“`html

United Airlines Poised for Strong Q4 Earnings as Stocks Soar

United Airlines UAL continues to outperform its rivals, showcasing remarkable operational and financial metrics.

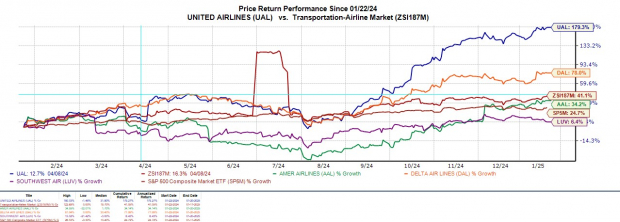

Over the past year, UAL’s share price jumped by over +170%, outshining Delta Air Lines DAL’s +78%. In comparison, American Airlines AAL and Southwest Airlines LUV have posted gains of +34% and +6%, respectively.

With the company’s Q4 earnings report set for after-hours on Tuesday, January 21, investors are eagerly anticipating whether UAL can sustain its upward trajectory.

Image Source: Zacks Investment Research

United Airlines Q4 Outlook

According to Zacks estimates, United’s Q4 sales are projected to rise by 5% to $14.39 billion, an increase from $13.63 billion in the same quarter last year. Earnings per share (EPS) are anticipated to soar by 50% to $3.01, compared to $2.00 a year prior.

The Zacks Expected Surprise Prediction (ESP) tool suggests that United might exceed earnings expectations, with the Most Accurate Estimate placing Q4 EPS at $3.06, exceeding the Zacks Consensus by over 1%.

Image Source: Zacks Investment Research

United has consistently outperformed the Zacks EPS Consensus for nine straight quarters, achieving an impressive average earnings surprise of 26.91% in its last four reports.

Image Source: Zacks Investment Research

Outlook for Fiscal Year 2025

For fiscal year 2024, United’s total sales are estimated to rise by 5% to $56.77 billion, with annual earnings expected to increase by 3% to $10.34 per share.

Looking to FY25, sales are projected to grow another 6% to $60.46 billion, and earnings are set to expand by over 20%, with EPS projections at $12.56.

Image Source: Zacks Investment Research

Encouragingly, EPS estimates for both FY24 and FY25 have risen consistently over the past 90 days, with recent increases noted in the last week.

Image Source: Zacks Investment Research

Analyzing United’s Valuation

Despite UAL’s impressive climb to over $100 per share, the stock trades at only 8.5X forward earnings. This is a significant discount compared to the S&P 500’s average of 22.4X, aligning closely with American and Delta’s P/E ratios, and considerably beneath Southwest’s 20.3X.

Image Source: Zacks Investment Research

Conclusion

As United Airlines approaches its Q4 report, the stock holds a Zacks Rank #1 (Strong Buy). Leading the recovery in airline stocks since the pandemic, positive earnings revisions signal potential further gains if United delivers strong results, as indicated by the Zacks ESP.

5 Stocks Poised for Major Gains

Each stock selected by a Zacks expert is considered a top candidate to increase by +100% or more in 2024. Although not every recommendation hits the mark, past selections have enjoyed returns of +143.0%, +175.9%, +498.3%, and even +673.0%.

Many of these stocks are under the radar on Wall Street, providing a prime opportunity to invest early.

Discover These 5 Potential Home Runs >>

Get a Free Stock Analysis Report for United Airlines Holdings Inc (UAL)

Get a Free Stock Analysis Report for Delta Air Lines, Inc. (DAL)

Get a Free Stock Analysis Report for Southwest Airlines Co. (LUV)

Get a Free Stock Analysis Report for American Airlines Group Inc. (AAL)

Read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`