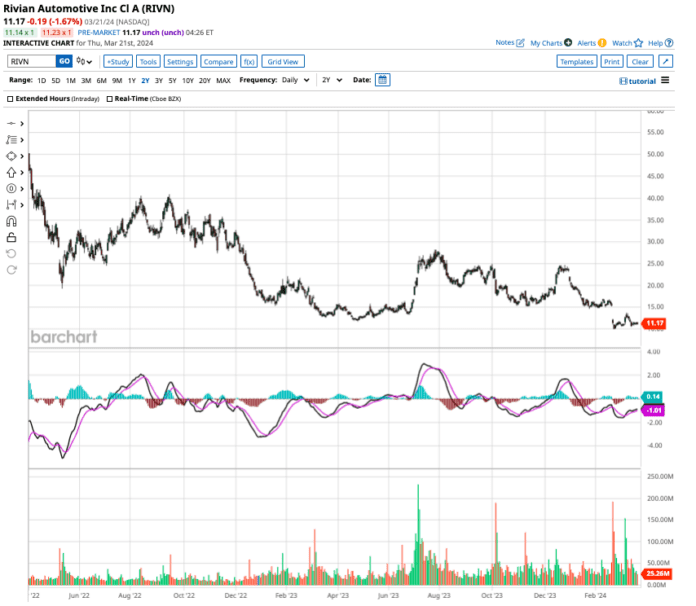

Rivian Automotive (RIVN) caused a stir with its IPO in 2021, but since then, shares have plummeted 93%, leaving the company with a market cap of $10.9 billion. The burning question on investors’ minds is whether Rivian stock has the potential to soar once more in 2024, according to predictions from Wall Street analysts.

A Glimpse into Rivian’s Journey

Specializing in electric vehicles, Rivian Automotive (RIVN) designs, produces, and markets a range of EVs, including the R1T pickup truck and the R1S SUV. Despite the hefty price tags (the R1T starts at $100,000 and the R1S at $70,000), Rivian’s vehicles have drawn notable interest, with the R1S emerging as a top seller. The company has also ventured into the commercial space, striking a deal with Amazon for 100,000 delivery vans by 2030.

Looking ahead, Rivian aims to diversify its offerings with the introduction of the more affordable R2 SUV, priced at $45,000, set to roll out within the next two years.

Running on Empty: Rivian’s Cash Challenge

The EV market grappled with subdued consumer interest in the past year, spurred by inflation and climbing interest rates. Rivian’s Q4 2023 deliveries of 14,000 vehicles, down from 15,500 in the previous quarter, suggest a possible peak in demand for premium EVs. Moreover, Rivian burned through $6 billion in free cash flow over the last year, leaving it with $9 billion in cash by the end of 2024. With an annual outflow of $6 billion, Rivian faces a cash runway of just 18 months, necessitating a likely equity fundraising round within the year.

Traditionally, automakers like Rivian must heavily invest in production capacity before reaping economies of scale and turning consistent profits. Such financial pressures could lead to dilution of shareholder value and strain on Rivian’s share prices.

Piper Sandler’s Bullish Bet on Rivian

In a surprising move, Piper Sandler recently upped its rating on Rivian from “hold” to “buy” and raised the price target on RIVN stock from $15 to $21 per share, signifying a potential upward swing of nearly 100% from current levels. The investment firm cites optimism around Rivian’s forthcoming mid-sized SUV, priced at $40,000, expected to witness heightened demand in the latter half of the decade. Piper Sandler notes that Rivian’s decision to produce the lower-cost SUV at its Illinois facility, delaying construction at the Georgia plant, could yield savings exceeding $2 billion.

The Crystal Ball for RIVN Stock

Analysts foresee a modest 8.8% year-over-year sales growth to $4.82 billion in 2024 for Rivian. However, a significant jump to 56% is expected in 2025, propelling revenues to $7.5 billion. Despite seeming attractively priced at less than three times its 2024 sales, Rivian remains a risky investment as long as it operates in the red.

Among the 24 analysts tracking RIVN stock, 13 advocate a “strong buy,” two suggest a “moderate buy,” seven recommend “hold,” and two advise against with a “strong sell” rating. The average price target for RIVN stands at $19.30, presenting a 78% upside from the previous closing price.

As of the publication date, Aditya Raghunath did not hold any positions in the securities discussed in this article, either directly or indirectly. The information provided here is purely for informational purposes. For additional details, kindly refer to the Barchart Disclosure Policy.

The perspectives expressed in this article reflect the views and opinions of the author, not necessarily those of Nasdaq, Inc.