After experiencing a disappointing earnings report along with a tough economic situation, shares of recreational vehicle manufacturer Winnebago Industries, Inc. WGO have seen significant declines in the past month. Historically, investors have often perceived such situations as chances to buy, which might support bullish predictions moving forward.

The decline in WGO stock primarily stems from the company’s fiscal first-quarter performance. Winnebago reported an adjusted loss of 3 cents per share, falling short of analysts’ expectations of a profit of 20 cents. Furthermore, revenue dropped by 18% year-over-year, totaling $625.6 million, also failing to meet the forecasted $672.232 million.

Management offered more insight during the earnings call, but it did little to reassure investors. President and CEO Michael Happe noted, “As expected, the RV and marine operating environment remained challenging in the first quarter, marked by subdued consumer demand and a cautious dealer network reluctant to make significant commitments on new orders ahead of the historically slow winter season.”

Despite these challenges, Happe expressed optimism for increased demand as the markets for RVs and marine products head into the more favorable spring season. While analysts have divided opinions on the possibility of a turnaround for WGO stock, an argument for potential upside remains.

Also Read: Netflix To Release ‘Beyoncé Bowl’ NFL Halftime Performance As Standalone Special

Market History Suggests WGO is a Value Opportunity

Typically, Winnebago stock follows a steady pattern in the market. Over the past five years, the likelihood of WGO generating a positive return on any given Friday—compared to the opening price on the previous Monday—is around 50.2%. This statistic comes from the number of positive weeks out of the total weeks observed during that five-year period.

However, this basic metric does not capture the emotional changes in investor sentiment during unusual market fluctuations. Price movements deviating significantly from the average can have a more pronounced effect on investor emotions compared to standard market behavior. Therefore, a more nuanced approach using Bayesian inference could provide more insight.

Last week, WGO stock saw a decline of 9.49%, a relatively rare event. In fact, over the last five years, there have only been 14 occasions (excluding last week) when WGO experienced a loss of 9.49% or more. Notably, in the following weeks, 57.14% of those instances resulted in positive returns.

Delving deeper into Winnebago’s performance history makes the stock even more appealing. Four of the weeks with losses of 9.49% or greater occurred in February and March of 2020. Most investors view COVID-19 as a unique market condition that is unlikely to recur soon.

When removing the effects of COVID-19 from the analysis, the positive return rate rises to 70%, showing that after ten weeks with similar losses, seven of those weeks generated a rebound in stock prices.

Exploring Bull Call Spreads for Strategic Investors

Given the tendency of investors to seize opportunities when WGO stock dips, using bull call spreads might be a worthwhile strategy. This options technique combines buying a call with simultaneously selling another call at the same expiration date, allowing investors to use the income from the short call to help offset the overall cost of the long call.

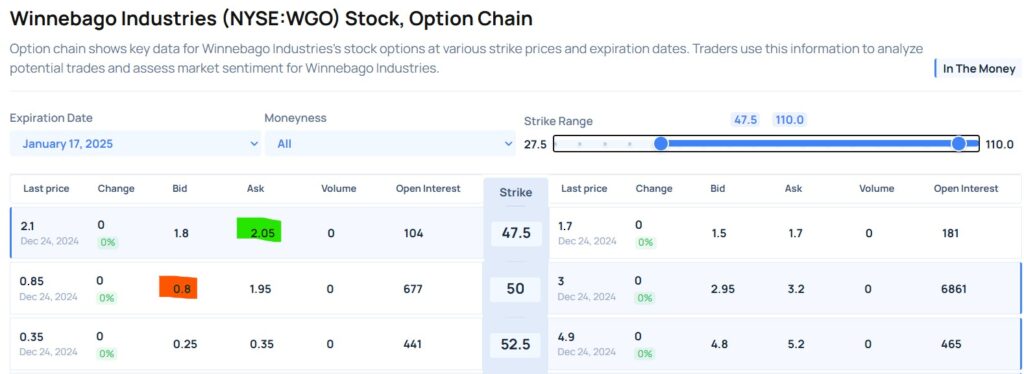

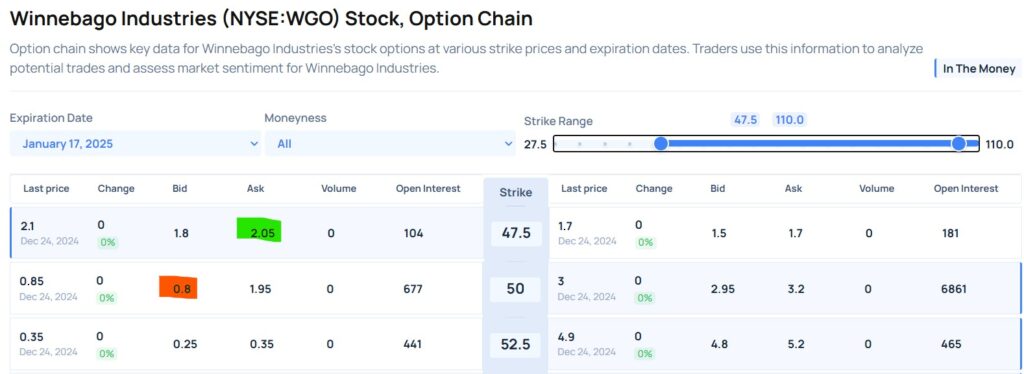

The upcoming options expiration date for WGO is set for January 17, 2025. Due to the current skepticism around Winnebago’s business outlook, these bull call spreads are being priced attractively by market makers.

For instance, the Jan. 17 47.50/50.00 bull call spread—where investors buy the $47.50 call and sell the $50 call—currently has a net debit of $125 after accounting for the options multiplier. If WGO stock reaches or surpasses the $50 short call strike price, the potential profit is the difference between the strike prices (which is $2.50) minus the net debit paid, resulting in a payout of $125.

In essence, within a few weeks, bullish investors could realize a potential 100% return. This prospect is particularly attractive, especially considering that historically, buyers have jumped in when WGO experiences significant volatility.

Read Next:

Photo: Jonathan Weiss/Shutterstock.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.