The Reckoning for Advance Auto Parts: A $1.2 Billion Turning Point

In the Competitive Landscape of Auto Parts Retail, Big Players Dominate

Autozone and O’Reilly have established themselves as the leaders in the car-parts retail industry, boasting market capitalizations of $53 billion and $71 billion, respectively. In stark contrast, Advance Auto Parts (NYSE: AAP) stands at a mere $2.4 billion. This significant gap raises eyebrows, especially considering Advance operates nearly 4,800 locations, while Autozone and O’Reilly have larger networks with about 7,400 and 6,200 stores, respectively.

Advancing through Challenges with a Major Sell-off

Advance Auto Parts faces some challenges. However, it is taking steps to address them. The company is set to receive a remarkable $1.2 billion from the sale of its Worldpac business, a sizeable amount for a firm with such a modest market cap.

Advance owns several brands, including Carquest and Worldpac. Under new CEO Shane O’Kelly, the company is undergoing a significant restructuring. Part of this process involves divesting the Worldpac segment.

In August, Advance inked a deal to sell Worldpac for $1.5 billion, which will net the company approximately $1.2 billion after transaction costs—a figure equal to half of Advance’s current market value. The deal is anticipated to close in the fourth quarter of this year.

Worldpac has reported $2.1 billion in revenue over the past year and $100 million in earnings before interest, taxes, depreciation, and amortization (EBITDA). This means Advance sold it at 0.7 times its revenue and 15 times its EBITDA.

To put this in perspective, Advance’s stocks currently trade at 0.2 times revenue and around 7 times EBITDA, showcasing that the Worldpac sale secured a significantly higher price compared to Advance’s stock performance.

Leverage from the Windfall: Will it Drive Change?

O’Kelly points out that the Worldpac sale enhances Advance’s “financial flexibility” as the company embarks on crucial transformations. These changes are surely needed, as Advance’s performance has been lackluster compared to its competitors.

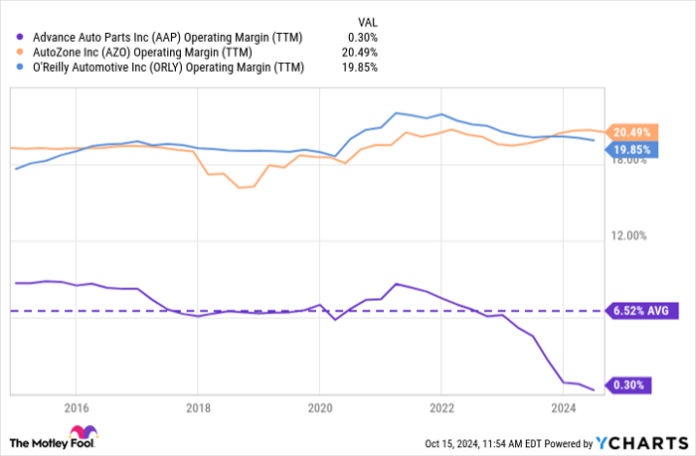

For instance, Autozone and O’Reilly have enjoyed operating margins consistently between 18% and 20% over the past decade. In stark contrast, Advance has averaged only about 6%, and its margins have recently dipped even further.

AAP Operating Margin (TTM) data by YCharts

To tackle these profitability issues, O’Kelly, an expert in supply chain management, identified inefficiencies within Advance’s supply chain as a major hurdle. The company has already begun a multi-year plan to transform this aspect, raising optimism for future shareholder returns.

If Advance can achieve a modest 10% operating margin—a figure still lower than that of its peers—it could generate nearly $1 billion in annual profits. Notably, even after the Worldpac sale, Advance still posts over $9 billion in annual sales, and if valued at ten times operating profit, the stock could potentially see a significant increase.

Restructuring the supply chain is paramount for Advance and its investors. However, this endeavor comes with financial burdens, as the company’s balance sheet shows $1.8 billion in long-term debt and under $500 million in cash. Although Advance is not at immediate risk of liquidity issues, this position is not ideal.

By selling Worldpac, Advance improves its balance sheet, thus allowing management to pursue strategies that can foster long-term growth and success.

Given these factors, the outlook for Advance Auto Parts appears promising after the Worldpac sale. With the right turnaround, investors may find considerable value in the current stock price.

A New Opportunity: Are You Prepared?

Feeling like you missed earlier profitable investments in successful companies? Now might be your chance.

At times, our expert analysts identify a special opportunity, termed a “Double Down” stock, for companies on the brink of notable growth. If you’re concerned about missing the boat again, consider investing now before it’s too late. The impressive growth data speaks volumes:

- Amazon: Invested $1,000 in 2010 would be worth $21,285!

- Apple: An investment of $1,000 in 2008 would be valued at $44,456!

- Netflix: A $1,000 investment in 2004 would grow to $411,959!

Currently, we’re spotlighting three exceptional “Double Down” stocks, and opportunities like this don’t come often.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Jon Quast holds shares in Advance Auto Parts. The Motley Fool has no position in the stocks mentioned. The Motley Fool has a disclosure policy.

The views expressed here are solely those of the author and do not reflect the views of Nasdaq, Inc.