Wolfe Research Boosts Devon Energy’s Outlook Amid Mixed Fund Activity

Fintel reports that on January 3, 2025, Wolfe Research upgraded their assessment of Devon Energy (WBAG:DVN) from Peer Perform to Outperform.

Fund Sentiment Analysis

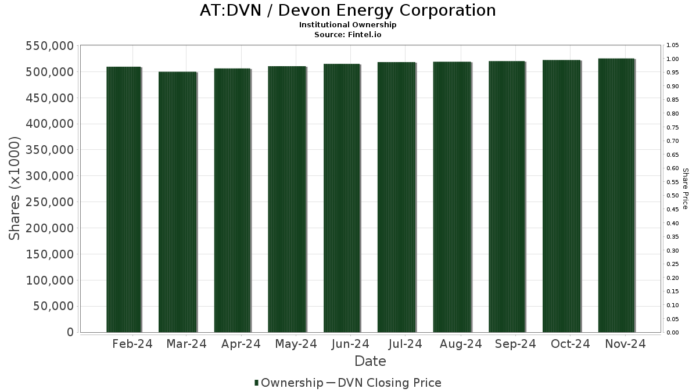

Currently, 2,037 funds or institutions hold positions in Devon Energy, marking an increase of 4 owners, or 0.20% over the last quarter. The average portfolio weight allocated to DVN by all funds stands at 0.28%, which is up by 3.02%. Over the past three months, total institutional shares owned surged by 8.78%, reaching 571,632K shares.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 19,822K shares, representing 3.02% ownership of the company. The latest filing shows a slight decline from 19,969K shares, reflecting a decrease of 0.74%. The fund has cut its DVN allocation by 23.05% in the previous quarter.

XLE – The Energy Select Sector SPDR Fund owns 16,687K shares, amounting to 2.54% ownership. This figure indicates a drop from 17,496K shares, demonstrating a decrease of 4.85%. The fund has reduced its DVN portfolio allocation by 15.95% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares currently holds 16,401K shares, representing 2.50% ownership. This is an increase from its previous 16,220K shares, marking a minor gain of 1.11%. However, the fund cut its DVN allocation by 23.20% in the last quarter.

Geode Capital Management controls 15,893K shares, equating to 2.42% ownership. An increase from 15,686K shares, this reflects a gain of 1.30%. Still, the firm has seen a significant allocation reduction of 59.61% for DVN over the previous quarter.

VIMSX – Vanguard Mid-Cap Index Fund Investor Shares holds 13,260K shares, representing 2.02% ownership, down from 13,538K shares, a decrease of 2.10%. Here too, the fund decreased its allocation in DVN by 25.64% last quarter.

Fintel serves as a comprehensive platform offering investment research for individual investors, traders, financial advisors, and small hedge funds.

The platform provides a wealth of data, including fundamentals, analyst reports, ownership data, options sentiment, insider trading, and more. Furthermore, Fintel’s exclusive stock picks are generated through advanced, backtested quantitative models aimed at enhancing profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.