The Rise of AI Stocks: Will NVIDIA Continue to Lead in 2025?

As artificial intelligence (AI) technology advances, the so-called “magnificent seven” stocks have thrived this year. Digital and online services are increasingly popular, leading to strong performance in these key players’ shares.

Remarkable Growth of the Magnificent Seven

Over the past decade, the representation of these companies has more than doubled in the S&P 500. Notably, shares of Alphabet Inc. (GOOGL), Amazon.com, Inc. (AMZN), Apple Inc. (AAPL), Meta Platforms, Inc. (META), Microsoft Corporation (MSFT), NVIDIA Corporation (NVDA), and Tesla, Inc. (TSLA) have jumped 40%, 49.4%, 34.5%, 70.5%, 182.6%, and 82.8%, respectively, this year.

Factors Behind Stock Increases

The success of these companies can be attributed to several factors: Alphabet’s leadership in search, Amazon’s robust AWS cloud infrastructure, Apple’s surge in service revenue, Meta’s growing user base, Microsoft’s strong Azure business, and Tesla’s innovative vehicle designs. Among these, NVIDIA has captured attention, primarily due to the soaring demand for AI chips.

NVIDIA’s Blackwell Demand Fuels Stock Optimism

NVIDIA’s upcoming Blackwell graphics processing unit (GPU) has become highly sought after, as it requires 25 times less energy to run large language models compared to the existing Hopper GPU platform. Companies like Alphabet, Oracle, and Microsoft have already placed orders for these advanced chips.

Morgan Stanley forecasts that NVIDIA will ship 300,000 Blackwell chips in Q4 2024 and an additional 800,000 in Q1 2025. In contrast, the company shipped just 13,000 Hopper chips in the last quarter, highlighting the accelerating demand for its new technology.

Competitive Positioning Benefits NVIDIA

NVIDIA enjoys a significant competitive edge in the GPU market, boasting nearly an 80% share. The market is projected to grow from $75.77 billion this year to an astounding $1,414.39 billion by 2034, with a compound annual growth rate (CAGR) of 13.8%, according to Precedence Research.

Many developers prefer NVIDIA’s CUDA software platform for its robust capabilities compared to AMD’s ROCm platform. The demand for NVIDIA’s CUDA X features, which enhance AI performance, helps to solidify its market position.

Strong Financials Indicate Future Growth

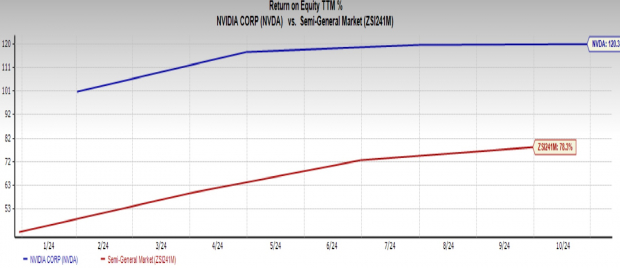

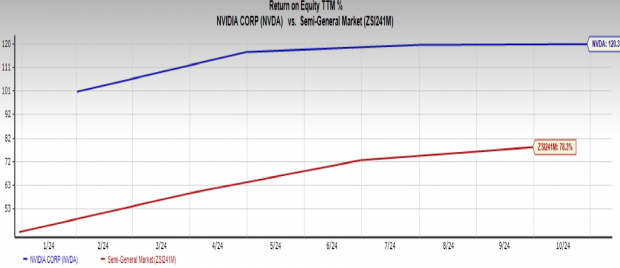

NVIDIA’s performance in profit generation and efficient cost management is a positive indicator for shareholders. The company’s return on equity (ROE) is 120.4%, exceeding the Semiconductor – General industry average of 78.3%. Such financial health suggests that NVIDIA generates substantial net income relative to its equity.

Image Source: Zacks Investment Research

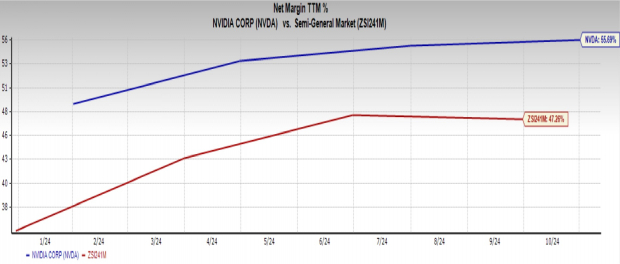

The company’s net profit margin of 55.7% significantly outpaces the industry average of 47.3%, indicating strong profitability.

Image Source: Zacks Investment Research

NVIDIA Stock Seen as a Smart Purchase for 2025

Given the robust demand for AI chips, unrivaled GPU market position, and solid fundamentals, NVIDIA is poised for growth in 2025. This stock stands out among the magnificent seven analysts have their eyes on.

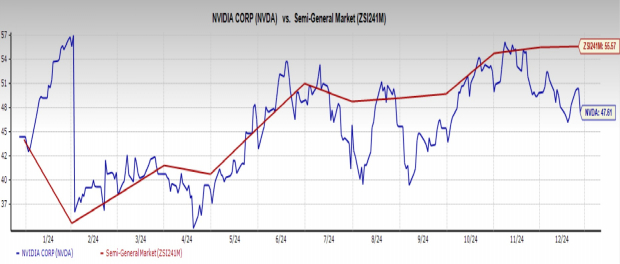

NVIDIA’s price/earnings ratio is 47.6, which is more appealing than the industry average of 55.5, making it a cost-effective investment opportunity.

Image Source: Zacks Investment Research

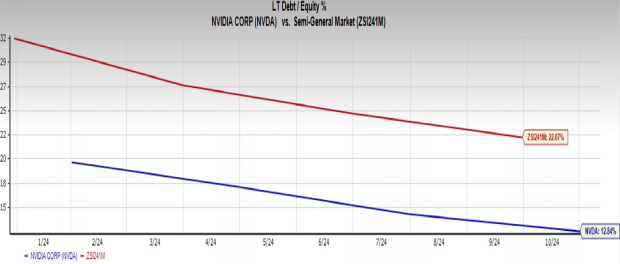

Moreover, NVIDIA’s debt-to-equity ratio of 12.8% is lower than the industry average of 22.1%, indicating reduced investment risk due to lower debt levels.

Image Source: Zacks Investment Research

Top 10 Stocks for 2025 by Zacks

Interested in early insights on our top 10 stock picks for 2025?

Historical performance indicates they could achieve remarkable success.

From 2012 (since the portfolio’s management transitioned to our Director of Research Sheraz Mian) through November 2024, the Zacks Top 10 Stocks posted a gain of +2,112.6%, vastly outperforming the S&P 500’s +475.6%. Currently, Sheraz is evaluating 4,400 companies to identify the best 10 stocks you can buy and hold in 2025. Don’t miss the January 2 unveiling of these selections.

Be First to New Top 10 Stocks >>

For the latest recommendations from Zacks Investment Research, download our report on “5 Stocks Set to Double” for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.