Nike Faces Challenges but Remains a Solid Investment Option

Nike (NYSE: NKE) stands out as a blue chip stock, known for its leading position in the athletic wear industry, financial stability, and powerful global brand. However, recent years have seen significant setbacks for the company.

Nike’s stock has dropped nearly 55% since reaching its all-time high in November 2021, with a 24% decline recorded in 2024 alone. This downturn has posed considerable challenges for both Nike and its shareholders.

While many investors understandably dislike seeing their investments lose value, Nike’s current trading levels may present a potential opportunity for long-term holders who can exercise patience.

Leadership Change Could Reinvent Nike’s Future

Nike has recently announced the upcoming transition from CEO John Donahoe to incoming CEO Elliott Hill, effective October 14.

Donahoe has led Nike since January 2020, experiencing a dual-phase tenure. His early leadership coincided with a stock boost during the COVID-19 pandemic, but the latter half has presented difficulties.

Critics have noted that one of Donahoe’s major drawbacks was his lack of experience in the creative aspects of the apparel industry. His earlier role at eBay focused heavily on e-commerce, while Nike’s increased emphasis on a direct-to-consumer model has negatively impacted performance.

In contrast, Elliott Hill brings decades of experience within Nike, which may help redirect the company back toward the innovation that has historically defined its success.

Nike Stock Valuation: Fair and Worth Considering

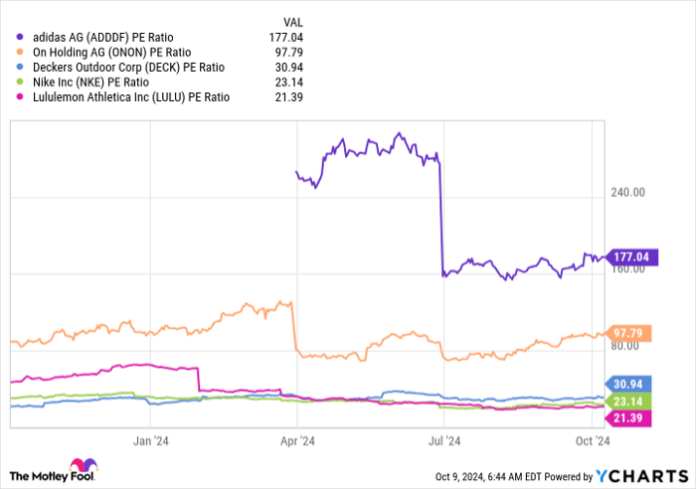

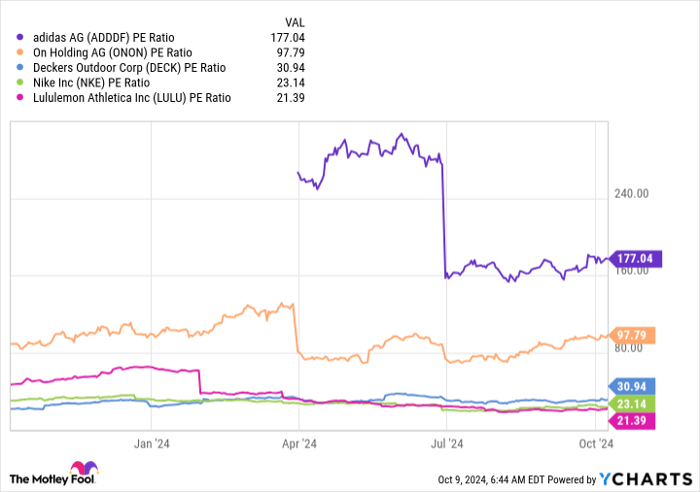

Nike’s price-to-earnings (P/E) ratio stands at just over 23.1, a significant drop from the 84 it reached in late 2021. While this statistic alone does not make the stock a bargain, it does reflect a fair pricing level compared to competitors such as Adidas, On Holding (owner of On shoes), Deckers Outdoor (owners of Ugg and Hoka), and Lululemon.

Data by YCharts.

Although these competitors have reported faster revenue and earnings growth recently, few can rival Nike’s brand power—a unique competitive advantage.

Consider this famous quote from Warren Buffett: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” This statement highlights Nike’s status as the leading name in athletic footwear and apparel. Recent setbacks are likely to be a temporary bump in an otherwise successful journey.

Strategic Stock Buybacks Amid Falling Prices

Nike management has recognized the stock’s decline as a chance to increase stock buybacks, spending nearly $1.2 billion on repurchases in the latest quarter.

| Month | Shares Repurchased | Average Price Paid Per Share | Total Spent |

|---|---|---|---|

| June | 3.26 million | $94.11 | $307 million |

| July | 6.16 million | $74.19 | $457 million |

| August | 5.39 million | $79.76 | $430 million |

Data source: Nike. Total spent rounded to the nearest hundred million.

Investors benefit from fewer outstanding shares, resulting in increased earnings per share. Stock buybacks, along with dividends, are vital methods of returning value to shareholders beyond stock price gains.

An increase in buyback activity may signal management’s belief that the stock is undervalued heading into its potential recovery period, especially given its steep drop this year.

Although Nike’s recovery won’t occur overnight, long-term investors may find this an advantageous time to acquire shares, especially with the forthcoming leadership changes.

Thinking About Investing $1,000 in Nike?

Before considering an investment in Nike, it’s essential to take a moment to evaluate:

The Motley Fool Stock Advisor analyst team has identified their top 10 stock picks for investors right now—and surprisingly, Nike is not included. The recommended stocks could yield remarkable returns in the upcoming years.

Reflect on when Nvidia made the list on April 15, 2005. An investment of $1,000 at that time would now be worth $826,069!

Stock Advisor offers a straightforward strategy for investor success, with ongoing portfolio-building guidance and two new stock selections each month. This service has significantly outperformed the S&P 500 since its inception in 2002.

Explore the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends On Holding. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.