Artificial intelligence (AI) has become a focal point for tech stocks, stirring up buzz and transforming businesses worldwide. The sturdy foundation of AI lies in semiconductors, with high-performance graphics processing units (GPUs) from standout companies such as Nvidia and Advanced Micro Devices, forming the bedrock for intricate models designed for tasks like machine learning or quantum computing.

Diving into chip manufacturers as a direct investment into generative AI is the obvious choice, but seasoned investors realize there are numerous other enticing prospects in the periphery of semiconductors. Currently, one of the most lucrative entries in this domain is the prideful entity known as Super Micro Computer (NASDAQ: SMCI). The enterprise crafts the architecture for IT solutions, featuring server racks and storage clusters, while maintaining intimate associations with Nvidia and AMD.

With the stock soaring by nearly 177% year to date and an astonishing 800% in the past year, an inquiry lingers in the air – could Super Micro Computer be steering itself towards a trillion-dollar valuation?

Emerging Titans: Unraveling the Potential of Super Micro Computer

Spotting the next market sensation is akin to embarking on a hunt for buried treasure – it’s an exhilarating, thrilling quest that might lead to a significant find, yet disappointingly, often does not. In recent times, the likes of the metaverse, blockchain technology, and now artificial intelligence (AI) have attracted unprecedented attention from investors. While some have raked in substantial profits from these areas, others found themselves clutching the bag.

The buzzword “artificial intelligence” seems to be on the tip of every tech luminary’s tongue. While I do not believe AI is merely a passing fad, I am of the opinion that only a select few will ultimately emerge victorious. Hence, it is crucial to separate the contenders from the pretenders.

Super Micro Computer’s remarkable growth over the past year comes as no surprise, given its close affiliations with top chip producers.

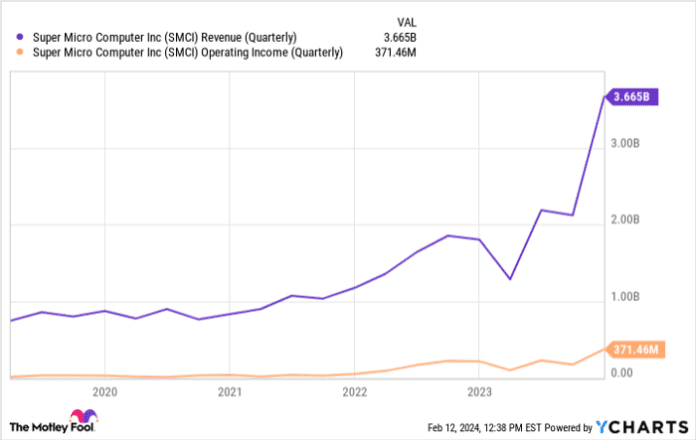

On the surface, the chart above might instill faith in Super Micro. Undoubtedly, while the market for AI-powered chips is anticipated to keep expanding, the company’s long-term prospects appear robust.

However, prudent investors should weigh several factors before diving headfirst into Super Micro stock solely on the assumption that its rise will continue.

SMCI Revenue (Quarterly) data by YCharts

Supermicro’s stock leaped forward following an impressive earnings report at the end of January. Nevertheless, a somewhat disconcerting pattern is emerging in the company’s trading dynamics.

It appears that whenever mainstream chip stocks such as Nvidia or AMD experience a surge in the market, Super Micro gets an unintended boost. This phenomenon is slightly troubling. Although investors have profited from Super Micro over the past year, it is crucial to broaden the horizon and contemplate the long term.

Sooner or later, Nvidia and other contributors to the AI revolution will hit a turning point. This implies that sales, margins, and profits will eventually decelerate in comparison to the current growth rates. When this transpires, some investors may start cashing in their gains. Consequently, it won’t be surprising to witness similar price movements with Super Micro.

While I am not suggesting that investors sit back and anticipate a market crash, it is imperative for them to delve into Super Micro’s valuation before delving into its shares.

The Trillion-Dollar Dilemma: Prospects for Super Micro Computer Stock

At present, Super Micro commands a market cap of $44 billion. With a trailing-12-month revenue of $9.2 billion, this translates to a price-to-sales (P/S) ratio of around 4.6. For comparison, more established and distinctive integrated systems designers such as Dell and Hewlett Packard Enterprise each trade at a P/S of roughly 0.7.

For the fiscal year concluding on June 30, Super Micro’s management anticipates revenue of up to $14.7 billion. In order to achieve a valuation of $1 trillion by 2030, the company must maintain a compound annual growth rate exceeding 40%, assuming its current P/S multiple.

While the current premium for Super Micro may be justified due to its growth rates and momentum, it is highly improbable that the market will uphold such a high valuation in the long haul. As businesses mature, their valuations often normalize accordingly. Should the company sustain annual growth rates in the high double digits, then Super Micro stock could retain its premium. However, this is a remote possibility.

The oscillating demand for semiconductors, coupled with unpredictable macroeconomic variables, could impede Super Micro’s progress at some point. Moreover, given its dependence on other manufacturers, Super Micro is not entirely shielded from potential downturns in the chip market. Ergo, I remain unconvinced that the company can sustain annual growth exceeding 40% for the next several years and reach a trillion-dollar valuation.

Considering investing in Super Micro Computer right now?

Before delving into Super Micro Computer stock, mull over this:

The Motley Fool Stock Advisor analyst team has pinpointed what they believe to be the 10 best stocks for investors to buy now… And Super Micro Computer did not make the list. These 10 stocks hold the potential for substantial returns in the coming years.

Stock Advisor furnishes investors with an easy-to-follow blueprint for success, offering guidance on constructing a portfolio, periodic insights from analysts, and two fresh stock picks each month. Since 2002, the Stock Advisor service has more than tripled the return of the S&P 500*.

Explore these 10 stocks

*Stock Advisor returns as of February 12, 2024

Adam Spatacco holds positions in Nvidia. The Motley Fool holds positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool abides by a disclosure policy.

The sentiments and opinions expressed herein are the writer’s own and do not necessarily mirror those of Nasdaq, Inc.