nvidia’s fifth generation of NVLink networking technology, enhancing communication speed between GPUs. Additionally, the GB200 NVL72 is 25 times more energy-efficient than its H100 predecessor, potentially saving data center operators significant electricity expenses.

In the third quarter of its fiscal 2025, Nvidia shipped 13,000 sample GB200 GPUs, but demand already exceeds supply, indicating rapid sales growth is on the horizon.

Morgan Stanley, which considers Nvidia stock a top choice for 2025, forecasts shipments of approximately 450,000 GB200 GPUs in the last quarter of 2024 and potentially up to 800,000 in early 2025. Other analysts are optimistic about the Blackwell’s potential, even if its initial scaling is slower than anticipated.

In fact, revenue from Blackwell could eclipse that from Hopper by April, showcasing just how quickly Nvidia’s operations can transform.

Nvidia’s fiscal year 2025 is set to conclude at the end of this month and is projected to achieve a record total revenue of $128.6 billion, reflecting a 112% increase from fiscal 2024. Data center sales, primarily from GPU transactions, are expected to account for around 88% of this year’s total revenue. This marks a significant rise from only representing 39% three years ago in fiscal 2022.

Attractive Valuation Rates for Nvidia Stock

Nvidia’s current high profit margins are attributed to the imbalance of demand over supply for GPUs, giving the company strong pricing power. Over the last four quarters, earnings per share (EPS) have more than tripled year-over-year, now standing at $2.62.

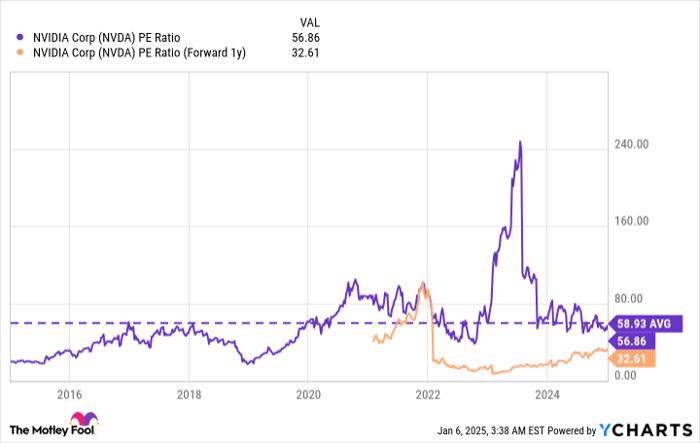

Based on this EPS, Nvidia stock currently trades at a price-to-earnings (P/E) ratio of 56.8, slightly below its 10-year average of 58.9. This suggests that, despite an 800% increase over the past two years, Nvidia stock may still be undervalued.

Looking ahead, Wall Street estimates that Nvidia could achieve $4.43 in EPS in fiscal 2026, which commences next month, resulting in a forward P/E ratio of just 32.6:

NVDA PE Ratio data by YCharts.

For Nvidia stock to align with its 10-year average P/E ratio, it would need to increase by 80% over the next year, reaching around $260.

However, as 2025 progresses, analysts will begin to look toward Nvidia’s expected outcomes for fiscal 2027. Should there be signs of growth slowing down, investors may hesitate to push the stock to $260.

At present, a $200 target for Nvidia stock in 2025 appears reasonable. This estimate indicates a P/E ratio of 45.5 by year’s end, assuming earnings projections hold up. This figure remains discounted relative to the long-term P/E average, likely appealing to investors seeking value.

Discover Potential Investment Opportunities

Have you ever felt like you missed an opportunity to invest in top-performing stocks? If so, this may be a moment you don’t want to overlook.

Occasionally, our analysts announce a “Double Down” stock recommendation for companies expected to see substantial growth. If investment opportunities seem limited, consider this moment to act before it passes. The successes speak for themselves:

- Nvidia: an investment of $1,000 when we double down in 2009 would now be worth $363,385!*

- Apple: if you invested $1,000 in 2008, you’d have $45,870!*

- Netflix: if you invested $1,000 in 2004, you’d have $474,140!*

At this time, we are issuing “Double Down” alerts for three promising companies, and opportunities like this may not arise again for some time.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.