MKS Instruments Reports Strong Q3 Earnings, Faces Mixed Revenue Trends

MKS Instruments (MKSI) reported adjusted earnings of $1.72 per share for the third quarter of 2024, reflecting a rise from $1.46 per share during the same period last year. This surpasses the Zacks Consensus Estimate by a notable 21.13%.

The company’s revenues reached $896 million, which edged past the consensus estimate by 2.62% despite experiencing a 3.9% decline year over year.

Revenues from products, making up 86% of total revenues, totaled $776 million, down 5.1% from the previous year. This still managed to outperform the Zacks Consensus Estimate by 1.78%.

In contrast, services revenues, accounting for 13.4% of total revenues, rose by 5.3% year over year to $120 million, exceeding the Zacks Consensus Estimate by 6.92%.

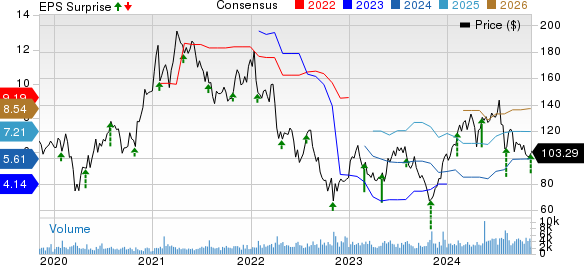

Earnings Overview and Market Position

The chart below illustrates MKS Instruments’ price, consensus, and earnings per share (EPS) surprises:

As of now, MKSI’s stock has increased by 0.4% in 2024, while the Zacks Computer & Technology sector has seen a growth of 11.5%. Analysts believe the raised guidance could positively influence MKSI’s stock performance in the near future.

Major Revenue Contributors for MKSI

The Semiconductor segment, contributing 42.2% of total revenues, grew by 3% year over year, reaching $378 million. This figure also exceeded the Zacks Consensus Estimate by 4.80%.

Revenue from Electronics & Packaging, which comprised 25.8% of total revenues, decreased to $231 million from $243 million a year ago. However, it still surpassed the consensus estimate by 3.02%.

On the other hand, Specialty Industrial revenues, representing 32% of total revenues, fell by 10.9% year over year to $287 million, missing the Zacks Consensus Estimate by 0.94%.

Operational Efficiency and Financials

In the third quarter, MKSI’s adjusted gross margin improved by 110 basis points to 48.2%, reflecting a stronger operational performance.

Research and development costs, as a percentage of revenues, grew by 20 basis points year over year, while sales, general, and administrative expenses increased by 70 basis points.

The company reported a non-GAAP operating income of $195 million, a decline of 3.9% from the previous year, while the adjusted operating margin remained steady at 21.8%.

Adjusted EBITDA dropped by 3.7% year over year to $232 million, although the adjusted EBITDA margin saw a slight increase of 10 basis points to 25.9%.

Financial Position and Future Outlook

As of September 30, 2024, MKS Instruments held $861 million in cash and cash equivalents, an increase from $850 million at the end of June 2024.

Cash flow from operations reached $163 million for the third quarter, up from $122 million in the second quarter. Free cash flow also improved to $141 million, compared to $96 million in the previous quarter.

Additionally, the company distributed cash dividends totaling $15 million, translating to 22 cents per share.

Q4 Guidance Provided by MKSI

Looking ahead, MKSI anticipates revenues between $910 million (+/- $40 million) for the fourth quarter of 2024. The adjusted EBITDA is expected to be approximately $226 million (+/- $23 million), with non-GAAP earnings projected at $1.95 (+/- 32 cents) per share.

Stock Rankings and Comparisons

Currently, MKSI holds a Zacks Rank #3 (Hold). Investors may want to explore stocks like Shopify (SHOP), BiliBili (BILI), and NVIDIA (NVDA), which have been rated higher in the sector. Shopify boasts a Zacks Rank #1 (Strong Buy), while BILI and NVDA carry Zacks Rank #2 (Buy) at this time.

Year-to-date, Shopify shares have increased by 4.9%. The company is slated to release its third-quarter results on November 12. Bilibili’s shares have surged by 82% in the same timeframe and will report results on November 14. NVIDIA has gained a significant 194% this year, with its fiscal 2025 third-quarter results set for November 20.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

MKS Instruments, Inc. (MKSI): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Bilibili Inc. Sponsored ADR (BILI): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.