U.S. Stocks Defy Doubts, Mark Record Growth Ahead of Presidential Election

In the face of various worries such as the upcoming presidential election, inflation, interest rates, and geopolitical tensions, U.S. stocks have made impressive gains this year. As we head into 2024, not only have they overcome these challenges, but the market is witnessing its best start for a presidential election year. The S&P 500 Index has risen by 22%, while the tech-focused Nasdaq has jumped 23%. As investors weigh the potential for further stock purchases against the risk of a market correction, questions arise about the sustainability of this growth.

Reasons for Continued Market Optimism

Here are five factors that suggest a bullish outlook for 2025:

Tech Giants: Solid Earnings and Positive Projections

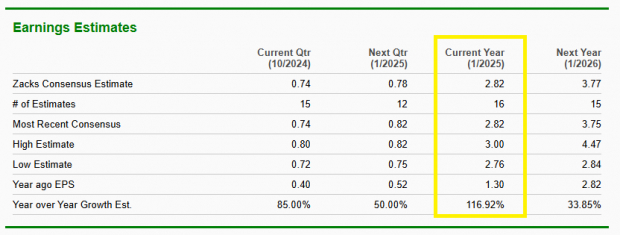

Major technology firms, including Meta Platforms (META), Arm Holdings (ARM), and Alphabet (GOOGL) have posted substantial gains this year, with expectations for continued growth into next year. Analysts predict strong earnings per share (EPS) for these companies, which is a crucial indicator of future success. Many of these tech stocks boast a Zacks Rank of #2 (Strong Buy).

Image Source: Zacks Investment Research

Furthermore, Wall Street forecasts for Nvidia (NVDA) indicate that the leading AI firm could more than double its EPS for the full year of 2025.

Image Source: Zacks Investment Research

Additionally, Tesla (TSLA) recently reported strong earnings, benefiting from a more lenient monetary policy from the Federal Reserve. Tesla projected auto growth to be 25% in 2025, significantly exceeding estimates of 16%. Despite a 17% drop in regulatory credit revenue, lower costs helped the company beat earnings expectations, leading to a 22% surge in its stock value last week.

Growing Investor Activity in Big Tech

High-profile investors are showing confidence in big tech stocks such as META and AAPL by purchasing significant amounts of call options. As these major companies hold substantial market shares and impact burgeoning sectors like AI, their continued strength is essential for overall market health. Investors anticipate greater insights into AI, cloud, and the tech sector when Google releases its earnings report tomorrow.

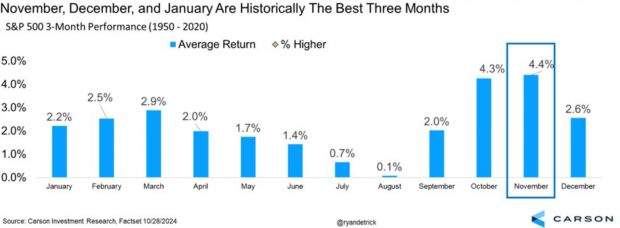

Seasonal Trends Favor Growth

Historically, the months of November, December, and January have been favorable for investors. According to Ryan Detrick from Carson Investment Research, data since 1950 shows that November has posted positive returns 11 times out of the last 12 years.

Image Source: Carson Investment Research

U.S. Market Positioning Remains Underweight

Relative to previous presidential election cycles, current U.S. equity positioning appears underweight, according to analyst Seth Golden. This suggests that domestic stocks have room to grow if investor sentiment tilts more positive.

Image Source: Seth Golden

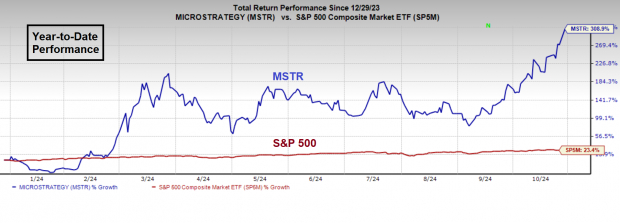

Strength in Risk-On Industries

Markets that are more risk-oriented are showing upward movement, while conservative sectors are declining. For instance, MicroStrategy (MSTR) has vastly outperformed the S&P 500 Index this year, while energy stocks faced declines as geopolitical tensions in the Middle East showed signs of easing.

Image Source: Zacks Investment Research

Conclusion: Bullish Outlook for Q4

Despite current challenges, the strong performance of stocks during this presidential election year indicates that the bullish trend is likely to persist into the fourth quarter.

Try Zacks’ Recommendations for Just $1

No strings attached.

Years ago, we surprised our members by offering them 30-day access to all of our picks for only $1. No hidden fees or commitments.

While thousands have seized this opportunity, many remained skeptical. Our goal is to familiarize you with our portfolio services, which include Surprise Trader, Stocks Under $10, Technology Innovators, and more. In 2023, we closed 228 positions with double- and triple-digit gains.

For the latest stock suggestions from Zacks Investment Research, download our report on 5 Stocks Set to Double today.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

MicroStrategy Incorporated (MSTR): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.