Amazon’s Remarkable Growth: Is It Still a Prime Investment Opportunity?

Since the beginning of 2023, Amazon (NASDAQ: AMZN) has seen its stock price soar 125%, becoming a favorite in the market. However, many investors are left wondering if now is the right time to buy into Amazon.

I believe it is. Here are three key reasons why.

Image source: Getty Images.

Growth Drivers: Cloud Services and Advertising

Many may not realize that Amazon’s e-commerce business is no longer its main source of growth. This segment is only increasing at about 5% annually.

In contrast, Amazon Web Services (AWS) has made significant strides, growing 19% to $26.3 billion in the second quarter. Additionally, the company’s advertising sector expanded by 20%, reaching $12.8 billion.

Together, these two divisions generate about $150 billion in annual revenue for Amazon. While that’s only a fraction of the total nearly $600 billion in yearly sales, it remains a significant figure.

Looking ahead, the rapid growth of AWS and advertising positions Amazon well for sustained revenue growth, even if e-commerce growth slows down.

Strong Leadership Under Andy Jassy

A company is only as good as its leadership, and this holds true for Amazon. After founder Jeff Bezos stepped down, Andy Jassy took the reins around three years ago.

At 56 years old, Jassy’s early leadership has been promising, despite the challenges in his first 18 months, which coincided with a broader market downturn during the pandemic.

This year, Amazon’s stock has rebounded, gaining 125%, partly due to Jassy’s cost-cutting initiatives. He shows the kind of leadership that investors look for in top-tier companies.

Financial Health: Record Highs in Income and Cash Flow

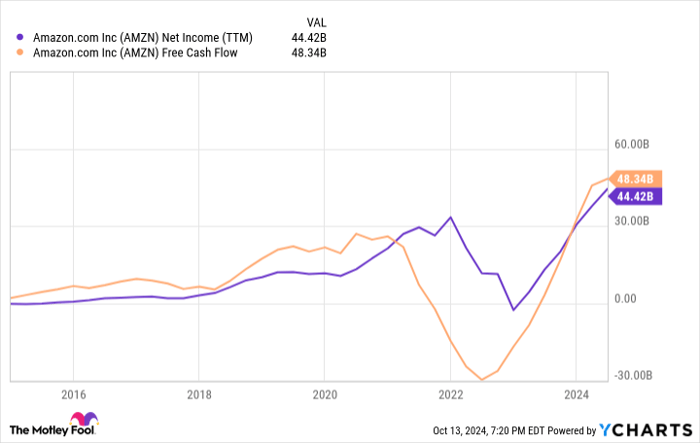

Looking at fundamentals, Amazon’s financial stability is clear. Both net income and free cash flow, essential indicators of a company’s performance, are reaching near-record levels.

AMZN Net Income (TTM) data by YCharts.

The increase in these metrics results from several factors. Amazon has scaled back some large infrastructure projects, including its HQ2 center in Virginia. Furthermore, investments made during the pandemic are now yielding results, such as regional distribution hubs that optimize delivery speed and costs.

In summary, Amazon offers more than just a rising stock price. Its blend of fast-growing sectors, strong leadership, and healthy finances suggest it remains a compelling investment now and in the future.

Is Investing $1,000 in Amazon a Smart Move Today?

Before buying Amazon stock, there are a few things to consider:

The analyst team from Motley Fool Stock Advisor has identified what they believe are the 10 best stocks for investors to consider right now, and surprise, Amazon isn’t one of them. The selected stocks could potentially deliver substantial returns in the years ahead.

For instance, consider Nvidia, which was featured on this list back on April 15, 2005… if you invested $1,000 then, you’d have $806,459!*

Stock Advisor equips investors with simple strategies for portfolio success, offering guidance, regular updates, and two new stock picks each month. Since 2002, Stock Advisor has more than quadrupled the S&P 500 returns.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.