Are you scouting for a stock that can benefit from the market’s current growth? Look no further than Shopify (NYSE: SHOP). This could be the perfect opportunity for investors, reaffirmed by the events on Tuesday. Luckily, there’s still time to get involved.

Why Now is the Right Time to Invest in Shopify

Understanding Shopify’s Role

If you’re unfamiliar, Shopify enables businesses, large and small, to create and manage an online store. It offers a range of services from shopping carts to payment processing, inventory management, and marketing tools. Shopify generates revenue through subscription fees and transaction-based charges.

To grasp why Shopify is crucial, consider this: it provides an alternative to merchants who wish to circumvent the influence of Amazon, North America’s dominant online retailer. While Amazon was once celebrated for its wide reach, it has become highly competitive and crowded, often competing directly with its own merchants.

This shift has led many brands and sellers to seek different online platforms. They are increasingly choosing Shopify, which often proves to be a more economical solution that fosters direct connections with consumers. Estimates suggest that between 2 million and 4 million merchants use Shopify’s services, though the company no longer reveals exact numbers.

Despite the uncertainty surrounding the number of merchants, Shopify shares impressive financial results. In its latest quarter, the company reported $69.7 billion in merchandise sales, translating to nearly $2.2 billion in revenue—both figures show significant growth from the previous year. This sets the stage for why investors may want to consider Shopify sooner rather than later.

1. Consistent Growth Trajectory

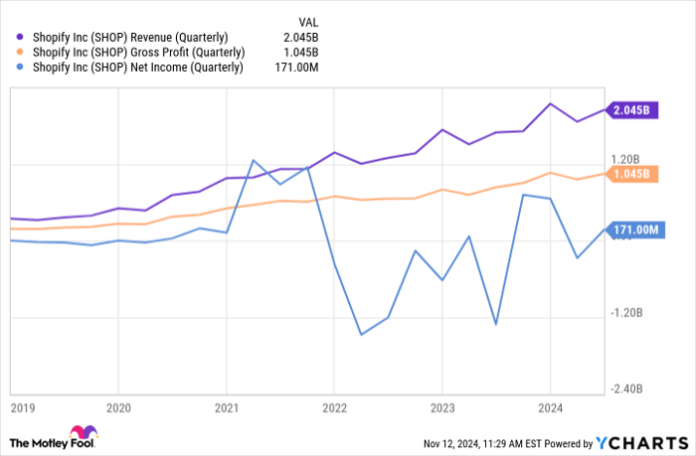

As highlighted, Shopify’s revenue saw a remarkable increase of 26% year-over-year in the recent quarter. Operating income more than doubled, and free cash flow surged from $276 million in the same quarter last year to $421 million this past September. This growth is commendable, especially amid a sluggish economic climate.

SHOP Revenue (Quarterly) data by YCharts

Notably, this past quarter marks Shopify’s sixth consecutive quarter of over 25% revenue growth, excluding contributions from its recently divested logistics business.

2. Meeting Merchant Needs

Shopify’s popularity stems from its ability to meet the specific demands of modern merchants. In the early days of e-commerce, platforms like Amazon and eBay filled a crucial need for new sellers. However, as the digital marketplace evolved—bolstered by social media and advanced marketing tools—brands are now able to find and engage their own customers more effectively.

Today, merchants require a means to convert web traffic into sales, and Shopify excels in this area.

3. Vast Growth Potential

Despite significant advancements in e-commerce, there remains substantial room for growth. According to the U.S. Census Bureau, approximately 16% of retail sales in the United States are conducted online, suggesting that a majority still occurs in stores. Internationally, similar trends are observed.

Industry researchers at Straits Research project that the global e-commerce software market will grow by more than 12% annually through 2032. Shopify is well-positioned to capture a significant portion of this expansion, particularly as it intensifies its international efforts.

Exercise Consideration, Not Hesitation

On Tuesday, Shopify’s shares surged following a positive third-quarter earnings report and optimistic guidance. The company anticipate “revenues to grow at a mid-to-high-twenties percentage rate,” likely boosting gross profits similarly.

However, the rapid price increase may make the stock vulnerable to profit-taking. It might be wise to wait for the market to settle before making a purchase decision.

Don’t wait too long, though. Historically, shares experience similar fluctuations, but long-term rallies have typically resumed. Each bump and dip presents new opportunities for investors.

Don’t Miss Out on Investing Wisely

Have you ever felt that you’ve missed your chance to buy into successful stocks? Here’s your opportunity to act.

Occasionally, our expert analysts issue a “Double Down” stock alert for companies they believe are on the verge of explosive growth. If you’re concerned that the window may be closing, now is the ideal time to invest.

- Amazon: If you had invested $1,000 when we doubled down in 2010, it would now be worth $23,818!*

- Apple: If you invested $1,000 when we doubled down in 2008, it would now total $43,221!*

- Netflix: A $1,000 investment when we doubled down in 2004 would now be valued at $451,527!*

Currently, we are recommending “Double Down” alerts for three impressive companies, and another chance like this may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Shopify. The Motley Fool recommends eBay. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.