Wolfe Research Upgrades Phillips 66: Read What the Analysts Are Saying

On January 3, 2025, Wolfe Research boosted their rating for Phillips 66 (LSE:0KHZ) from Peer Perform to Outperform.

Analyst Predictions Indicate Significant Growth

As of December 23, 2024, analysts set an average one-year price target for Phillips 66 at 146.95 GBX per share. Projections vary between a low of 125.54 GBX and a high of 170.12 GBX. Notably, this target suggests a potential 28.11% increase from the most recent closing price of 114.70 GBX per share.

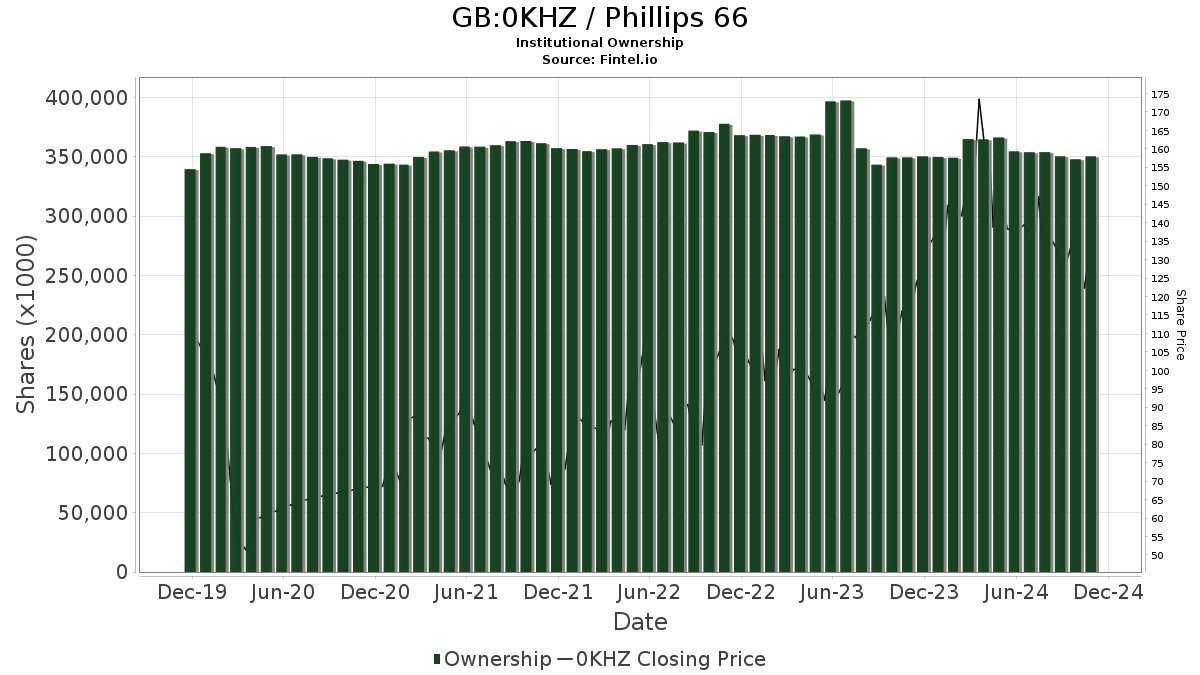

Exploring Fund Sentiment

A total of 2,707 funds or institutions currently report holdings in Phillips 66. This reflects a decline of 39 owners or 1.42% from the last quarter. The average portfolio weight assigned to 0KHZ by all funds has risen by 14.31% to 0.30%. However, institutional shares owned have decreased by 2.87% over three months, totaling 346,132K shares.

Tracking Other Shareholders

Wells Fargo currently holds 16,153K shares, equating to 3.91% ownership of the firm. This represents a reduction from 16,621K shares, or a decrease of 2.89%. The firm’s allocation in 0KHZ has dropped significantly by 71.82% in the latest quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 13,266K shares, representing 3.21% of Phillips 66. Previously, they reported 13,385K shares, indicating a 0.90% decrease. Their portfolio allocation in 0KHZ was reduced by 13.32% over the past quarter.

XLE – The Energy Select Sector SPDR Fund possesses 11,154K shares, accounting for 2.70% ownership, down from 11,736K shares, a decline of 5.22%. Their portfolio allocation in 0KHZ decreased by 5.51% in the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares has 10,963K shares, which is 2.65% ownership. This portfolio marginally increased from 10,881K shares, marking a 0.75% rise. However, their allocation in 0KHZ has reduced by 13.66% this quarter.

Harris Associates L P holds 9,795K shares, representing 2.37% ownership. They previously held 8,447K shares, an increase of 13.76%. Yet, their portfolio allocation in 0KHZ has decreased by 18.22% over the past quarter.

Fintel is widely recognized as a leading platform for investing research, catering to individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data includes fundamentals, analyst reports, ownership insights, fund sentiments, insider trades, and much more. Proprietary stock picks leverage advanced, backtested models to enhance potential profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.