Wolfe Research Boosts Phillips 66 Outlook Amid Shifting Institutional Holdings

Wells Fargo and Vanguard Lower Positions in Phillips 66

Fintel reports that on January 3, 2025, Wolfe Research upgraded their outlook for Phillips 66 (WBAG:PSXC) from Peer Perform to Outperform.

Fund Sentiment Overview

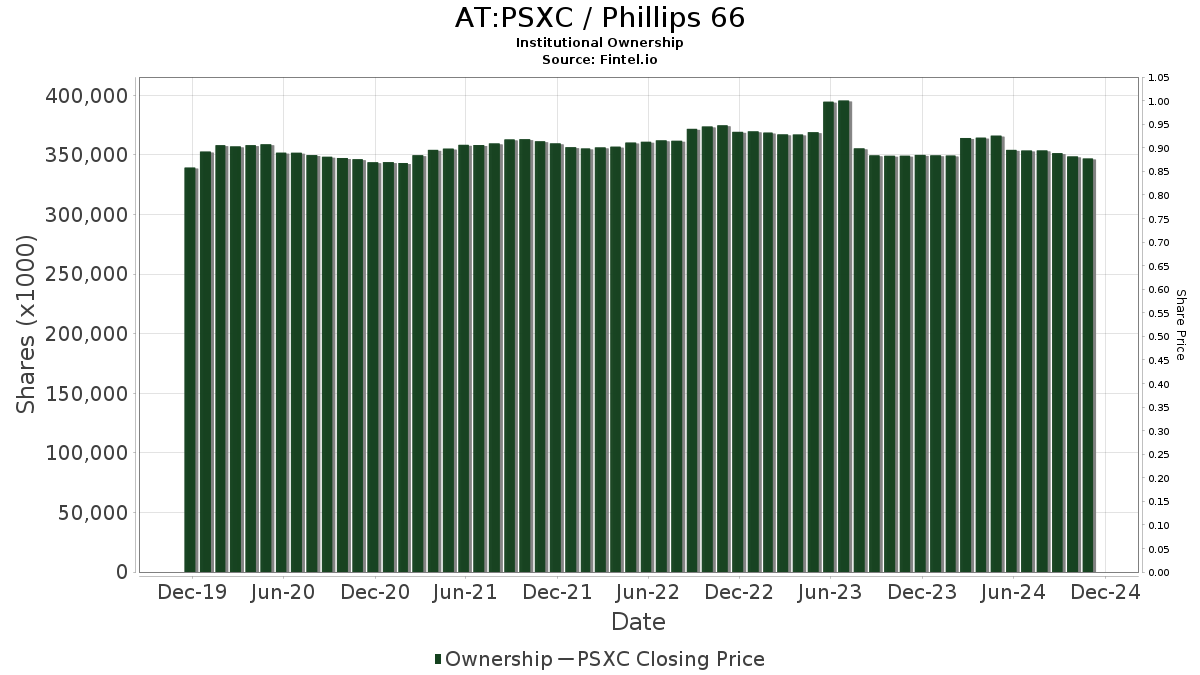

Currently, 2,707 funds or institutions are reporting positions in Phillips 66. This reflects a decrease of 39 owners, or 1.42%, from the prior quarter. The average portfolio weight dedicated to PSXC among all funds is 0.30%, marking an increase of 14.31%. However, total shares owned by institutions saw a decline of 2.87%, totaling 346,132K shares over the last three months.

Institutional Moves

Wells Fargo now holds 16,153K shares, which accounts for 3.91% ownership of Phillips 66. This is a decrease from their previous report of 16,621K shares, reflecting a drop of 2.89%. The firm also reduced its portfolio allocation in PSXC by 71.82% in the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) has 13,266K shares, representing 3.21% of the company. This is down from 13,385K shares, a decrease of 0.90%. VTSMX cut its portfolio allocation in PSXC by 13.32% over the last quarter.

The Energy Select Sector SPDR Fund (XLE) holds 11,154K shares, a 2.70% stake. The fund reported a reduction from 11,736K shares, which is a 5.22% decrease. They also decreased their portfolio allocation in PSXC by 5.51% lately.

The Vanguard 500 Index Fund (VFINX) currently has 10,963K shares, or 2.65% ownership of the company, slightly up from 10,881K shares, showing an increase of 0.75%. However, VFINX decreased its portfolio allocation in PSXC by 13.66% over the most recent quarter.

Harris Associates L P owns 9,795K shares (2.37% ownership), up from 8,447K shares previously, indicating an increase of 13.76%. They also reduced their portfolio allocation in PSXC by 18.22% over the last quarter.

Fintel provides comprehensive investing research tools for individual investors, traders, financial advisors, and small hedge funds.

The platform offers extensive data including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading data, and more. Exclusive stock picks utilize advanced, backtested quantitative models aimed at enhancing profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.