ASML’s Stock Slump: Is It Time to Buy or Wait?

Artificial intelligence (AI) has become the centerpiece of this year’s stock market surge, and its influence is being felt across various sectors.

The introduction of OpenAI’s ChatGPT has sparked intense competition within the tech industry. Generative AI could revolutionize business much like the internet did in the past. While many AI-related stocks have thrived, the performance has varied significantly among them.

Nvidia recently achieved an all-time high, driven by the high demand for its new Blackwell platform. However, not all AI stocks are following this upward trend. For instance, ASML (NASDAQ: ASML) is down 34% from its peak earlier this year after delivering a disappointing forecast during its third-quarter earnings call this week. The stock plummeted by 16.3% following the news.

![]()

Image source: Getty Images.

The Reasons Behind ASML’s Decline

ASML is the only manufacturer of extreme ultraviolet (EUV) lithography machines, critical for producing the most advanced semiconductor chips.

Investors had hoped for a rebound in ASML’s business after a slowdown attributed to factors such as high interest rates and inflation.

The company is poised to benefit from an increase in chip production globally as various governments and industries gear up for the AI boom. Notably, the U.S. is expected to invest tens of billions of dollars via the CHIPS Act to develop semiconductor foundries. Meanwhile, Taiwan Semiconductor, the largest foundry operator, aims to relocate operations closer to its clients.

Despite these positive indicators, ASML indicated that the recovery might take longer than anticipated. CEO Christophe Fouquet noted weaknesses in both the logic and memory sectors, which are critical to ASML’s operations. He mentioned customer hesitance and adjusted the 2025 revenue forecast downward from 30-40 billion euros ($33-43 billion) to 30-35 billion euros ($33-38 billion). Investors reacted accordingly, showcasing their disappointment.

Is This a Good Time to Buy ASML Shares?

When companies report disappointing results or forecasts, it’s often due to challenging market conditions or internal issues. In ASML’s case, the challenges are primarily external. Although there’s a buzz around AI, problems persist in the legacy chip market, affecting key customers like Intel and Samsung.

Samsung is reportedly postponing mass production at its Texas fab due to poor yields in its 3-nanometer process. At the same time, Intel has announced a significant restructuring, raising doubts about its expansion plans. Notably, about half of ASML’s recent revenue comes from China, where the economy has struggled since the end of the pandemic.

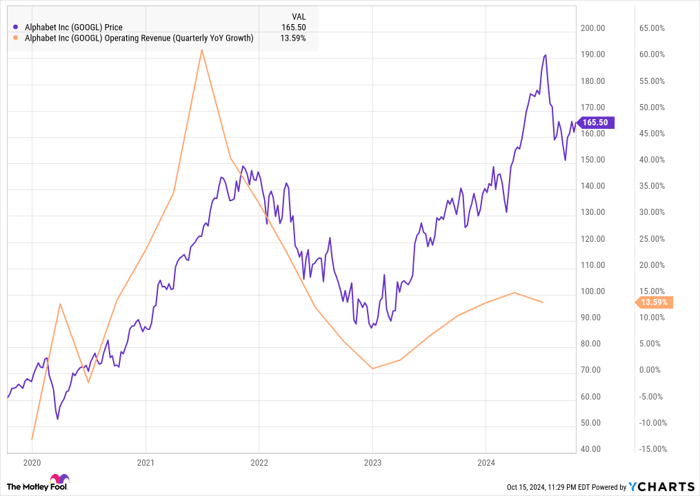

A comparable situation occurred with Alphabet, which faced headwinds in digital advertising during 2022. The chart below illustrates that while Alphabet’s Q4 revenue growth fell to just 1%, those who invested in the stock at that time could enjoy more than an 80% return today.

GOOGL data by YCharts.

ASML still holds a significant edge as the sole producer of EUV lithography machines. As chip production picks up due to AI demand, the company is likely to benefit in the long run. Even with the reduced guidance, ASML is projecting growth of 16.1% at the midpoint, along with improving gross and operating margins.

As conditions improve, the stock may rebound, making it an attractive option for long-term investors focused on AI-related growth.

Should You Invest $1,000 in ASML Now?

Before diving in, consider the following:

The Motley Fool Stock Advisor has identified what it believes to be the 10 best stocks to invest in currently, and ASML is not among them. The recommended stocks have the potential for substantial returns in the years ahead.

For instance, if you invested $1,000 in Nvidia when it made the list on April 15, 2005, your investment would now be worth $845,679!*

Stock Advisor offers an accessible approach to investing, including portfolio guidance, regular analyst updates, and two new stock picks each month. Since 2002, Stock Advisor has consistently outperformed the S&P 500 by more than fourfold.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has no position in any of the mentioned stocks. The Motley Fool has investments in and recommends ASML, Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing, while recommending Intel along with specific options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.