Analysts Upgrade EOG Resources Amid Significant Institutional Activity

On January 3, 2025, Wolfe Research raised its rating for EOG Resources (BRSE:EO5) from Peer Perform to Outperform.

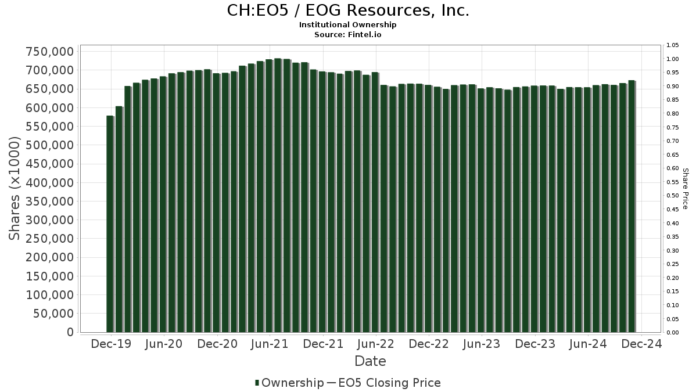

Current Fund Sentiment for EOG Resources

A total of 2,571 funds and institutions currently hold positions in EOG Resources, reflecting a slight decrease of 7 owners, or 0.27%, over the previous quarter. The average portfolio weight for all funds dedicated to EO5 has increased to 0.32%, which is a significant jump of 24.66%. Institutional ownership has also risen by 4.42% in the past three months, totaling 674,398K shares.

Capital World Investors has made a notable investment, holding 43,649K shares now, which represents 7.76% ownership of EOG. This reflects a significant increase from the 32,786K shares previously reported, amounting to an impressive growth of 24.89% in their holdings.

Another major stakeholder, Capital Research Global Investors, now holds 32,495K shares, accounting for 5.78% of EOG. They reported an increase of 5.61%, up from 30,672K shares. However, their overall portfolio allocation in EO5 decreased slightly by 1.99%.

JPMorgan Chase has also adjusted its stake, with holdings of 26,278K shares, making up 4.67% ownership. This represents a reduction of 8.40% from the former 28,486K shares, although they increased their portfolio allocation in EO5 dramatically by 838.99% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) hold 18,017K shares for 3.20% ownership, which is a slight drop of 0.73% from their previous holding of 18,150K shares. Their portfolio allocation in EO5 fell by 8.94% during this period.

Finally, Charles Schwab Investment Management holds 17,411K shares, reflecting 3.10% ownership of EOG. They increased their previous holding of 17,336K shares by 0.43%, yet their overall allocation in EO5 saw a considerable reduction of 22.60% in the last quarter.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our data spans the globe and includes fundamentals, analyst reports, ownership statistics, fund sentiment, options sentiment, insider trading, and more. Additionally, our exclusive stock selections are driven by sophisticated, backtested quantitative models aimed at enhancing profits.

This article first appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.