Against the backdrop of slipping fertilizer prices, the Fertilizers industry grapples with weakened demand and squeezed margins due to grower affordability and raw material costs inflating post the Russia-Ukraine conflict. But all is not lost in this arena of agricultural nourishment. Supportive global agricultural fundamentals and robust farm economics are rays of hope for the likes of CF Industries Holdings, Inc. CF, ICL Group Ltd ICL, and Intrepid Potash, Inc. IPI in this tempestuous landscape.

Setting the Stage

The Fertilizers industry encompasses the vital nutrients (phosphates, potash, nitrogen) indispensable for enhancing agricultural output and soil fertility. By replenishing soil nutrients, these companies play a pivotal role in augmenting crop yields to cater to the ever-growing global food demand. The sector’s fortunes are closely tied to the imperative to address the world’s burgeoning appetite for sustenance.

The Industry’s Unfolding Trajectory

The Weight of Price Erosion: Historic high levels in 2022 saw fertilizer prices propelled by the Ukraine conflict, only to plummet later due to weakened demand. This downturn led to growers scaling back on applications or shifting to less fertilizer-intensive crops, thereby softening demand. Meanwhile, global nitrogen prices have been on a descent in 2023. The sector grapples with the aftermath of escalating costs and dwindling profitability prospects.

Rising Input Costs: The surge in prices of key raw materials like sulfur and ammonia adds further strain to industry players. Supply shortages, maintenance issues, and strong demand have hiked up prices, creating a drag on margins for fertilizer manufacturers.

Favorable Agricultural Dynamics: Despite the pandemic’s ravaging impact on global markets, agriculture stood firm on the back of consistent food demand. Crop commodity prices soared amid concerns over supply disruptions post the Russia-Ukraine conflict. Although prices have eased from their peaks, they remain elevated, fostering strong farming economics with high global crop demand and planted acreage projections.

Assessment of Industry Standing

The Fertilizers industry sports a Zacks Industry Rank #237, placing it in the bottom 6% of Zacks industries, indicative of a gloomy near-term outlook. Historically, top-ranked industries have outperformed their lower-ranked counterparts significantly, with the top 50% surpassing the bottom 50% by a wide margin.

Before delving into specific stock picks, let’s glimpse at the industry’s recent market performance and valuation metrics relative to the broader market.

Industry Performance Review

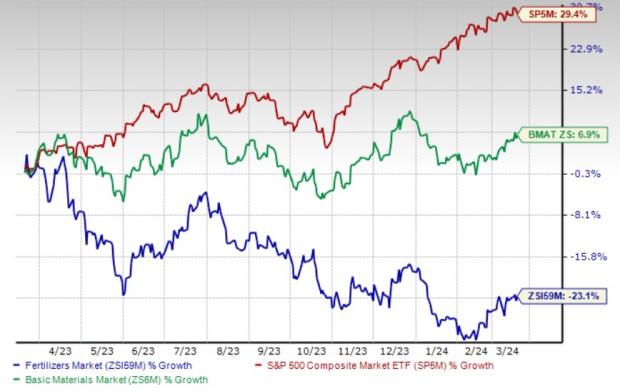

The industry lagged behind both the Zacks S&P 500 composite and the broader Basic Materials sector over the past year, shedding 23.1% while the S&P 500 and the sector surged by 29.4% and 6.9%, respectively.

One-Year Price Performance

Valuation Snapshot

Benchmarked against the S&P 500 and the sector, the industry’s trailing 12-month enterprise value-to EBITDA ratio currently stands at 10.04X, below the S&P 500’s 14.72X and the sector’s 11.13X. Over the past five years, the industry’s EV/EBITDA ratio has ranged from 4.94X to 21.85X, with a median of 12.16X, reflecting fluctuating valuations.

Enterprise Value/EBITDA (EV/EBITDA) Ratio

.jpg)

Enterprise Value/EBITDA (EV/EBITDA) Ratio

.jpg)

3 Promising Fertilizer Stocks

CF Industries: Leading the pack, Illinois-based CF Industries specializes in nitrogen products for various applications. Propelled by surging demand, particularly in industrial uses, the company benefits from a favorable market in North America buoyed by low natural gas prices. With a Zacks Rank #3 (Hold), CF exhibits a tendency to surprise with an average earnings beat of 5% over the trailing four quarters and a projected long-term EPS growth of 6%.

Price and Consensus: CF

The Growing World of Fertilizer: ICL Group and Intrepid Potash

The Fertile Ground of ICL Group

As the world turns its focus towards sustainable agriculture, Israel-based ICL Group stands firm in its mission within the fertilizer and specialty chemical sectors. The company, like a determined farmer tending to his crops, remains unwavering in its commitment to cultivating its specialties businesses. With a keen eye on boosting operational efficiency and productivity, ICL Group is like a skilled horticulturist carefully nurturing its plants.

Not content with the status quo, ICL Group has embarked on a journey of innovation, sprouting new solutions that promise to bear fruit in the form of enhanced results. The recent acquisition of Nitro 1000 shines a light on ICL’s ambition to expand its foothold in the Brazilian market, establishing itself as a leader in specialty plant nutrition, much like a sturdy tree firmly rooted in the soil.

Supporting its endeavors is the company’s Zacks Rank #3, a testament to its solid performance. Over the past four quarters, ICL has consistently outshone the Zacks Consensus Estimate, delivering an average earnings surprise of approximately 15.7%. Such resilience and growth demonstrate ICL’s ability to weather the storms of the market, much like a seasoned farmer navigating through seasonal uncertainties.

The Resilient Price and Consensus of ICL

Amidst the market fluctuations, the price and consensus of ICL Group stand tall like a sturdy oak tree, unwavering in the face of changing winds.

The Dynamic Realm of Intrepid Potash

In the heart of Colorado, Intrepid Potash stands as the sole producer of muriate of potash in the United States, akin to a lone ranger in the Wild West. But that’s not all – this stalwart company also specializes in crafting a unique fertilizer, Trio, setting it apart in the field.

With a favorable environment of robust farmer economics and crop prices, Intrepid Potash is riding the wave of strong demand, mirroring a skilled surfer navigating the highs and lows of the market. The resurgence in economic activities acts as a tailwind for Intrepid Potash, propelling the demand for its specialty fertilizer, Trio, to new heights.

Looking ahead, the company’s focus on executing capital projects signifies a mindset of growth and expansion, much like a skilled gardener planting the seeds of tomorrow’s harvest. These initiatives are poised to boost production, fostering a growth trajectory for Intrepid Potash that shines brightly on the horizon.

Embracing a Zacks Rank #3, Intrepid Potash is positioned for growth, with a projected earnings growth rate of a staggering 72% for 2024. The upward revision of the Zacks Consensus Estimate by 61.1% over the past 60 days further fuels the optimism surrounding Intrepid Potash, like a beacon of hope in a field of uncertainty.

The Promising Price and Consensus of Intrepid Potash

Against the backdrop of market volatility, the price and consensus of Intrepid Potash paint a picture of promise and potential, akin to a sunrise signaling the dawn of a new era.

.jpg)