The Magnificent Seven: Titans of the Market in 2024

The “Magnificent Seven” stocks—Apple AAPL, Alphabet (GOOGL, GOOG), Microsoft MSFT, Amazon AMZN, Meta META, Tesla TSLA, and NVIDIA NVDA—have enjoyed remarkable success in 2024, significantly influencing the overall market. The S&P 500 climbed 23.3% this year, while the Roundhill Magnificent Seven ETF (MAGS) soared by 66.5%.

Impact of the Magnificent Seven on the S&P 500

These seven companies have a substantial presence in the S&P 500, contributing greatly to the index’s growth. In Q3 2024, they represented 23.1% of the index’s total earnings, with expectations to rise to 25.8% in Q4. By 2025, analysts forecast that the Magnificent Seven will account for 23.3% of total earnings and 33.8% of the index’s market capitalization.

As reported by FactSet, the combined earnings of these seven stocks surged by 33% year over year in 2024, in contrast to a modest 4.2% increase for the remaining 493 companies in the S&P 500.

Will Their Dominance Diminish in 2025?

Looking ahead, some analysts suggest the remarkable performance of the Magnificent Seven may cool in 2025. Although these companies outpaced their peers in earnings growth last year, that advantage is expected to diminish. David Kostin, chief U.S. equity strategist at Goldman Sachs, indicates that this shift could create a more balanced performance across the broader market.

Kostin comments, “The narrowing differential in earnings growth rates should correspond with a narrowing in relative equity returns,” predicting that the Magnificent Seven may outshine the other S&P 500 companies by just 7 percentage points in 2025, the least since 2018.

Examining the Earnings Prospects of the Magnificent Seven

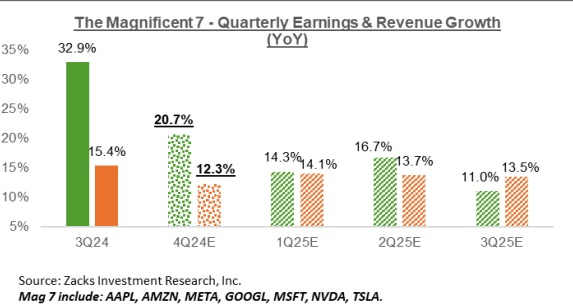

The Q4 2024 earnings for the Magnificent Seven are projected to increase by 20.7% compared to the same period last year, supported by a 12.3% rise in revenues. This follows robust earnings growth of 32.9% in Q3, alongside 15.4% higher revenue. According to Zacks Earnings Trend published on December 18, 2024, earnings for the Magnificent Seven are anticipated to rise by 15.6% in 2025.

Image Source: Zacks Investment Research

AI Optimism Expanding Beyond the Magnificent Seven

BofA’s equity strategy team, led by Savita Subramanian, highlights that Microsoft, Amazon, Alphabet, and Meta are expected to raise their capital expenditures by 42% in 2024, followed by an additional 17% increase in 2025. Their total spending is predicted to reach $244 billion next year, as cited by Yahoo Finance.

This expenditure will support not just AI chips but also the energy costs associated with running AI data centers. The emphasis will increasingly shift toward AI utilities and software in 2025. The Utilities Select Sector SPDR ETF (XLU) saw gains of 17.8% in 2024, benefiting from the excitement surrounding AI developments.

Unlike hardware, which experiences a one-time sale, AI software typically operates on a subscription basis ensuring consistent demand. ETFs such as the SPDR S&P Software & Services ETF (XSW), which rose by 29.2% in 2024, and the SPDR NYSE Technology ETF (XNTK) with a 26.5% increase, are well-positioned for growth in 2025.

Reasons to Invest in “Mag 7” ETFs Despite Slowing Growth

While growth among the Magnificent Seven may slow next year, their strong position remains intact due to the ongoing AI boom. According to Morgan Stanley, NVIDIA’s Blackwell chips may mitigate concerns about decelerating revenue growth.

Furthermore, Tesla’s position may strengthen politically. CEO Elon Musk’s increasing political involvement could extend Tesla’s influence beyond the automotive sector. Optimism surrounds potential federal deregulation, which could benefit Tesla, as there’s a significant portion of its valuation linked to the autonomous vehicle market. This could expedite approval for its self-driving software and Robotaxi services.

Despite current challenges, interest rates are expected to remain lower in 2025 compared to 2024, benefiting tech stocks reliant on borrowing for growth initiatives. Lower rates make loans cheaper for companies looking to expand.

According to Citi strategists, the Magnificent Seven stocks might serve as a solid investment in 2025 amid market uncertainty, thanks to their strong fundamentals that offer stability in tumultuous times.

ETFs Worth Considering

In addition to MAGS, investors may look at other ETFs heavily featuring the Magnificent Seven. Options include the MicroSectors FANG+ ETN (FNGS), Vanguard Mega Cap Growth ETF (MGK), Invesco S&P 500 Top 50 ETF (XLG), and the iShares S&P 100 ETF (OEF).

Research Chief Highlights “Single Best Pick to Double”

Among thousands of stocks, five Zacks experts each have selected a favorite expected to rise by 100% or more in the coming months. From these picks, Director of Research Sheraz Mian identifies one as having the most potential upside.

This particular company focuses on millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter. A recent pullback creates an opportunity for potential investors. While not all Zacks selections succeed, this one could outperform previously successful picks like Nano-X Imaging, which gained 129.6% in just over nine months.

Free: See Our Top Stock and 4 Runners Up

Interested in the latest recommendations from Zacks Investment Research? You can download the report titled “5 Stocks Set to Double” for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Utilities Select Sector SPDR ETF (XLU): ETF Research Reports

Alphabet Inc. (GOOGL): Free Stock Analysis Report

SPDR S&P Software & Services ETF (XSW): ETF Research Reports

Invesco S&P 500 Top 50 ETF (XLG): ETF Research Reports

Vanguard Mega Cap Growth ETF (MGK): ETF Research Reports

iShares S&P 100 ETF (OEF): ETF Research Reports

SPDR NYSE Technology ETF (XNTK): ETF Research Reports

MicroSectors FANG+ ETN (FNGS): ETF Research Reports

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.