Understanding Recent Inflation Trends and What They Mean for Investors

A personal shopping trip highlights the ongoing impact of inflation on everyday prices.

During a recent grocery visit, I noticed a significant jump in the price of my staple items, especially milk. The cost was nearly $0.20 higher than during my last shopping excursion just weeks ago. Confronted with this unexpected price hike, I briefly contemplated buying a smaller size or forgoing it altogether, but ultimately, I knew I needed to make the purchase.

Upon returning home, I decided to investigate historical milk prices. According to the Bureau of Labor Statistics (BLS), the average price for a gallon of milk in August stood at $4.044. This figure was down from its peak of $4.22 per gallon in November 2022. To put this in perspective, milk only cost around $3.25 in January 2020, just before the COVID pandemic affected the economy. This indicates a 24% price increase, which is indicative of broader inflation trends.

This week, new insights into inflation were revealed through the September inflation report. Each data point offers a glimpse into the economy, showing how prices affect consumers.

The Consumer Price Index (CPI) report released on Thursday showed an average price for milk at $4.021 for September. With the recent interest rate cut, Wall Street was keen to understand whether inflation remained stable to assess future monetary policy decisions.

In today’s Market 360, I’ll analyze the recent CPI and Producer Price Index (PPI) results and suggest the sectors investors should consider right now.

Current Inflation Insights

Consumer Price Index (CPI)

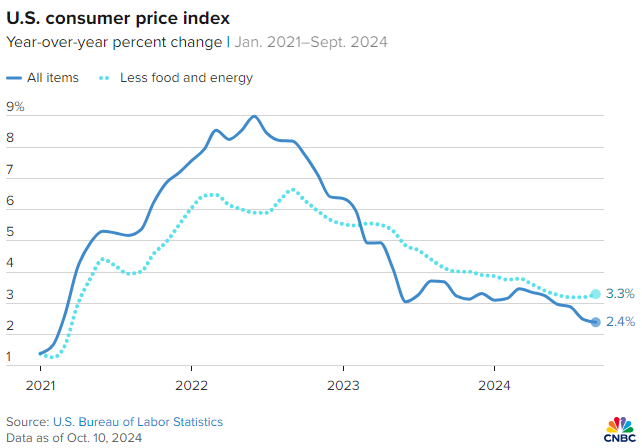

The latest CPI report was released on Thursday, prompting varied reactions in the market. In September, CPI increased by 0.2%, a rise of 0.1% above economists’ expectations. Year-over-year, CPI went up by 2.4%, also 0.1% above the forecast, marking the lowest annual rate since February 2021.

Core CPI, which excludes food and energy costs, increased by 0.3% month-over-month, reaching 3.3% on an annual basis. This was higher than the anticipated rise of 0.2% and the expected 3.2% yearly increase.

Further examination reveals that much of this inflation stemmed from a 0.4% increase in food prices, a 0.7% rise in medical care services, and a 1.1% jump in apparel costs.

In contrast, energy prices dropped by 1.9% in September, following a 0.8% decline in August. Other categories that fell include:

- Gasoline, down 4.1%,

- Recreation, decreasing by 0.4%

- Communications, down by 0.6%.

However, owner’s equivalent rent (OER) remains a significant concern for inflation. The index for shelter costs saw a 0.3% rise in September, reflecting a 5.2% increase from a year ago. For context, OER rose by 0.5% month-over-month in August and 0.4% in July. This shows the market is starting to stabilize somewhat.

Producer Price Index (PPI)

The latest PPI report reveals stable wholesale prices for September. Month-over-month, the headline PPI remained flat, whereas economists had predicted a 0.1% increase. Year-over-year, PPI rose by 1.8%, aligning with estimates. Excluding food, energy, and trade margins, the core PPI increased by 0.2% in September, reflecting a 2.8% rise over the past year.

An analysis of the details shows that the 0.2% increase in final demand services balanced out a 0.2% drop in final demand goods. Specifically, increases in transportation services (up 0.2%) and warehousing services (up 0.3%) contributed to this balance.

In stark contrast, demand goods saw declines led by gasoline, which fell by 5.6%. Energy prices overall decreased by 2.7%. However, wholesale food prices spiked by 1%, representing the largest rise since February, with processed poultry prices soaring by 8.8% in September.

Shifting Focus to Earnings

Even with a slight rise in consumer inflation for September, overall inflation has moderated. This trend suggests a 0.25% key rate cut is likely during the Federal Open Market Committee (FOMC) meeting on November 7.

This leads to an important question: where should investors direct their focus now?

The clear answer is earnings season.

Encouragingly, a robust earnings season is on the horizon. S&P 500 earnings are expected to grow by 4.2%, with revenue anticipated to increase by 4.7% for the third quarter, as reported by FactSet. If these projections hold, it would mark the fifth consecutive quarter of year-over-year earnings growth and the sixteenth consecutive quarter of revenue growth.

With the third-quarter earnings season kicking off today, major banks like Citigroup Inc. (C), JPMorgan Chase & Co. (JPM), and Wells Fargo & Company (WFC) are reporting their results. While they have shown positive responses post-releases, I remain cautious about investing in large banking stocks.

Understanding Earnings Season: Why Quality Stocks Matter

If you’re like me, a former banking regulator, you’re aware that financial institutions can sometimes misrepresent their figures. During the late 1970s and early 1980s, I encountered significant challenges as the yield curve flipped, creating tough conditions for banks. Merging failing banks was one of the strategies I employed to help them qualify for Federal Deposit Insurance Corporation (FDIC) or Federal Savings and Loan Insurance Corporation (FSLIC) coverage. By merging a larger financial entity with a smaller one and adjusting its asset valuations, I aimed to create a healthier appearance on paper.

This approach never truly solved the underlying cash flow issues; rather, it merely delayed the inevitable. An inverted yield curve creates dangerous circumstances for banks, much like putting lipstick on a pig. That experience left a lasting impression on me, leading me to tread carefully when recommending banks.

Instead, I now focus on fundamentally superior stocks. These are companies that show robust earnings and significant sales growth, often on the brink of exceptional earnings reports.

If you want to make gains this earnings season, consider investing in fundamentally superior stocks right now. Unsure where to start your search? My Growth Investor service is a great resource. Stocks from the Growth Investor portfolio average an impressive 23.9% annual sales growth and a remarkable 469.7% annual earnings growth.

Join Growth Investor today to access the full range of my recommended stocks.

(Are you already a Growth Investor member? Click here to log into the members-only website.)

Sincerely,

Source: InvestorPlace unless otherwise noted

Louis Navellier

Editor, Market 360