The Future of Tech Stocks: Recovery or Repeat of 2022’s Crash?

Investors often favor tech stocks for their potential to deliver high returns over both short and long terms. However, the excitement surrounding the latest technologies can lead to inflated valuations and risk of a downturn.

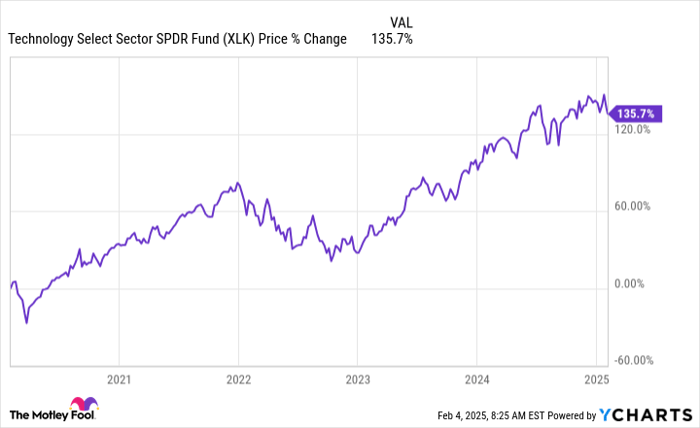

In 2022, tech stocks took a significant hit, primarily due to inflated valuations. The S&P 500 (SNPINDEX: ^GSPC) dropped over 19%, while the Technology Select Sector SPDR Fund (NYSEMKT: XLK) fell by 28%. Notably, Nvidia plummeted by over 50% that year, and Meta Platforms lost a staggering 64% of its value.

Considering where to invest $1,000 now? Our analysts have identified the 10 best stocks for today. Discover the 10 stocks »

Current valuations in tech raise concerns once more, prompting speculation: Could we face another crash in 2025?

XLK data by YCharts

What Contributed to Tech’s Decline in 2022?

At the pandemic’s onset, government stimulus checks and strong economic conditions fueled online spending. Companies in e-commerce ramped up hiring to meet the increased demand.

Many tech giants underwent significant expansions—Microsoft CEO Satya Nadella remarked that we were witnessing “the dawn of a second wave of digital transformation.” From 2019 to 2022, major firms, including Meta and Amazon, saw their employee counts more than double.

However, these companies miscalculated the situation, mistaking a temporary trend as a lasting shift. Consequently, layoffs ensued, with tech losing 93,000 jobs in 2022 and another 191,000 in 2023, according to Crunchbase.

Despite a recovery in 2023, primarily driven by renewed interest in artificial intelligence (AI) following the launch of ChatGPT, the market’s overall sentiment remained fragile.

Are Tech Companies Overspending Once Again?

Presently, tech corporations are heavily investing in AI, echoing past sentiments of transformative change. However, the hype surrounding AI can sometimes lead to excessive spending.

Meta Platforms is on track to invest at least $60 billion in AI this year, while Microsoft aims for an even more ambitious $80 billion in spending on AI data centers during its current fiscal year.

Although advancements like chatbots and automation promise substantial improvements, the costs associated with these technologies are notable. Sam Altman, CEO of OpenAI—creator of ChatGPT—indicated that despite charging $200 per month for premium subscriptions, the company continues to operate at a loss.

Furthermore, the market reacted negatively earlier this year when DeepSeek, a Chinese AI firm, announced the development of a comparable AI model for under $6 million, provoking fears of renewed over-spending in tech. Given the rapid pace of investment from Meta and Microsoft, concerns about unaccounted costs remain high.

Should Investors Pull Out of Tech Stocks Now?

A surge in hype accompanied by soaring spending can result in catastrophic outcomes, as seen in 2022. Observing stocks like Palantir Technologies, which trades at over 200 times its trailing earnings after a strong earnings report, raises alarms about investor disregard for valuations. This behavior heightens the risk of another market crash.

Eventually, every bubble faces a burst. Currently, the average stock within the Technology Select Sector SPDR Fund trades at 39 times earnings, with many tech stocks exceeding that figure.

While not all tech stocks appear overvalued, a substantive number do. It might not be time to exit the tech sector entirely, but careful evaluation of stock valuations is crucial. If a stock exceeds 100 times its trailing earnings, strong justification for that premium is necessary—and often, it isn’t present.

The projection of ignoring valuations spells risk; high-priced stocks tend to be more vulnerable during market corrections. While it’s appealing to assume stocks will maintain upward trajectories, investors should prepare for the reality of a significant correction or an outright crash.

Notably, the Technology Select Sector Fund has declined 2% this year, indicating it has not started with robust momentum. A complete crash may not manifest in 2025, but prudent investors should always remain alert to such possibilities—especially with the sector’s escalating valuations.

Is Now the Right Time to Invest $1,000 in the Technology Select Sector SPDR Fund?

Before considering an investment in the Technology Select Sector SPDR Fund, it’s essential to assess the following:

The Motley Fool Stock Advisor team has pinpointed their top 10 stocks for investment… and the Technology Select Sector SPDR Fund isn’t among them. The selections they endorse promise substantial potential returns in the future.

Reflecting on when Nvidia was recommended on April 15, 2005… if you had invested $1,000 at that time, you would have amassed $765,024!

The Stock Advisor service equips investors with a straightforward path to success, offering portfolio-building guidance, periodic analyst updates, and two new stock recommendations each month. The Stock Advisor program has more than quadrupled the S&P 500’s returns since 2002.*

Further information »

*Stock Advisor returns as of February 3, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board. John Mackey, former CEO of Whole Foods Market (an Amazon subsidiary), is also a board member. David Jagielski holds no positions in any stocks mentioned. The Motley Fool has vested interests in and recommends Amazon, Meta Platforms, Microsoft, Nvidia, and Palantir Technologies. Recommendations include options for Microsoft. The Motley Fool maintains a disclosure policy.

The views expressed here represent the opinions of the author and do not necessarily reflect those of Nasdaq, Inc.