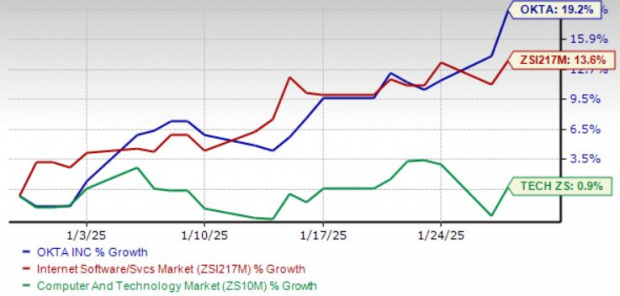

Okta (OKTA) has seen its shares climb by 19.2% over the past month, significantly surpassing the Zacks Computer & Technology sector’s return of 0.9% and the Zacks Internet Software and Services industry’s increase of 13.6%.

Strong demand for products like Okta identity governance and Okta privileged access is driving this growth, even in a tough economic landscape. The company’s expanding client base, particularly through the adoption of its Identity Threat Protection solution, positions Okta favorably for growth-oriented investors.

Okta’s collaboration with the McLaren Formula 1 Team is also notable. This partnership will explore new methods to enhance the security and efficiency of McLaren Racing’s applications and platforms, contributing to a stronger digital infrastructure.

Okta Shows Strong Performance Compared to Sectors

Image Source: Zacks Investment Research

Prospects for Share Growth in 2025

Okta’s innovative offerings are likely to attract new clients, which will drive revenue growth. As of the end of the third quarter of fiscal 2025, Okta had 19,450 customers and $2.062 billion in current remaining performance obligations, indicating strong future subscription revenue potential. The number of customers with over $100K in Annual Contract Value rose by 8% year over year, totaling 4,705.

Okta AI, featuring a suite of AI-driven tools in both the Workforce Identity Cloud and Customer Identity Cloud, enables organizations to leverage AI for better user experiences and protection against cyber threats.

The company’s revenues are projected to experience a compound annual growth rate (CAGR) of 26% from fiscal 2022 to fiscal 2025.

The recent increase in the Auth0 Free Plan now allows for 25,000 monthly active users and includes features like passwordless access, unlimited social and Okta connections, along with custom domain support. Paid plans offer enterprise-level security, incorporating multi-factor authentication, System for Cross-domain Identity Management support, enhanced log retention, and more.

Okta’s strong portfolio is gaining market share in the cybersecurity space, competing effectively against Microsoft (MSFT), International Business Machines (IBM), and CyberArk (CYBR).

According to Gartner, Okta outperformed Microsoft and CyberArk in all use cases on its Critical Capabilities for Access Management report. For the third consecutive year, Okta has also ranked highest in Gartner’s Magic Quadrant for Ability to Execute.

Demand for Identity Solutions Fuels Okta’s Growth

Recent global security breaches highlight the increasing need for cybersecurity services, making companies like Okta essential.

IDC forecasts the global security market to grow at double-digit rates over the next five years, with revenues expected to reach $200 billion by 2028. Its segment, Identity and Access Management (IAM), is anticipated to be one of the fastest-growing sectors, with a CAGR in the teens or higher expected between 2024 and 2028.

The strong potential for IAM is driven by the rising demand for secure remote access and improved protection during the ongoing digital transformation of businesses. These trends bode well for Okta’s long-term outlook.

In October, Okta unveiled new capabilities for the Workforce Identity Cloud that address challenges faced by unmanaged SaaS accounts, governance risks, and identity verification issues.

The Secure SaaS Service Accounts feature enhances protections for non-federated SaaS accounts through methods such as vaulting and credential rotation along with step-up multi-factor authentication and audit trails.

Governance Analyzer provides managers with critical insights, including usage data and previous governance decisions, to facilitate quick and confident authorization decisions.

Positive Outlook for OKTA’s Fiscal Q4 & FY25

For the fourth quarter of fiscal 2025, Okta anticipates revenues between $667 million and $669 million, representing a 10-11% year-over-year increase. The company expects non-GAAP earnings of 73 to 74 cents per share.

For the entire fiscal year 2025, Okta projects revenues to be between $2.595 billion and $2.597 billion, an increase from the earlier guidance of $2.555 billion to $2.565 billion, which would indicate a 15% growth compared to fiscal 2024.

Non-GAAP earnings estimates for fiscal 2025 have also been adjusted upward to between $2.75 and $2.76 per share, an improvement from previous projections of $2.58 to $2.63 per share. Additionally, the free cash flow margin is expected to be around 25% for the fiscal year.

Bright Future Reflected in Earnings Estimates

In the past month, the Zacks Consensus Estimate for Okta’s fiscal 2025 earnings has risen by a penny to $2.77 per share, indicating a projected growth of 73.13% compared to the previous fiscal year.

The consensus for revenues stands at $2.60 billion, suggesting a 14.75% uptick over the previous year’s numbers.

For the fourth quarter of fiscal 2025, the consensus for earnings remains steady at 73 cents per share, reflecting a year-over-year growth of approximately 15.87%. Revenue projections are currently set at $668.8 million, which would be a 10.55% increase compared to last year’s quarter.

Okta, Inc. Price and Consensus

Okta, Inc. price-consensus-chart | Okta, Inc. Quote

Okta has consistently exceeded the Zacks Consensus Estimate in the last four quarters, with an average surprise of 19.87%.

Track the latest EPS estimates and surprises on Zacks Earnings Calendar.

OKTA’s Premium Trading Position

Currently, Okta shares are trading at a premium, as indicated by a Value Score of F. The forward 12-month Price/Sales (P/S) ratio for OKTA stands at 5.84X, outpacing the industry average of 3.87X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

In Conclusion

Okta appears to be a strong investment option in the near term, given its substantial growth potential in a large market, which justifies its premium valuation.

With a Zacks Rank of #2 (Buy) and a Growth Score of A, Okta presents a compelling opportunity for investors, according to Zacks Proprietary methodology. A complete list of Zacks #1 Rank (Strong Buy) stocks is available here.

7 Top Stocks for the Next Month

Newly released: Experts have curated 7 standout stocks from a group of 220 Zacks Rank #1 Strong Buys, recommending them as “Most Likely to See Early Price Gains.”

Since 1988, this selection has outperformed the market by over twice, yielding an average annual gain of +24.3%. Be sure to look into these 7 selected stocks.

Get the latest recommendations from Zacks Investment Research by downloading the report on the 7 Best Stocks for the Next 30 Days now.

Microsoft Corporation (MSFT): Free Stock Analysis Report

International Business Machines Corporation (IBM): Free Stock Analysis Report

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

Okta, Inc. (OKTA): Free Stock Analysis Report

For full access to this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.