Will Amazon’s Stock Shine Again? Here Are Five Good Reasons to Consider an Investment

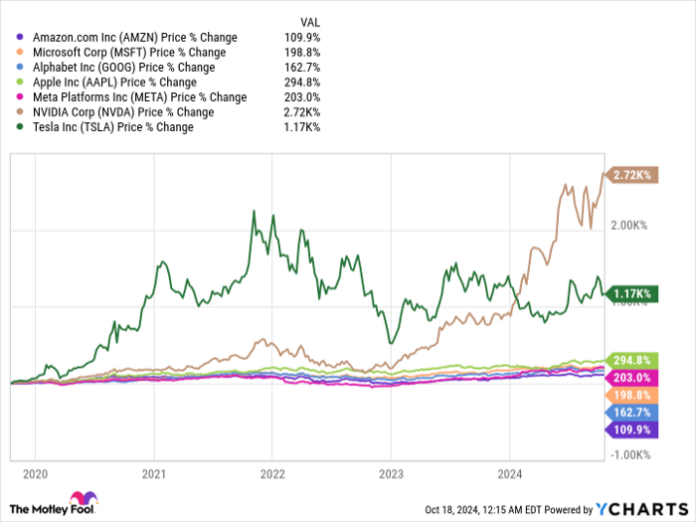

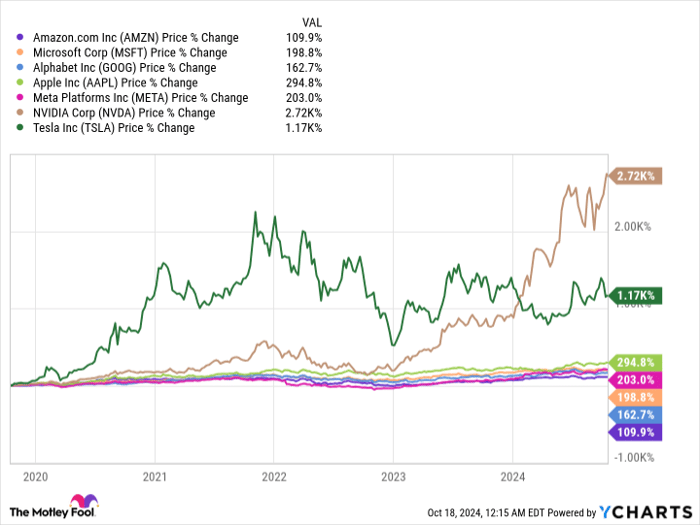

Among the Magnificent Seven stocks, Amazon (NASDAQ: AMZN) surprisingly reports the lowest returns over the past five years.

AMZN data by YCharts

This trend is intriguing, especially given how the Covid-19 pandemic underscored the importance of Amazon’s e-commerce and cloud services among consumers and businesses.

However, the post-pandemic world has reversed some of the gains Amazon accomplished during lockdowns. Combined with founder Jeff Bezos stepping down, investor confidence has wavered. Nonetheless, almost all of Amazon’s business segments are showing signs of improvement, which presents several promising reasons to buy Amazon stock now.

1. AWS is Gaining Momentum Again

In the most recent quarter, Amazon Web Services (AWS) recorded a 19% increase in revenue growth, marking the third consecutive quarter of acceleration. Operating margins also rose impressively to 35.5%, up from 24.2% in the same quarter last year.

Though AWS isn’t expanding as quickly as competitors, this is typical given its size as a leading cloud service. With a revenue run-rate exceeding $100 billion, a 19% growth rate is commendable.

While some might think Amazon lagged behind in artificial intelligence, recent AWS developments suggest otherwise. Although Microsoft has unique ties with OpenAI, Amazon has strategically invested in Anthropic, the firm behind Claude large language models (LLMs). AWS is also focusing on a wide range of generative AI options through its Bedrock platform.

As LLMs may eventually see more players, Amazon’s early investments in proprietary chips since 2015, such as the Graviton series, position it favorably to reduce costs compared to competitors. Given that training on Nvidia chips is notoriously pricey, Amazon’s in-house AI chips are 40% to 50% cheaper, enhancing AWS’s competitive edge.

2. E-commerce Efficiency is Improving

Under CEO Andy Jassy’s leadership, Amazon has successfully made its e-commerce operations more profitable in the past year. Operating margins for both North American and International segments have improved every quarter since Q4 2022, aided by a new regional system that reduces delivery costs. Notably, the growth in paid units delivered has outpaced shipping costs every quarter since Q3 2022.

Despite earlier skepticism, both North American and International operations are now profitable and consistently improving.

3. Steady Growth in Advertising

Amazon’s advertising business has become a standout performer recently. With growth at approximately 20% and a $50 billion annualized run-rate, its advertising segment now ranks among the top digital ad players, following major platforms like Search, Facebook, and Instagram.

This growth trajectory is likely to continue, thanks to Amazon’s vast customer data, which enables effective ad targeting. Additionally, Prime Video is set to introduce ads in key international markets by 2025, tapping into further growth potential.

As long as consumers remain engaged with Amazon’s online platforms and Prime services, the advertising segment should thrive.

Image source: Getty Images.

4. Exploring New Ventures

While focusing on profitability, Amazon is also investing in promising new sectors like grocery, healthcare, and Project Kuiper—its satellite broadband initiative designed to compete with SpaceX’s Starlink.

Though launching satellites is costly, with estimates around $20 billion, this high barrier to entry may deter many competitors. Analysts believe that if Project Kuiper succeeds, it could significantly boost Amazon’s profits in the long run.

Kuiper’s broadband services are projected to launch next year, potentially acting as another growth catalyst for the stock by 2025.

5. Anticipated Cost Reductions

In addition to promising growth avenues, CEO Jassy has outlined an efficiency plan that aims to streamline operations. By increasing the ratio of workers to managers by 15%, Amazon aims to eliminate excess managerial layers. Jassy is also encouraging a return to the office five days a week, benefiting from the previous 15-month hybrid office model.

These changes may lead to voluntary departures among staff less inclined to work full-time, further assisting in cost control. If this initiative enhances Amazon’s efficiency as effectively as previous ones, shareholders could look forward to even more robust profit growth.

Is Amazon Stock Worth a $1,000 Investment Right Now?

Before making an investment in Amazon, consider the following:

The Motley Fool Stock Advisor team has recently identified the 10 best stocks to consider, with Amazon not making the list. The selected stocks are projected to yield substantial returns in the coming years.

Take for instance when Nvidia was featured on this list on April 15, 2005; an investment of $1,000 then would be worth $845,679 today!*

Stock Advisor offers investors valuable resources for building portfolios, regular insights from analysts, and two new stock picks each month. The Stock Advisor service has significantly outperformed the S&P 500 since 2002.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board. Billy Duberstein and/or his clients hold positions in Amazon and Microsoft. The Motley Fool also recommends these stocks: Amazon, Microsoft, and Nvidia. For full disclosures, refer to the Motley Fool’s policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.