Wolfe Research Adjusts Outlook for Lazard Amid Mixed Institutional Sentiment

Analyst Predictions Point to Potential Growth

Fintel reports that on January 3, 2025, Wolfe Research downgraded its outlook for Lazard (LSE:0UB6) from Outperform to Peer Perform.

Price Target Forecast: 27.61% Upward Potential

As of November 21, 2024, the average one-year price target for Lazard stands at 61.13 GBX/share, with estimates varying from a low of 56.55 GBX to a high of 69.48 GBX. This average price target indicates a possible increase of 27.61% over its most recent closing price of 47.90 GBX/share.

For further insights, explore our leaderboard featuring companies with the largest price target upsides.

Annual Revenue and Earnings Projections

Lazard is projected to generate annual revenue of 3,080 million GBP, which reflects an increase of 1.07%. Additionally, the expected annual non-GAAP EPS is 4.65.

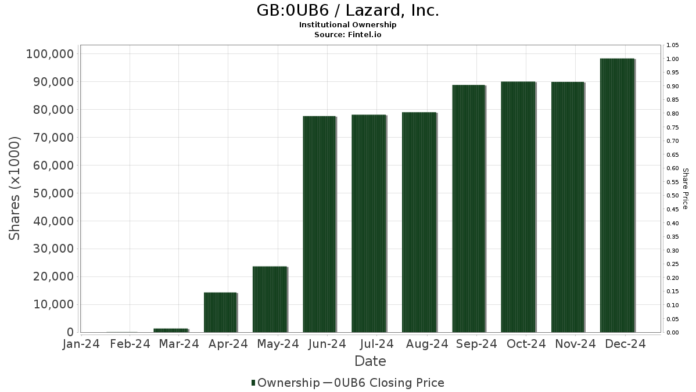

Institutional Ownership Trends

Currently, 545 funds or institutions hold positions in Lazard, marking an increase of 45 owners or 9.00% over the last quarter. The average portfolio weight of funds dedicated to 0UB6 is 0.26%, showing a growth of 9.16%. Institutional ownership rose by 11.91%, totaling 98,479,000 shares over the past three months.

Ariel Investments currently owns 6,151,000 shares, representing 6.80% ownership and an increase of 1.78% from their previous filing. They have raised their portfolio allocation to 0UB6 by 22.40% in the last quarter.

Capital Research Global Investors holds 4,189,000 shares for a 4.63% stake, up 45.08% from their previous 2,300,000 shares. Their allocation to 0UB6 surged by 127.59% this past quarter.

SMCWX – Smallcap World Fund Inc. has increased its holdings to 3,746,000 shares (4.14% ownership), growing from 1,602,000 shares, an increase of 57.23%. Their portfolio allocation in 0UB6 has expanded by an impressive 189.30% over the past quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 3,386,000 shares, or 3.74%. In contrast, they reported a slight increase of 0.16% from 3,381,000 shares, raising their allocation by 24.14% over the most recent quarter.

NAESX – Vanguard Small-Cap Index Fund Investor Shares reports holding 2,681,000 shares (2.96% ownership). They experienced a minor decrease of 0.50% from their prior 2,695,000 shares, but still increased their portfolio allocation by 19.81% last quarter.

Fintel is recognized as one of the most comprehensive investing research platforms available, serving individual investors, traders, financial advisors, and small hedge funds.

Our extensive data covers global markets, encompassing fundamentals, analyst reports, ownership data, fund sentiment, insider trading insights, and much more. Additionally, our unique stock selections are supported by advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.