Expedia Group EXPE is continuously gaining from a growing customer momentum on the back of its robust travel solutions portfolio.

The latest partnership with Cathay is a testament to the aforesaid fact.

Cathay will integrate Expedia’s White Label Template technology into its newly launched Cathay Holidays travel hub to expedite and customize travel booking and trip planning experiences of customers.

Cathay partnership is expected to boost Expedia’s footprint in the travel and tourism market in Asia which as per a report from Statista, is expected to hit $326.2 billion in 2024 and reach $402 billion by 2028, indicating a CAGR of 5.4% during the period of 2024-2028.

Expedia Group, Inc. Price and Consensus

Expedia Group, Inc. price-consensus-chart | Expedia Group, Inc. Quote

Portfolio Strength & Growing Clientele to Aid Growth

Per a Statista report, the global travel and tourism market is expected to hit $927.3 billion in 2024 and reach $1.06 trillion by 2028, indicating a CAGR of 3.5% during the forecast period of 2024-2028.

An MMR report indicated the online travel booking market is likely to reach $1.18 trillion by 2030, witnessing a CAGR of 9.7% between 2024 and 2030.

Expedia remains well-poised to capitalize on these growth opportunities on the back of its robust portfolio.

Recently, it introduced a slew of new products and features in a bid to boost the travel experiences of its customers. It launched Romie, the industry’s first AI-based travel assistant designed to assist users in planning, shopping, booking and helping them with unexpected changes during trips.

Expedia also launched Travel Shops, a new storefront that allows creators to share and save travel recommendations in one central place on the app.

The company unveiled a travel media network, leveraging its first-party traveler intent and purchase data to reach more travelers. The network offers an in-house creative team, industry-leading advertising tools and offsite capabilities, enabling advertising partners to collaborate on campaigns, target high-intent travelers, and tap into Expedia Group’s vast B2B network.

Expanding product portfolio is expected to continue driving Expedia’s customer momentum.

Recently, Expedia Group announced several partnerships to expand its clientele across the Asia-Pacific, North America, Europe and the Middle East regions on the back of its robust solutions.

The company collaborated with Tourism and Events Queensland, Tourism Tropical North Queensland, Tourism Northern Territory and Brisbane Economic Development Agency to enhance travelers’ experiences, improve sustainable tourism and showcase Australia’s unique culture.

Expedia Group also partnered with Ikyu, a Japanese luxury hotel booking service, offering its customers over 20,000 additional properties worldwide and enabling them to earn points for future bookings using Expedia’s Rapid API solutions.

In North America, the company collaborated with Alaska Airlines and United Airlines, further expanding the customer base for its White Label Template technology. Per the terms, both partners will utilize Expedia Group’s White Label Template technology capabilities to upgrade their online travel platforms by integrating flights, car rentals and properties into customizable packages.

Expanding customer base will continue to aid EXPE’s overall performance..

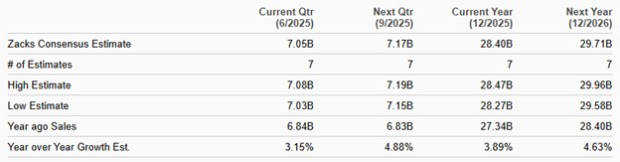

The Zacks Consensus Estimate for 2024 revenues is pegged at $11.86 billion, indicating growth of 22.4% year over year.

The consensus mark for 2024 earnings is pegged at $11.86 per share, indicating year-over-year growth of 22.4%.

Intensifying Competition

However, intensifying competition in the travel and tourism market space from major players like TripAdvisor TRIP, Airbnb ABNB and Booking Holdings BKNG, remains a risk for this Zacks Rank #3 (Hold) company. Expedia Group’s shares have lost 27.3% on a year-to-date basis, underperforming the Retail-Wholesale sector’s 9.1% growth. Its shares have also underperformed TRIP, ABNB and BKNG.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Tripadvisor’s launch of an AI-powered travel itinerary generator for Trips, enabling personalized itineraries based on human insights from over a billion reviews and opinions from over eight million businesses on the platform, remains noteworthy.

Shares of TRIP have lost 16.7% on a year-to-date basis.

Airbnb unveiled a few updates for group booking, including a new category called “Icons” hosted by celebrated personalities in music, film, TV, and sports. These features will allow users to create shared wishlists, invite friends or family, add properties, leave notes or vote on bookings.

ABNB has gained 7.7% on a year-to-date basis.

Meanwhile, Booking Holdings’ subsidiary, Priceline, added a slew of generative AI-powered features to its Trip Intelligence suite, facilitating the trip planning and booking process for travelers to save time.

BKNG has gained 5.5% on a year-to-date basis.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Expedia Group, Inc. (EXPE) : Free Stock Analysis Report

TripAdvisor, Inc. (TRIP) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.