Will Amazon Continue Its Winning Streak in 2025?

If you’re like many investors, discovering stocks that consistently outperform the market is the ultimate goal. Numerous examples exist across various industries, but one standout has been Amazon(NASDAQ: AMZN), which saw its stock rise nearly 50% in 2024. The question now is: Can it replicate that success in 2025?

Diverse Business Segments Drive Growth

Most people associate Amazon with its sprawling e-commerce platform, which generated $61.4 billion in online store sales during Q3, marking a 7% increase compared to the previous year. While that’s a significant source of revenue, the company also has rapidly growing segments that are worth noting.

One of the standout areas is Amazon’s advertising services. In Q3, this segment generated $14.3 billion in revenue, reflecting a remarkable 19% year-over-year growth. Amazon’s advertising growth is not just about boosting sales; it has significantly contributed to the company’s profits as well.

Although Amazon doesn’t disclose specific advertising margins, overall trends suggest they are quite healthy. Comparisons with other industry leaders like Meta Platforms and Alphabet, which enjoy operating margins in the 30% to 40% range, imply that Amazon’s advertising also plays a crucial role in its financial performance. Amazon’s companywide Q3 operating margin was 11%, indicating the benefits from its ad revenue.

Another vital division for Amazon is Amazon Web Services (AWS). As the leading provider in the cloud computing sector, AWS faced challenges in 2023, showing revenue growth in the low teens. However, thanks to increasing demand driven by artificial intelligence, AWS is back on track. In Q3, it achieved 19% year-over-year growth, with its operating income soaring 50%, leading to an impressive operating margin of 38%.

Valuation and Future Outlook

Looking ahead, analysts project a revenue growth of 10.8% for Amazon in 2025, following an estimate of 11% growth for 2024. They expect earnings per share (EPS) to increase by 20% in 2025, although the 2024 forecast predicts a remarkable 77% growth.

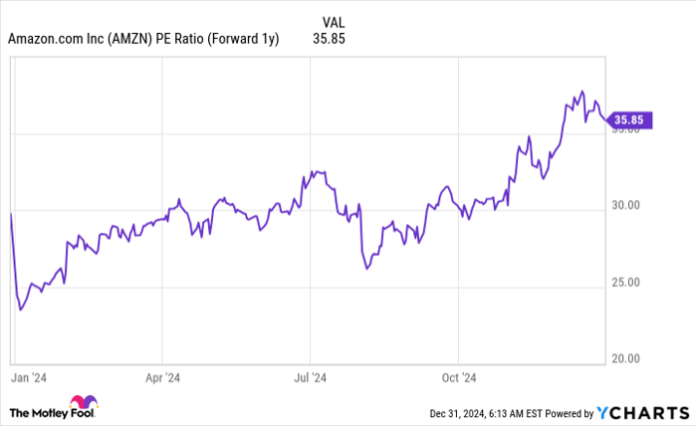

Despite the promising earnings growth, Amazon’s stock currently trades at 36 times 2025 projected earnings, which some may consider high. This presents a valuation risk that investors should keep in mind. However, given Amazon’s potential for growth in the coming years, this could balance out in the long run.

The coming year appears bright for Amazon; it could likely outperform the market. Nevertheless, investors shouldn’t count on another 50% surge in stock price.

Is Now the Right Time to Buy Amazon Stock?

Before making any investment, consider the following:

The Motley Fool Stock Advisor analyst team has recently identified the 10 best stocks for investment currently… and Amazon wasn’t included among them. The stocks that did make the list are viewed as having the potential for impressive returns in the future.

For context, if you had invested $1,000 in Nvidia on April 15, 2005, based on their recommendation, that investment would be worth $885,388 today!

Stock Advisor offers a straightforward plan for success, including portfolio-building advice, regular updates, and two new stock recommendations each month. Since its inception, Stock Advisor has greatly outperformed the S&P 500 by more than four times.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.