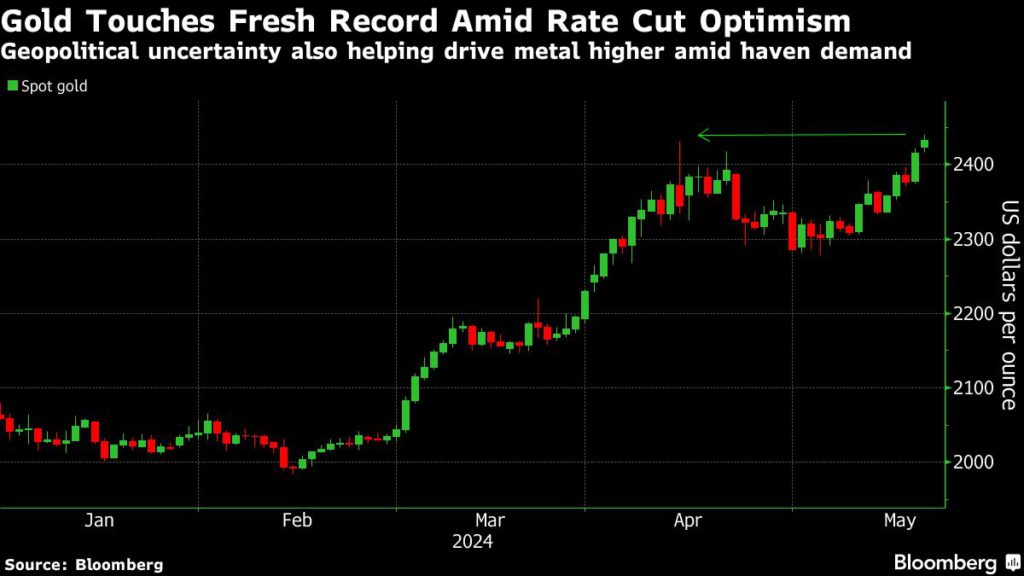

US gold futures saw a similar rise of 0.5% at $2,429.60 per ounce, having hit $2,454.20 earlier in the day.

The metal eased off its high on profit-taking but the outlook remains positive and “new records could be on the way,” explained Fawad Razaqzada, market analyst at City Index, in a Bloomberg note.

Traders have been boosting bets in recent sessions that the Fed may reduce borrowing costs as early as September, a scenario that would bolster gold since it doesn’t pay interest.

A weaker dollar has provided the precious metal with additional support. Recent economic data releases indicated that the US economic recovery is slowing, which could lower inflation and reduce the need for prolonged tight monetary policy, according to Razaqzada.

Broader macroeconomic drivers are also at play for precious metals and other commodities such as copper.

“China’s various stimulus measures have bolstered demand or perceived demand for commodities, and we’ve seen improvements in eurozone and UK data,” said Razaqzada.

Rising Middle East tensions

Gold’s haven status entered the spotlight after news that Iran’s President Ebrahim Raisi, widely seen as a candidate to become the country’s next supreme leader, was killed in a helicopter crash on Sunday. His death came at a time of turmoil in Middle East due to the Gaza war.

The latest incident adds a sense of rising geopolitical risks across the region after a China-bound oil tanker was hit by a Houthi missile in the Red Sea on Saturday.

Hedge funds trading Comex futures boosted bullish bets on gold to a three-week high in the week ending May 14, according to data from the Commodity Futures Trading Commission.

The gains suggest that bullion has broken out of what’s been a fairly narrow trading range in recent weeks amid a lack of clarity over the US rate path. Prices are about 17% higher this year.

The metal’s strength has been linked to central bank purchases, robust demand from Asia — especially China — and elevated geopolitical tensions in Ukraine and the Middle East.

The recent rally also spilled over into other metals, including its sister metal silver, which earlier had climbed to its highest since December 2012.

(With files from Bloomberg)