Identifying Bargains: Analyzing Oversold Stocks in Consumer Discretionary

In the world of investing, moments marked by price drops can provide a chance to purchase shares at lower valuations. The Relative Strength Index (RSI) plays a crucial role in this process. This popular momentum indicator compares the strength of a stock’s price increases to its price declines, and a stock is generally seen as oversold when its RSI falls below 30, according to Benzinga Pro.

Let’s examine some notable oversold companies currently in the consumer discretionary sector, all with RSIs around or below 30.

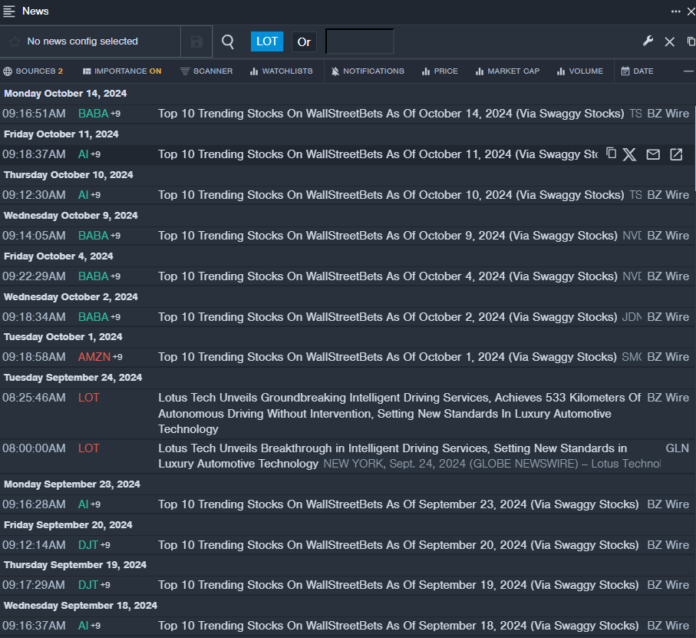

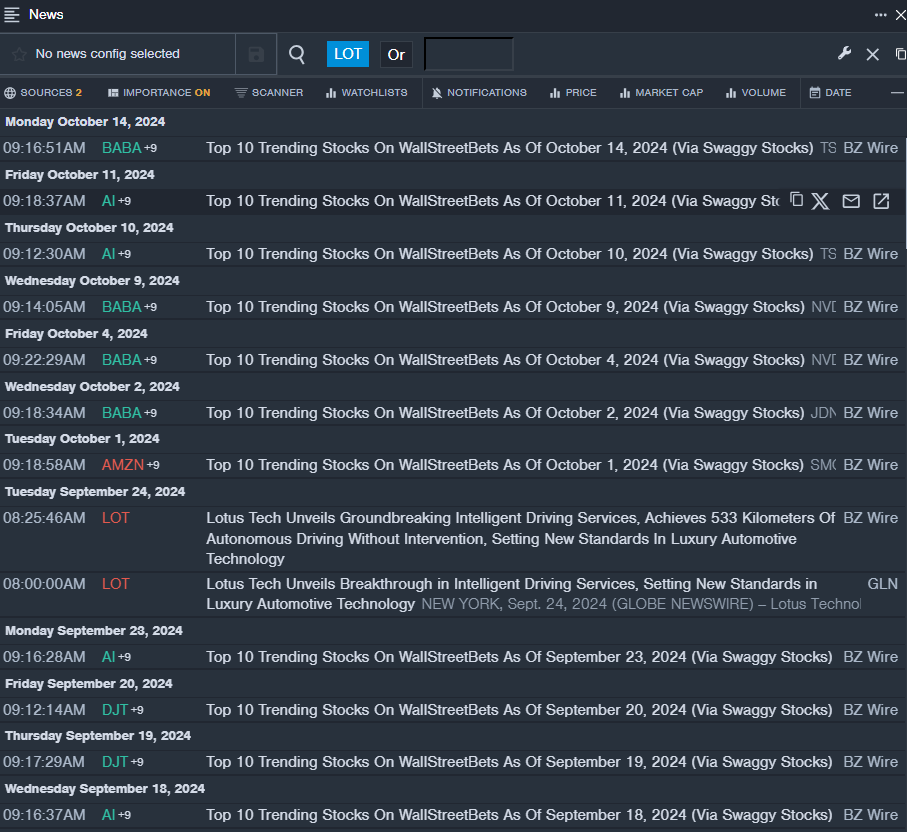

Lotus Technology Inc – ADR LOT

- On September 24, Lotus Tech introduced groundbreaking intelligent driving services, setting new benchmarks in luxury automotive technology. Unfortunately, the stock has dropped approximately 14% over the last month and reached a 52-week low of $4.27.

