Exploring Dividend Yield Strategies

Shareholders of Extra Space Storage Inc (Symbol: EXR) have the opportunity to significantly enhance their investment return beyond the stock’s modest 3.6% annual dividend yield. By strategically selling the December covered call at the $185 strike, investors can tap into additional income through premium collection. This elevated strategy, known as YieldBoost, offers a substantial 19.5% rate of return against the current stock price. When combined with the existing dividend yield, this approach yields a promising total annualized rate of 23.1%, under the assumption that the stock is not called away.

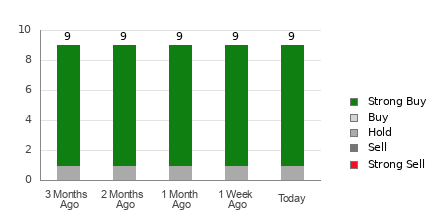

Historical Context and Future Predictions

Examining the dividend history of Extra Space Storage Inc, as depicted in the chart below, provides valuable insights into the company’s past performance. While dividend amounts are subject to fluctuations based on profitability, a deeper analysis of historical data can aid investors in gauging the sustainability of the current 3.6% annualized dividend yield.

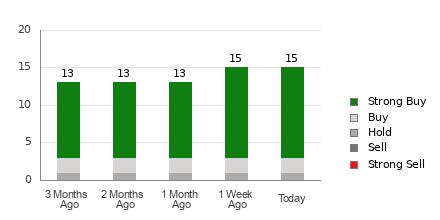

Strategic Options Analysis

A meticulous assessment of the stock’s trailing twelve-month trading history, illustrated below, presents the $185 strike as a focal point for option strategy evaluation. Considering the historical volatility of EXR shares alongside fundamental analysis, investors can weigh the risk-reward dynamics of selling the December covered call at the $185 strike. With a trailing twelve-month volatility of 29%, investors can make informed decisions regarding their options trading strategy.

Market Trends and Trading Insights

In the current market landscape, a notable uptick in call volume relative to put options indicates a preference for bullish sentiment among traders. With a put:call ratio of 0.54 as of mid-afternoon trading on Wednesday, investors are showing a strong inclination towards call options. This heightened call volume underscores a prevailing optimism and confidence in the market trajectory among traders today.

![]() Top YieldBoost Calls of the REITs »

Top YieldBoost Calls of the REITs »

Also see:

Analyst Actions

WHR Videos

NFG Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.