Vanguard S&P 500 Growth ETF Outshines Market: Key Insights for Investors

The S&P 500 gained around 23% in 2024, which is significantly higher than its historical average annual returns of 10.6% since its inception in 1957. In contrast, if you had invested in the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG), your return would be an impressive 38%. This ETF closely follows the S&P 500 Growth index, consisting of only the top 233 growth stocks within the broader index.

This strategy places greater emphasis on rapidly growing companies like Nvidia, resulting in superior returns. As trends such as artificial intelligence (AI) gain traction, there’s strong potential for the Vanguard S&P 500 Growth ETF to continue outperforming the S&P 500 in 2025.

Considering an investment? Our analysts have pinpointed the 10 best stocks to consider today. Explore the 10 stocks »

Image source: Getty Images.

Investing Heavily in Top Technology Stocks

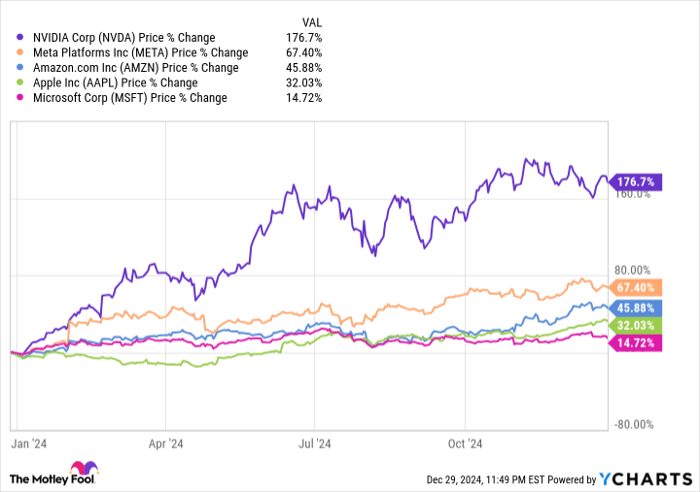

The S&P 500 Growth index evaluates stocks based on momentum and sales growth. Below is a table featuring the top five stocks in the index, alongside their recent performance:

NVDA data by YCharts.

All but one of these stocks outperformed the S&P 500, and since the Vanguard ETF assigns them larger weightings, its strong performance over the past year is not surprising:

|

Stock |

Vanguard ETF Portfolio Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

12.38% |

7.06% |

|

2. Nvidia |

11.67% |

6.66% |

|

3. Microsoft |

10.80% |

6.16% |

|

4. Amazon |

6.66% |

3.80% |

|

5. Meta Platforms |

4.31% |

2.46% |

Data source: Vanguard. Chart by author. Portfolio weightings are accurate as of Nov. 30, 2024 and subject to change.

The information technology sector represents 49.1% of the Vanguard ETF, compared to just 31.3% in the S&P 500. The top three companies listed above are each valued at over $3 trillion and are all in this tech sector.

With AI expected to make major advancements, technology will likely lead the Vanguard ETF again. Morgan Stanley recently projected that four companies—Microsoft, Amazon, Meta, and Alphabet—could collectively spend $300 billion on AI chips and infrastructure this year.

This spending will benefit Nvidia, the leading supplier of AI graphics processors (GPUs), as well as other companies like Broadcom, Advanced Micro Devices, and Texas Instruments that are also in the Vanguard ETF.

Though primarily tech-focused, the ETF also includes prominent stocks like Eli Lilly, Costco Wholesale, and McDonald’s from various industries.

Why the Vanguard ETF Could Outperform Again in 2025

Since its launch in 2010, the Vanguard ETF has averaged a compound annual return of 16.4%, which is higher than the S&P 500’s 14.1% over the same timeframe. This 2.3 percentage-point difference may seem minor, but it compounds significantly over time:

|

Starting Balance (2010) |

Compound Annual Return |

Balance at the End of 2024 |

|---|---|---|

|

$50,000 |

16.4% (Vanguard ETF) |

$419,094 |

|

$50,000 |

14.1% (S&P 500) |

$316,934 |

Chart and calculations by author.

As noted earlier, the Vanguard ETF soared by 38% in 2024, widening the gap compared to the S&P 500’s return. If stocks like Nvidia continue to lead, the ETF is poised for another year of strong performance in 2025.

However, if the stock market takes a downturn or faces an economic shock, the Vanguard Growth ETF may lag behind due to its focus on high-growth stocks, which tend to drop more sharply in those situations. This shift occurs as investors seek safe-haven dividend stocks, providing more support for the S&P 500.

Currently, there are no obvious threats on the horizon, making the Vanguard S&P 500 Growth ETF a solid option for 2025.

Seize the Opportunity Before It’s Gone

Feeling like you missed your chance to invest in the next big stocks? You’re not alone.

Occasionally, our seasoned analysts recommend a “Double Down” stock—a potential high-growth opportunity just waiting for the right moment. Don’t miss this chance; investment returns can be significant:

- Nvidia: Investing $1,000 when we doubled down in 2009 would have netted you $348,216!*

- Apple: A $1,000 investment during our 2008 recommendation would now be worth $47,425!*

- Netflix: Investing $1,000 when we doubled down in 2004 grew to $480,681!*

Right now, we’re issuing “Double Down” alerts for three exciting companies, and opportunities like this don’t come around often.

Explore 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Texas Instruments. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.