Tesla, renowned for its electric vehicles and vibrant CEO Elon Musk, has sold millions of cars and trucks since its inception over 20 years ago. In the past decade, Tesla’s share price surged by more than 1,300%, leading to a market valuation of approximately $700 billion.

Although Tesla remains a solid investment today, savvy investors should seek opportunities similar to Rivian Automotive (NASDAQ: RIVN). Here are three compelling reasons to anticipate significant stock price growth in the coming years.

1. Rivian’s Path to Profitability Is Near

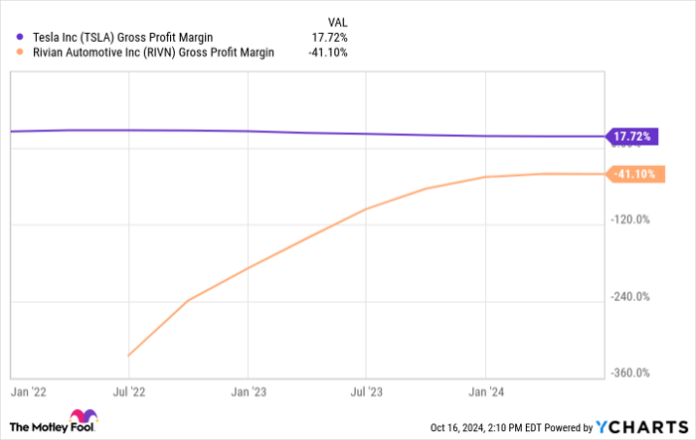

In its early days, Tesla achieved a positive gross margin, setting the stage for its later success. In contrast, Rivian is currently facing challenges in reaching this crucial benchmark. Last quarter, the company incurred losses of over $30,000 for each vehicle sold. Although this loss is a considerable improvement, it highlights the hurdles Rivian must overcome in a demanding industry prone to failures due to insufficient capital.

To advance, Rivian must demonstrate its ability to sell vehicles profitably. Encouragingly, management aims to reach a positive gross margin by the end of this fiscal year. With two quarters remaining in Rivian’s fiscal year, investors can expect quarterly results to be released in early November. Though much work remains before achieving a positive gross margin, management has not wavered in its commitment, even if market sentiment remains cautious.

A successful report on gross margins could trigger a strong upward movement in Rivian’s stock price, making further milestones more attainable.

TSLA Gross Profit Margin data by YCharts

2. Upcoming Mass Market Models May Revolutionize Rivian

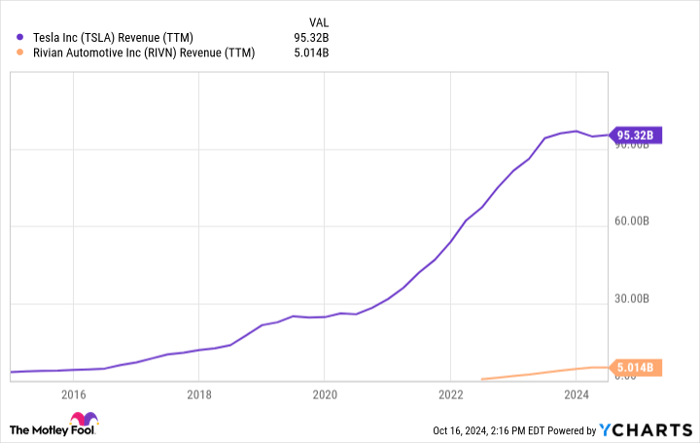

A decade ago, Tesla’s revenue position mirrored Rivian’s current status. However, Tesla’s revenue has shot up by nearly 1,000% since then. Can Rivian replicate this growth? Absolutely, provided it can deliver new mass market vehicles promptly and at competitive prices.

Earlier this year, Rivian made waves by unveiling three new mass market models: the R2, R3, and R3X, all expected to be priced below $50,000. Due to Rivian’s established brand loyalty and reputation, high demand is anticipated when these models launch. Tesla similarly enjoyed a surge in sales with the debut of its Model Y and Model 3, which were pivotal in expanding its customer base.

However, it’s essential to recognize that Rivian’s mass market models are still in the prototype stage. To bring these vehicles to market, Rivian needs substantial funding for design, testing, marketing, manufacturing, and service. Should the company achieve gross profitability soon, it could inspire investor confidence, facilitating funding to address its negative cash flows until these vehicles reach consumers.

TSLA Revenue (TTM) data by YCharts

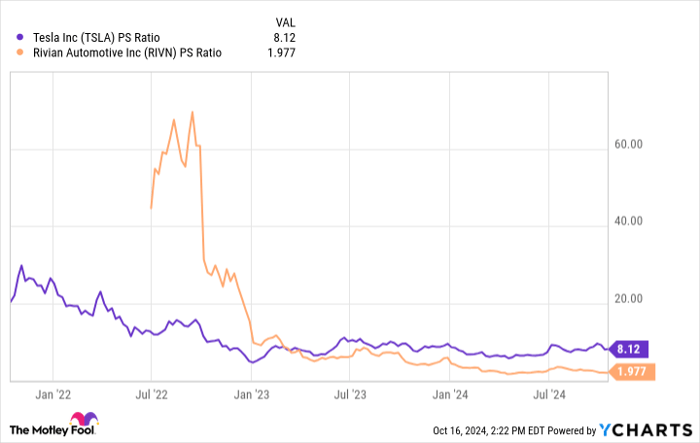

3. A Bargain with a Caveat

Once trading at a premium, Rivian’s stock is now available at a significant discount compared to Tesla. Currently, Rivian trades at under twice its sales, while Tesla commands a valuation exceeding eight times its sales. This may represent an opportune moment to invest in Rivian ahead of a substantial sales increase linked to its upcoming mass market vehicles. However, investors should proceed with caution.

TSLA PS Ratio data by YCharts

Rivian’s management plans to launch its first mass market vehicle in 2026, although launch timelines often shift due to the complexities of establishing new manufacturing operations. The R3 and R3X models may not be ready until 2027. This extended timeline is a primary factor in Rivian’s current valuation discount.

If you are looking for quick gains through a convergence of Rivian and Tesla valuations, success may be unlikely. Barring significant updates regarding Rivian’s gross margin, major catalysts for growth may be sparse for the next couple of years.

However, patience might prove rewarding. If Rivian successfully rolls out its mass market vehicles beginning in 2026, an explosive sales trajectory is expected, with further launches in 2027 enhancing growth prospects. Until then, expect volatility driven by minimal news.

Rivian’s current stock appears undervalued, but it may take years to determine whether the investment thesis holds true. Investors willing to wait for potential substantial returns should contemplate a position in Rivian, keeping in mind that immediate rewards may not be forthcoming.

An Opportunity Not to Be Missed

If you’ve ever felt like you missed your chance to invest in high-performing stocks, take note.

Our expert analysts occasionally issue a “Double Down” stock recommendation for companies poised for significant growth. If you think you’ve lost your chance, now is the ideal time to invest before the moment passes. The data underscored by historical performance is compelling:

- Amazon: A $1,000 investment following our recommendation in 2010 would now be worth $21,285!*

- Apple: A $1,000 investment after our 2008 recommendation would have grown to $44,456!*

- Netflix: A $1,000 investment from our 2004 recommendation would have skyrocketed to $411,959!*

We are currently issuing “Double Down” alerts for three exceptional companies, and another chance like this may not arise soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.