Wolfe Research Upgrades Devon Energy to Outperform, Forecasting Significant Price Growth

Analysts Bullish on Future Price Potential

Fintel reports that on January 3, 2025, Wolfe Research upgraded their outlook for Devon Energy (LSE:0I8W) from Peer Perform to Outperform.

Analyst Price Forecast Suggests 53.78% Upside

As of December 23, 2024, analysts expect Devon Energy’s average one-year price target to be 51.27 GBX per share. These forecasts range from a low of 43.44 GBX to a high of 67.22 GBX, indicating a potential increase of 53.78% from the company’s most recent closing price of 33.34 GBX per share.

Financial Projections Show Growth

Devon Energy is projected to achieve an annual revenue of 15,902 million, reflecting a growth rate of 9.45%. Additionally, the estimated annual non-GAAP earnings per share (EPS) stands at 6.48.

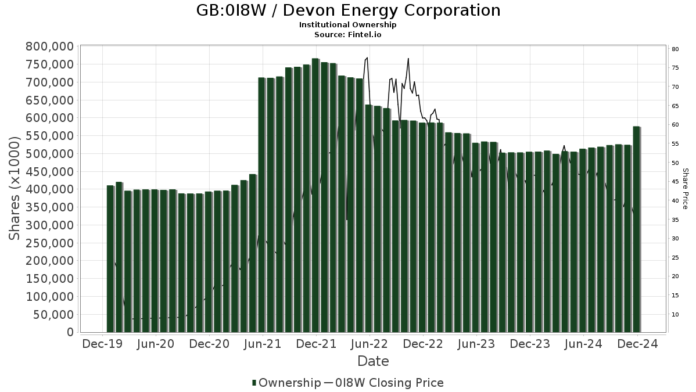

Institutional Interest Remains Steady

As of now, there are 2,037 funds or institutions reporting positions in Devon Energy, marking a slight increase of four owners, or 0.20%, in the last quarter. Collectively, these funds dedicate an average portfolio weight of 0.28% to 0I8W, which is an increase of 3.02%. Total shares owned by these institutions rose by 8.78% over the past three months, totaling 571,632K shares.

Key Shareholders Adjust Their Holdings

The Vanguard Total Stock Market Index Fund Investor Shares, holding 19,822K shares, represents 3.02% ownership. However, this reflects a decrease of 0.74% from the prior quarter, as the firm reduced its portfolio allocation in 0I8W by 23.05%.

The Energy Select Sector SPDR Fund reported ownership of 16,687K shares, or 2.54%. This is a drop of 4.85% from 17,496K shares previously held, demonstrating a 15.95% reduction in its portfolio allocation.

Similarly, the Vanguard 500 Index Fund Investor Shares increased their stake to 16,401K shares, representing 2.50% ownership, which is an uptick of 1.11%. However, they also reduced their portfolio allocation by 23.20% during the last quarter.

Geode Capital Management shows ownership of 15,893K shares, or 2.42%, which marks a 1.30% increase from the last filing, yet they decreased their allocation significantly by 59.61%.

The Vanguard Mid-Cap Index Fund Investor Shares has decreased its stake as well, holding 13,260K shares, which is a reduction of 2.10% from 13,538K shares in its last report, and has reduced its portfolio allocation by 25.64% in the same period.

Fintel serves as a comprehensive investment research platform for individual investors, traders, financial advisors, and small hedge funds. They provide crucial data on fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and more, supporting informed decision-making.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.