Nvidia’s Remarkable Growth: What Lies Ahead in 2025?

The impressive surge in shares of Nvidia (NASDAQ: NVDA), which began in late 2022, has yielded an extraordinary 11-fold gain over nearly two years. A $100 investment in Nvidia stock at that time would now exceed $1,100. This remarkable performance may continue into 2025, driven by advancements in the artificial intelligence (AI) chip market.

Solid Demand and Improved Supply: Factors Driving Nvidia’s Growth

Current forecasts anticipate Nvidia will generate $125.5 billion in revenue for the fiscal year 2025, reflecting a 125% increase from last year. Analysts from KeyBanc predict even higher revenue of $130.6 billion by January 2025.

The analysts credit the company’s anticipated revenue boost to the launch of its new Blackwell AI processors. During a recent earnings call, Nvidia’s management indicated expectations for “several billion dollars in Blackwell revenue” in the fourth quarter of fiscal 2025.

Moreover, sales of Nvidia’s current Hopper chips—namely the H100 and H200 models—are projected to grow in the latter half of fiscal 2025 due to strong demand and enhanced supply. KeyBanc analysts noted that this demand for Hopper chips remains robust.

Suppliers are also stepping up to support Nvidia’s growth. Notably, contract manufacturer Foxconn is constructing the world’s largest production facility for Nvidia’s GB200 Grace Blackwell Superchip. This chip features two B200 Tensor Core GPUs connected to a Grace CPU.

Each GB200 Superchip is priced between $60,000 to $70,000, and multiple chips assembled into server systems are seeing strong market demand. Nvidia reportedly increased its orders for Blackwell GPUs by 25% in July, reinforcing strong demand.

Market research firm TrendForce estimates that Nvidia could ship 60,000 units of GB200 NVL36 servers next year, with an average selling price of around $1.8 million per unit. This suggests potential sales exceeding $108 billion for these servers alone. Additionally, Mizuho, a Japanese investment bank, projects sales of 6.5 to 7 million AI graphics cards, potentially leading Nvidia to generate nearly $200 billion in data center revenue for calendar 2025—matching much of its fiscal 2026.

Nvidia’s Stock Projects Further Growth for 2025

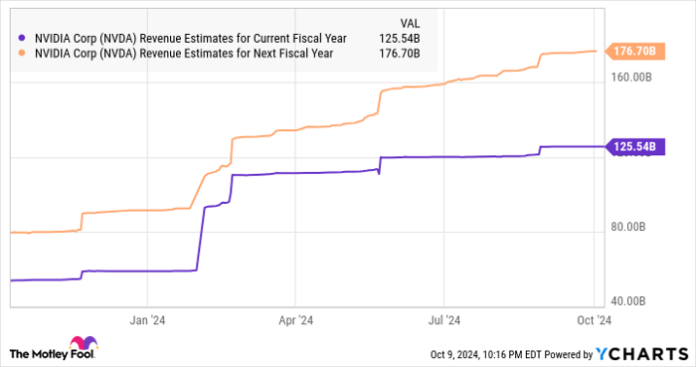

As shown in current estimates, analysts anticipate Nvidia will reach $177 billion in revenue for fiscal 2026.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

The revenue expectations have risen significantly this year. Observers believe Nvidia could exceed the $200 billion revenue mark, driven by data center chip sales alone. This anticipated revenue growth is likely to translate into impressive earnings growth as well.

Analysts project Nvidia’s earnings will reach $4.02 per share in fiscal 2026, representing a 41% increase from the current year’s forecast of $2.84 per share. Estimates for the upcoming year have surged; just three months ago, the projected earnings were $3.69 per share.

In summary, Nvidia appears poised to maintain its robust growth trajectory into next year. The stock has a median 12-month price target of $150, indicating a potential 13% upside. With the highest target at $203, a 53% increase is feasible, should Nvidia’s plans materialize as anticipated.

Is Nvidia a Smart Investment Right Now?

Before making a decision to invest in Nvidia, it’s essential to consider the following:

The Motley Fool Stock Advisor analyst team has recently identified their choice of the 10 best stocks for investors to consider—Nvidia was notably absent from this list. The selected stocks may offer substantial returns in the years ahead.

Reflecting on Nvidia’s historical performance, had you invested $1,000 when it was recommended on April 15, 2005, your investment would now be worth approximately $826,069!*

Stock Advisor equips investors with straightforward strategies for success, including portfolio-building advice, regular analyst updates, and two new stock selections every month. Since 2002, their service has more than quadrupled the S&P 500’s returns.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views expressed herein represent the views of the author and do not necessarily reflect those of Nasdaq, Inc.