Rattlesnakes. Poison dart frogs. A hornet’s nest.

Some things are just better left untouched. Similarly, when it comes to exchange-traded funds (ETFs), there are certain ones that spell out unavoidable danger. Let’s shine a light on one particular ETF that investors might want to steer clear of.

Image source: Getty Images.

An ETF to avoid?

The 2x Long Vix Futures ETF (NYSEMKT: UVIX) is a volatility ETF that tracks the Chicago Board Options Exchange volatility index using double leverage.

Breaking it down step by step, let’s dissect.

Firstly, what exactly is volatility?

How volatility works

Picture a stock currently valued at $100. Now, visualize that, on average, its price fluctuates by $1 each day.

Now, let’s think about another hypothetical stock, also priced at $100. However, this stock’s price swings by $20 each day.

In this scenario, while the price of stock one remains stable, stock two’s price wildly fluctuates. Hence, stock two would be deemed more volatile than stock one.

In essence, volatility gauges the extent of price variations from day to day. This principle is not exclusive to individual stocks but can be extended to the broader stock market. When stock market prices remain relatively constant daily, volatility is low. However, when prices begin swinging drastically, particularly downwards, stock market volatility surges.

The VIX, also known as “the fear index,” represents one measure of stock market volatility, estimating the future 30-day volatility of the S&P 500 index using stock option prices.

And it is the VIX that forms the foundation of the UVIX ETF.

What about the 2x leverage?

Charlie Munger famously stated that there were only three ways for an intelligent person to go bankrupt: “liquor, ladies, and leverage.”

In the case of the UVIX ETF, the fund adopts a leveraged approach to double the daily return of the VIX. However, to sustain this exposure, the fund must invest in and subsequently roll one- and two-month futures contracts. This incurs substantial costs, resulting in significant investor charges.

For instance, the UVIX bears an expense ratio of 1.77%. This signifies that a $10,000 investment, held for one year, would rack up $177 in annual fees. This expense ratio stands as one of the highest in the market, vastly surpassing the average expense ratio of approximately 0.57%.

In summary, the employment of 2x leverage by the UVIX, along with its elevated expense ratio, presents yet another compelling reason to avoid this ETF as a long-term investment.

Why would anyone invest in this ETF?

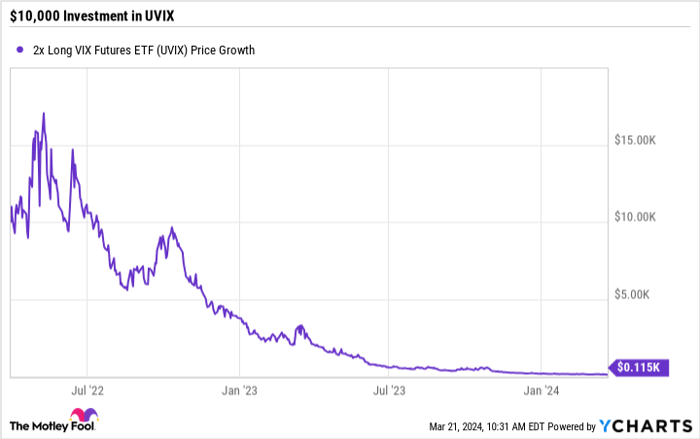

While UVIX may not be a buy-and-hold asset, let’s delve into what the consequences would have been if $10,000 were invested in it in 2022:

UVIX data by YCharts

Although, there is a rationale behind investing in this fund: it experiences a meteoric rise in periods of market decline.

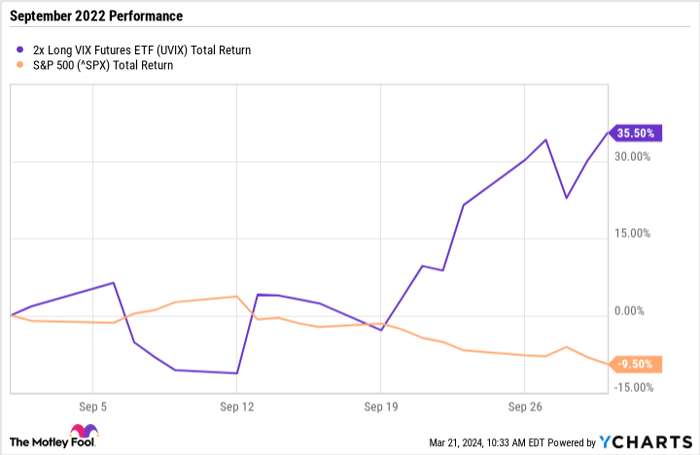

Compare its performance in September 2022 with that of the S&P 500:

UVIX Total Return Level data by YCharts

While the S&P 500 plummeted nearly 10% that month, UVIX surged over 35%.

Hence, some traders opt for UVIX as a hedge since it delivers substantial returns when the stock market nosedives. Nevertheless, even though this may prove effective in the short run, it is not a viable long-term strategy due to the inherent nature of volatility and the exorbitant fees levied by the fund.

Thus, for long-term investors, steering clear of this ETF is the prudent choice.

Should you invest $1,000 in Vs Trust – 2x Long Vix Futures ETF right now?

Before buying stock in Vs Trust – 2x Long Vix Futures ETF, consider this:

Motley Fool Stock Advisor analysts have pinpointed what they believe are the 10 best stocks for investors to buy currently, and Vs Trust – 2x Long Vix Futures ETF did not make the list. These chosen stocks have the potential to yield significant returns in the years ahead.

Stock Advisor furnishes investors with a user-friendly roadmap to success, offering advice on constructing a portfolio, regular insights from analysts, and two fresh stock picks each month. Since 2002, the Stock Advisor service has tripled the returns of the S&P 500*.

Discover the 10 stocks

*Stock Advisor returns as of March 25, 2024

Jake Lerch holds no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cboe Global Markets. The Motley Fool abides by a disclosure policy.

The views and opinions expressed herein are the author’s own and do not necessarily reflect those of Nasdaq, Inc.