- RSI Value: 27.96

- LOT Price Action: On Wednesday, shares of Lotus Technology declined by 0.8%, trading at $4.32.

- Benzinga Pro’s real-time newsfeed provided updates on the latest developments for LOT.

Stride Inc LRN

- Fuzzy Panda Research published a report on October 16, titled “Stride Inc (LRN) – The Last Covid Over Earner – Hiding That Est >25% of EBITDA Came from Covid Funds.” In light of this, Stride’s stock has fallen around 20% in the past month, now standing at a 52-week low of $43.77.

- RSI Value: 17.43

- LRN Price Action: Shares of Stride decreased by 6.6% to a price of $65.94 on Wednesday.

- Benzinga Pro’s charting tool identified the current trend in LRN stock.

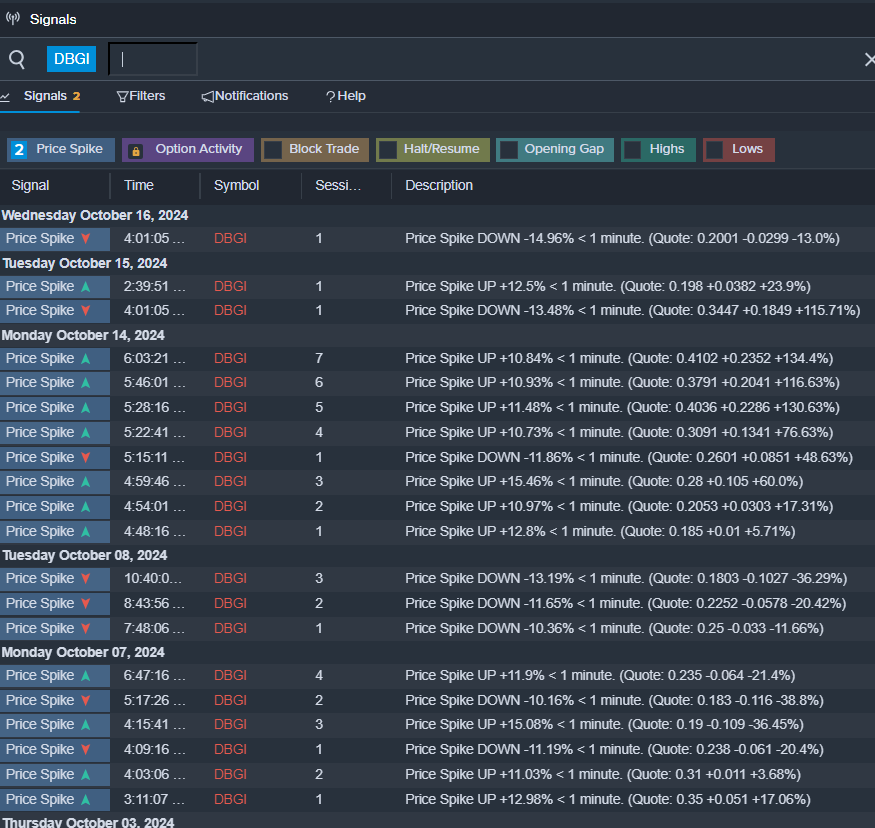

Digital Brands Group Inc DBGI

- On October 2, Digital Brands Group received a warning from Nasdaq regarding a failure to meet continued listing requirements. The stock has experienced a steep decline, losing about 59% of its value over the last month, now at a 52-week low of $0.14.

- RSI Value: 28.93

- DBGI Price Action: Digital Brands shares fell 10.9%, closing at $0.20 on Wednesday.

- Benzinga Pro’s signals feature highlighted a potential breakout opportunity for DBGI shares.

Read More:

Market News and Data brought to you by Benzinga APIs