Tesla (NASDAQ: TSLA) may be competing soon with Uber (NYSE: UBER). That’s the plan, at least, with autonomous (self-driving) robotaxis at the center of Tesla CEO Elon Musk’s long-term strategy. Musk is doubling down on investing in robotaxis and wants to roll out a more advanced model to consumers with no steering wheel, perhaps this summer. The eccentric CEO says that Tesla customers will be able to rent out their Teslas as self-driving taxis to make money, similar to Airbnb.

If Tesla is successful in getting a fleet of robotaxis to market, that could spell trouble for existing ride-sharing networks such as Uber and Lyft. But should investors of ride-sharing companies have genuine concerns about Tesla and robotaxi disruption? Let’s take a closer look at the facts.

Tesla promises self-driving taxis

Tesla is putting an emphasis on robotaxis once again in 2024. During the first-quarter 2024 earnings call, Musk said that in August the company would be unveiling a new vehicle “purpose-built” as a self-driving taxi. In theory, this could present a large threat to existing ride-sharing networks such as Uber. The largest cost to mobile ride-sharing networks is the drivers themselves. If you could operate a fleet of self-driving taxis, that network could undercut Uber (as well as its smaller competitor Lyft) and still generate a profit. This is what Musk is trying to achieve with Tesla’s robotaxi strategy.

Even more concerning, Uber ended its self-driving research back in 2020, selling the division to another autonomous driving start-up, Aurora. It does have a partnership with Alphabet‘s self-driving division, Waymo, but it has clearly given up on building self-driving car technology itself. That puts Uber in a vulnerable position if — and this is a big if — a competitor can bring fully autonomous vehicles to the masses.

Look at the facts, not false promises

The self-driving threat sounds scary for existing ride-sharing players such as Uber and Lyft. Investors following Musk lately might think that this is an existential risk for Uber’s business that could tank the stock price. The reality is much less scary, however.

For close to a decade now, Musk has been promising investors that a robotaxi and fully autonomous vehicle software was just around the corner. For example, in 2016 — eight years ago — Musk said that every Tesla sold going forward would have the computing hardware necessary to be a self-driving vehicle. That has not panned out so far. Tesla even has a partnership with Uber to offer its cars to drivers at a discount. While this has nothing to do with self-driving technology disruption, the companies have a relationship.

Perhaps 2024 is the year that self-driving Teslas finally arrive for consumers. I would take Musk’s words with a grain of salt. He has essentially promised this every year for the past decade and still hasn’t delivered on it. Investors have every reason to be skeptical of Tesla robotaxis arriving in 2024.

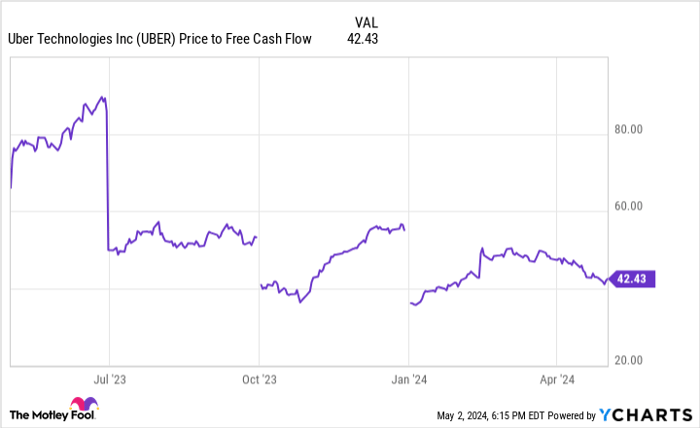

UBER Price to Free Cash Flow data by YCharts.

Should Uber investors worry about Tesla robotaxis?

Uber investors shouldn’t worry about Tesla robotaxis. Unless you think that 2024 is the year Tesla finally solves self-driving vehicle software, selling Uber stock due to Tesla robotaxi fears seems like an overreaction.

What may be a larger concern in the short term is Waymo, Alphabet’s self-driving division. The service is actually operational, albeit in enclosed areas, in four cities (Phoenix, San Francisco, Los Angeles, and Austin, Texas). If Waymo can get licenses in more cities around the country, the service could start to take market share from Uber over the next five to 10 years. Investors in Uber should pay full attention to Waymo and what cities it launches in next.

Another concern might be Uber’s valuation. It trades at a price-to-free-cash-flow (P/FCF) multiple of 42, which is a premium valuation. In light of that, a potential Waymo expansion could be a major headwind for Uber’s stock price. But Tesla robotaxis shouldn’t pose a concern.

Should you invest $1,000 in Uber Technologies right now?

Before you buy stock in Uber Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Uber Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $554,830!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 6, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Airbnb, Alphabet, Tesla, and Uber Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.