Buffett’s Shift: Bank of America Stays Strong

Despite Warren Buffett’s recent sale of some shares in Bank of America Corp BAC, the stock demonstrates a promising trend. Year-to-date, BAC has improved by 23.75%, and it has gained a remarkable 55.43% over the past year, showcasing strong investor confidence even as Buffett’s Berkshire Hathaway Inc BRK BRK quietly retreats.

A Significant Divestment: What It Means

In a surprising move, Buffett’s Berkshire Hathaway sold 9.5 million shares of Bank of America in just three days last week at an approximate price of $40 per share, earning around $380 million. This recent activity means Berkshire no longer holds a 10% stake in BAC, simplifying future trading reporting obligations.

This isn’t the first time Buffett has scaled back his BAC shares since mid-July. In response to inquiries regarding Buffett’s sell-off, Bank of America’s CEO Brian Moynihan maintained a calm demeanor, stating, “Life will go on.” BAC stock price actually jumped 5% on Friday following the news, demonstrating resilience.

Bullish Sentiment: Indicators of Continued Growth

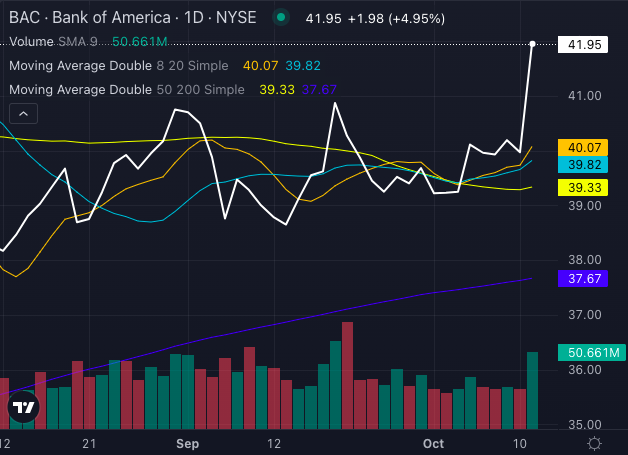

While Buffett may be stepping back, stock charts indicate that bullish momentum remains intact.

Chart created using Benzinga Pro

Currently, BAC stock closed at $41.95, significantly exceeding its eight-day and 20-day simple moving averages, which are $40.07 and $39.82, respectively. Additionally, it surpasses both the 50-day and 200-day moving averages, indicating a potential for further price growth.

Chart created using Benzinga Pro

Market indicators reflect positive signs, with the MACD showing a positive reading of 0.26. The relative strength index (RSI) stands at 68.28, suggesting the stock may be nearing overbought territory. Nonetheless, BAC remains well positioned above its Bollinger Bands range of $38.31 to $41.02, indicating potential for further increases.

Read Also: JP Morgan And Wells Fargo Report Better Than Expected Q3 Results That Reflect Resilient U.S. Consumers

What Will Q3 Earnings Reveal?

Investors are keenly awaiting the third-quarter earnings report, set to be released on Tuesday before the market opens.

Analysts predict earnings per share (EPS) of 77 cents along with revenue anticipated around $25.28 billion. If Bank of America exceeds these expectations, the stock could see an additional surge, despite Buffett’s exit.

As Buffett downsizes his position, Bank of America’s stock continues to exhibit strength, frequently signaling bullish potential. With favorable momentum, the upcoming earnings could further elevate BAC stock prices.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs