Investing in Tomorrow: 12 Innovative Startups with High Growth Potential

The U.S. stays at the forefront of innovation, where fresh ideas evolve into impactful companies. On Wall Street, everyday investors can take part in the growth of tomorrow’s industry leaders.

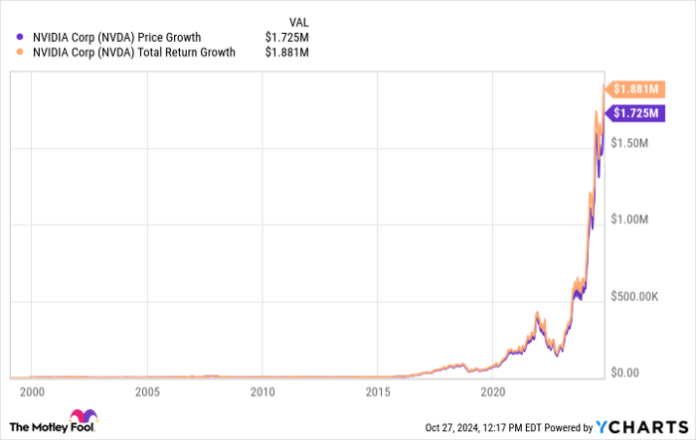

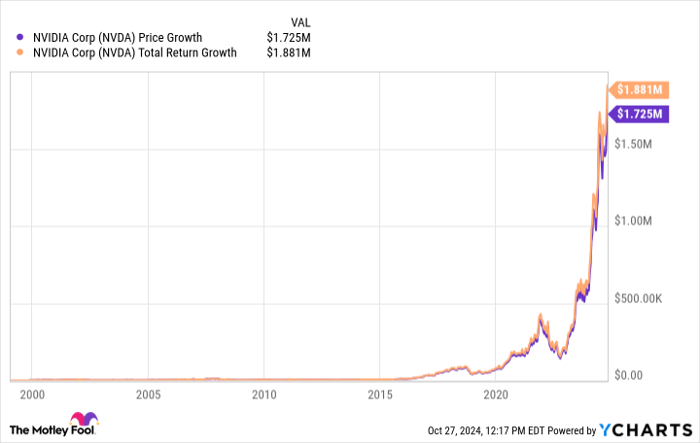

Starting with a modest $500 investment can lead to seven-figure returns with the right choice and patience. Take Nvidia (NASDAQ: NVDA), which began as a speculative gaming chip maker in 1999. It has transformed into an artificial intelligence (AI) powerhouse, turning a $500 initial investment into $1.88 million over 25 years, factoring in reinvested dividends.

NVDA data by YCharts

Let’s dive into 12 innovative companies likely to provide similar transformative returns over the next 25 years. Although each company has unique challenges, they are all pursuing large market opportunities with groundbreaking technologies.

Urban Air Mobility: The Future of City Travel

1. Archer Aviation (NYSE: ACHR) is valued at $1.26 billion and is focused on electric vertical takeoff and landing (eVTOL) aircraft for urban transport. The company aims to start commercial operations by 2025, echoing Tesla‘s initial steps in revolutionizing transportation.

2. Joby Aviation (NYSE: JOBY), with a valuation of $4.46 billion, is a frontrunner in the eVTOL sector, boasting key partnerships, including one with Toyota Motor Corp. The company has made important strides in obtaining FAA certifications for a market expected to be worth $1 trillion, despite concerns around battery technology and market adoption.

The Rise of Gene Editing

3. Intellia Therapeutics (NASDAQ: NTLA) leads in genetic medicine, with a market cap of $2.02 billion. Its CRISPR-based therapies could revolutionize treatments for hard-to-manage genetic disorders, significantly increasing its value if successful.

4. CRISPR Therapeutics (NASDAQ: CRSP), valued at $4.03 billion, became the first commercial-stage CRISPR company late last year. While logistical issues may slow adoption, its first-mover advantage and partnerships, particularly with Vertex Pharmaceuticals, suggest potential undervaluation.

5. Prime Medicine (NASDAQ: PRME) introduces prime editing, with a modest market cap of $483 million. This company is aiming for a slice of the global gene therapy market, which could exceed $52 billion by 2033. However, it faces the standard challenges of biotech development as it progresses its early-stage programs.

Advancements in Computing

6. Applied Digital (NASDAQ: APLD) is valued at $1.85 billion and focuses on building data centers for AI and blockchain applications. Revenue is skyrocketing as it seeks to become a key provider of digital infrastructure.

7. Navitas Semiconductor (NASDAQ: NVTS), with a market capitalization of $467 million, is revolutionizing power delivery through its gallium nitride charging technology, finding increasing adoption among major electronics manufacturers.

The Future of Space Exploration

8. Rocket Lab USA (NASDAQ: RKLB), valued at $5.56 billion, leads in small satellite launch services with its successful Electron rocket. Its expanding launch backlog and development of the larger Neutron rocket underscore its capabilities in the commercial space sector.

Image Source: Getty Images.

9. Intuitive Machines (NASDAQ: LUNR), priced at $507 million, made headlines with a successful moon landing in February 2024. The company is at the forefront of commercial lunar services as the space economy approaches a projected $1 trillion by 2040.

Innovations in Mobility and AI

10. Virgin Galactic (NYSE: SPCE), with a valuation of $201 million, is venturing into space tourism. The company is already running commercial flights and plans to deploy its Delta class spaceships by 2026, despite facing challenges from a high cash burn rate.

11. SoundHound AI (NASDAQ: SOUN), valued at $1.78 billion, is leading developments in voice AI technology, finding increasing use in the automotive and restaurant fields as voice interfaces gain importance in business.

Automation and Delivery Solutions

12. Serve Robotics (NASDAQ: SERV), with a market cap of $417 million, is working on autonomous sidewalk robots for last-mile delivery. The company is broadening its reach across major cities through partnerships with restaurants and delivery services.

Investing Wisely in High-Growth Opportunities

These emerging tech companies offer significant growth potential, yet their early-stage valuations require careful consideration. Although some may yield extraordinary returns, others face considerable operational and market challenges.

A sensible approach is to limit investment amounts to what you can afford to lose and to diversify your portfolio, keeping high-risk investments to a minimum share. Many of these investments can act like long-term call options on innovative technologies, complementing stable holdings like broad market exchange-traded funds (ETFs).

Investors should also avoid purchasing speculative growth stocks with borrowed money—whether through margin accounts, loans, or asset leverage—due to the volatility associated with these companies. Always invest only what you can afford to lose entirely.

As with any strategy focused on high-growth investments, thorough research, risk assessment, and attention to position sizing are essential for long-term success. These companies may help define their industries’ futures but require both patience and disciplined investment management.

Seize this Opportunity for Potential Gains

Feeling like you missed out on investing in successful stocks? Now’s your chance.

Our expert analysts occasionally issue a “Double Down” stock recommendation, highlighting companies anticipated to rise. If you think you missed your chance, now may be the best time to invest. The statistics are telling:

- Amazon: investing $1,000 when we doubled down in 2010 would yield $21,154!*

- Apple: investing $1,000 when we doubled down in 2008 would now be $43,777!*

- Netflix: investing $1,000 when we doubled down in 2004 would amount to $406,992!*

Currently, we’re issuing “Double Down” alerts for three promising companies, so don’t miss your chance again.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

George Budwell has positions in Archer Aviation, CRISPR Therapeutics, Intuitive Machines, Joby Aviation, Navitas Semiconductor, Nvidia, Prime Medicine, and Rocket Lab USA. The Motley Fool has positions in and recommends CRISPR Therapeutics, Intellia Therapeutics, Nvidia, Serve Robotics, and Tesla. The Motley Fool recommends Rocket Lab USA. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.